Intraday Market Thoughts

5 Markets Upended by the Fed

by

Jun 21, 2019 14:01

Here are the markets that have been markedly impacted by the Federal Reserve decision, which we think derserve close scrutiny from chartists and traders in the weeks ahead. Meanwhile, Bitcoin hit 9922 and Ripple 0.45 as the erosion of carry from the Fed and Persian Gulf tensions help the cryptospace.

Click To Enlarge

1) Gold

Gold pushed further into its 5-year highs to make its biggest daily % gain in 8 months and the biggest weekly gain in over 3 years (when gold was gaining ahead of pre-US presidential election dynamics). It tested 1350 last Friday and again Tuesday before backing off. It finally closed above $1350 after the Fed and that kicked off a $27 surge to a five-year high at $1411. This zone has been a major level of resistance going all the way back to 2014. The last time global central banks embarked on an easing cycle, gold hit $1921. Add to it the escalation tensions in the Persian Gulf and you bolster the case for higher lows and a follow-up to 1480. The Cup-&-Handle followed and shared by Ashraf over the last 6 months was last shown here.2) USD/CHF

Increasingly correlated with USDX, USDCHF is the biggest mover of the past two days (Thursday was the biggest % daily slide since Jan 2018), falling to 0.9800 from 1.000. It's carved out a rough head-and-shoulders top and broken the trendline that started in February 2018. USD/CHF can do well with Fed rate cuts but it can do even better if it's coupled with risk aversion because of a trade war or recession. Ashraf sent me a chart of a stabilizing and rising CHFJPY, suggesting that market risks may be shifting from the US-China fear matrix to that of a broader slowdown in global growth.3) USD/JPY

USD/JPY has fallen by over a full yen (yen has risen) despite the run-up in global indices, highlighting the USD-side of dynamics. Ashraf's reationale to short USDJPY ahead of the Fed decision, whereby a dovish Fed would hurt USD and the pair, while a hawkish surprise would damage markets and booost JPY, thereby also dragging USDJPY. The BoJ won't welcome the Fed dovish turn but there is now little support separating a return to the March 2018 and flash crash lows, both of which are near 104.50.4) US 2-year yield

Not every market is screaming the same message. US 2-year yields plunged 7% on Wednesday to as low as 1.69%, posting its biggest % daily drop since September 2016, before turning around to finish higher on the day at 1.78%. Technically there isn't much of a reason to expect a further significant bounce but it's a spot to watch as the 2-year yield is the highest positively correlated US govt fixed income with USD. The bond market was first to sniff out the Fed's dovish turn and any signals now are doubly important.5) CAD against everything

The Bank of Canada is suddenly in a bind. Central banks almost everywhere else are poised to ease but the data in Canada has simply been too strong to follow along. Bouncing oil on the Persian Gulf tensions and absent BoC has dirven USD/CAD down the June lows and is threatening the Feb low of 1.3113. The BOC is loathe to see the loonie strengthen rapidly, but their options to contain the decline are limited because there are no speeches scheduled ahead of the July 10 decision. The CAD trade in the Premium Insights remains short USDCAD at 1.3360/90.| Act | Exp | Prev | GMT |

|---|---|---|---|

| FOMC's Brainard Speaks | |||

| Jun 21 16:00 | |||

Latest IMTs

-

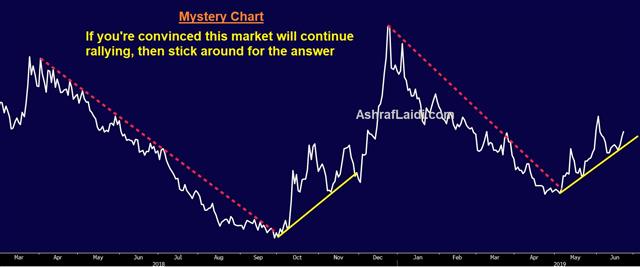

Mystery Chart & Coordinated Silver Attack

by Ashraf Laidi | Feb 6, 2026 10:52

-

From 4920 to 5090 and back

by Ashraf Laidi | Feb 5, 2026 9:41

-

How I Nailed $5090oz

by Ashraf Laidi | Feb 4, 2026 11:44

-

2x our Gains in 8 Weeks

by Ashraf Laidi | Feb 3, 2026 10:28

-

4500 and 72 Hit, now what?

by Ashraf Laidi | Feb 2, 2026 2:22