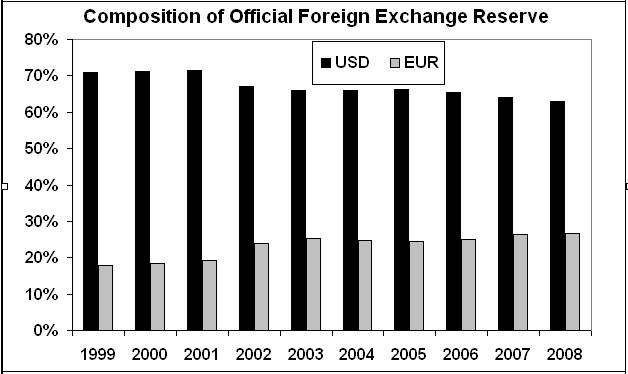

EUR Share of FX Reserves vs USD

The Q1 2008 IMF data on currency composition of Official Foreign Exchange Reserves shows a continued gradual fall in USD claims along with continued increase in the EUR claims.

USD claims rose 4.5% to $2.72 billion making up 63% of total allocated reserves, down from 64.02% in Q4 2007

EUR claims rose 7.7% to $1.16 billion making up 26.80% of total allocated reserves, up from 26.42% in Q4 2007.

The data take into consideration total allocated reserves, thus not including undisclosed reserves such as China and the Gulf nations. Nonetheless, due to the increasing mobility of capital flows out of sovereign wealth funds, the importance of foreign exchange reserves has somewhat given way to the FX implications of the currency allocation of SWFs. These remain largely denominated in USD.

One interesting phenomenon is the role of the Aussie and the Swiss franc, two currencies which have headed the ranking of G10 FX returns in H2 2008. Although AUD and CHF offer contrasting levels of interest rates at 7.25% and 2.75% respectively, the consistency of their returns remains boosted by a favorable performance for copper, gold and wheat in the case of the Aussie, while improved reaction on falling risk appetite in the case of the franc. The franc had outperformed the yen, its low yielding counterpart, in the latest downturn in global stocks primarily due to the escalating effects of higher oil in Japan.

The impact of the falling value of the dollar on composition valuations did play a factor in dragging down the USDs share of FX reserves versus the EUR. But this development is far from being a major element. Looking at the chart, the EUR composition rose in 2000 and 2001 in a year when the euro dropped 6% against USD in both years. At the current pace, the EUR may not attain a 50-50% composition before 2020. But a major factor in deciding the pace of such evolution will be any progress by OPEC in pricing their oil in a basket of currencies or any revaluation in their USD-pegged currency regimes.