Intraday Market Thoughts Archives

Displaying results for week of Feb 10, 2019تطبيق مؤشر القوة النسبية

ماذا تعرف عن مؤشر القوة النسبية وكيفية تطبيقه؟ تابع معنا هذا الفيديو الأسبوعي

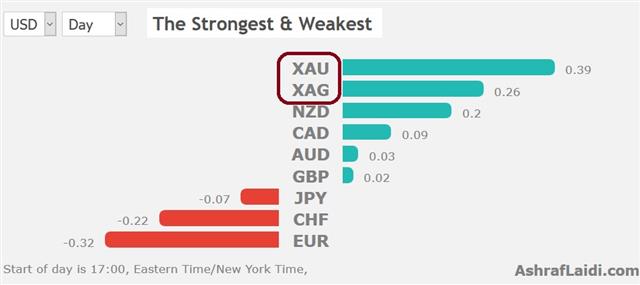

Gold & Oil Lead the Way

US indices are bouncing higher ahead of the long weekend (US presidents Holiday on Monday), with gold and oil firming along. Interestingly, energy is outperforming metals, while gold rallies against silver as the mint ratio (Gold/Silver Ratio) reaches a 2-month high. The OIL Premium long deepens further in the green. UK retail sales jumped 4.2% y/y, their biggest annual rise since December 2016, but GBP remains weighed by the Brexit impasse. Yesterday saw the worst US retail sales number in a decade, which weighed on USD, but the market was skeptical. 2 Premium trades were added yesterday to the Premium Insights. Technically speaking, both metals trades remain the strongest as the chart below shows. January Empire manufacturing (NY Fed) is due at at 13:30 GMT, followed by US industrial production for January exp +0.3% is due at 14:15 GMT.

Emergency solution usually not a good sign

The White House confirmed there won't be another shutdown with Trump poised to sign the spending bill. At the same time, he will declare an emergency to build his border wall. That's sure to create political drama but will matter little to markets. If anything, his fight over the wall may sap his resolve to battle with China where multiple reports said that negotiations are stalled on structural issues – something we warned about yesterday.US Treasury secr'y Mnuchin continues to sound off his usual optimistic notes, describing talks with with China's Vice Premier Liu He as “productive.” But officials familiar with the discussions indicate that China is resisting US demands for further structural economic reform. Investors are becoming increasingly cautious as the round of talks looks set to wrap up without a resolution. SPX has yet to make a decisive close above the 200-DMA.

Yesterday, US retail sales sank 1.2% in December in the biggest decline since 2009. They had been expected to rise 0.1% after a 0.2% climb in November. The weakness was widespread with the control group down 1.7% compared to +0.4% expected. That was the worst since 2000. Initially the US dollar sank but it later recovered against the euro and pound. USD/JPY fell a half-cent and the losses stuck.

What puzzled investors is how sales could have been so weak when other indications were that customers were solid in the month. Redbook sales were strong and corporates have been upbeat on the US consumer. The government shutdown may have hurt and the equity selloff on Christmas Eve may have curbed Boxing Day sales. If so, those are issues that reversed.Retail sales bounced back sharply in January, rising by 1% on the previous month, official figures showed.

Strong UK sales

UK retail sales rose 1% in January after a 0,7% decline in December. Year on year, retail sales rose 4.2%, posting their biggest annual rise since December 2016.| Act | Exp | Prev | GMT |

|---|---|---|---|

| Retail Sales (m/m) | |||

| 1.0% | 0.2% | -0.7% | Feb 15 9:30 |

Underpricing Trade Risks

The market remains upbeat about US-China trade negotiations but may be underestimating the risks. Lofty exports Chinese data were released overnight. US retail sales on Thursday are sure to be a market mover. A new Premium trade in commodities was issued yesterday and a trading update was posted on GBP. All indices trade are now closed and a new Trade is due up today. Sterling traders await new debate on Brexit-related amendments in Parliament later this eveing so expect prolonged GBP swings.

The consensus in markets is that the US and China are on their way to deal. Trump and Xi have both sent signals that they don't want a trade war to derail their economies. Based largely on that sentiment, Chinese stocks have climbed 13% from the recent lows and the S&P 500 is up 17% including 8 more points on Wednesday. Markets have gotten a bit ahead of themselves.

The rule of thumb on negotiations is that they're always toughest right at the end. It won't be smooth sailing to the finish line and at this point negative headlines are going to hurt more than positive ones might help. The wild card in negotiations is Robert Lighthizer. He's been pining to be in this spot for his entire 40-year career and he's a notorious China hawk. It would be a big surprise if he doesn't try to push China further than Xi is willing to go.

Elsewhere, economic news Wednesday showed that the market hasn't entirely moved on from inflation worries. US CPI rose 2.2% y/y compared to 2.1% and that gave a lift to the dollar, especially against the euro which slid 65 pips to 1.1260 on the day including a dip after CPI. EURUSD basing process turns to US retail sales and PPI.

Gold also posted an outside day in a fall to $1302 after rising as high as $1318. Keep an eye on $1300/$1296 in the day ahead. A break below would signal a deeper retracement and possibly the end of the uptrend.

Coming up is big slate of economic data culminating with US December retail sales at 1330 GMT. This is the December data that has been delayed due to the shutdown. It's a key month for consumers and the consensus is for a 0.1% rise following the 0.2% climb in November. The control group is the spot to watch and it's forecast up 0.4%. Beware of the secular trend towards earlier Christmas shopping around Black Friday in November pushing sales ahead then leading to a miss in December.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Consumer Prce Index (y/y) | |||

| 1.9% | 1.9% | Feb 15 1:30 | |

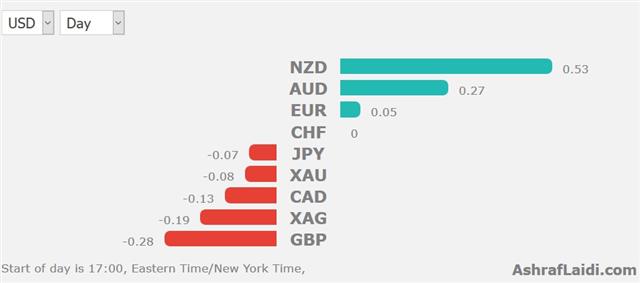

Shutdown Off, Risk On

A deal to avoid a US government shutdown continues to lift risk assets, helping the S&P 500 to close above the 200-day moving average. NZD is the top performer after the RBNZ explicitly stated the odds of a rate cut have NOT increased, defying expectatations that it's changing tack as did the Fed and RBA. US CPI is up next, with the headline figure seen at 1.5% from 1.9% and core at 2.1% from 2.2%. A new update on EURUSD for Premium subscribers will be issued ahead of the NY bell.

تدقيق في المضاربة فيديو المشتركين

Optimism about global growth and an apparent deal to end the US government shutdown have helped boost sentiment. Trump said he's unhappy there isn't more money for his border wall but hasn't said he will veto it. He could be expected to later use his executive authority to fund additional border measures.

Treasury yields climbed and the S&P 500 surged 35 points to 2744, finishing just above the 200-DMA. SPX futures are now at 2752. That level had called a rally last week. Global stocks joined in the rally and the US dollar, yen and Swiss franc softened in a classic risk-on move.

In the oil market, Saudi Arabia's energy minister said they could cut production by an additional 500k bpd in March and that led to a rally in WTI to $54.00. There's a minor double bottom forming at $51.23 that will be a spot to watch this month. USD/CAD fell back to Friday's post-jobs report lows.

UK CPI slowed to 1.8% in Jan from 2.1%, undershooting expectations of a 1.9% reading. Core CPI held at 1.9% y/y as expected.

Carney reiterated Tuesday that modest tightening over time is likely to be needed but falling inflation numbers and endless Brexit uncertainty argue against it. On that front, May's latest meaningful vote was delayed until late in the month and there were reports that Boris Johnson could support the current deal with a firm expiration date for the Irish backstop. There was also talk that May could quit in the summer once a deal is struck.

أداء شركات التداول الفوركس

انخفض أداء أسعار الأسهم في جميع شركات الفوركس “بروكرز” المدرجة في البورصات العالمية عمومياً بشكل كبير منذ الصيف الماضي بسبب مزيج من انخفاض اهتمام المتداولين باالعملات المشفرة وتشديد القوانين والرقابة من قِبل هيئة الرقابة الأوروبية الرئيسية. وهنا نوضح لكم التفاصيل من خلال الرسوم البيانية والحقائق. المقال الكامل

Forex Brokers' Performance

Here's the latest on the share price performance of 6 publicly traded forex trading firms. Full chart & write-up.

USD Pushes Envelope Pre-Trade Talks

Better sentiment on a US-China trade deal kicked off the week but be warned that it could all fall apart in a moment. The US dollar led the way while the pound lagged. Powell speaks on Tuesday. The DAX trade was locked in at a gain and a new Index trade was opened. The latest Premium Video is posted below, containining technical and fundamental ideas on the existing and upcoming trades. It also details the FX implications to the binary outcome of the US-China talks.

White House advisor Kellyanne Conway said on Monday that it looks like the US and China are getting closer to a deal. High-level talks will take place Thurs-Fri but lower level meetings have already begun so expect a steady stream of rumours and reports.

The rule of thumb on negotiations is that they're always toughest at the end. They often look like they may fall apart before there is a deal. Trump and Xi have both privately pushed for compromise but the 'generals' of the negotiations might be less flexible and the latest market moves could evaporate. The US dollar strengthened to start the week as equities and yields rose. Gold fell $6 on slipping demand for safety. Flows may also have been a factor with China returning from a week of holidays and Japan finishing up a long weekend.

The Premium video lays out how to tie the FX component to the binary outcome of the US-China talks, while highlighting the crucial support levels for EURUSD, GBPUSD and XAUUSD. Specifically for GBPUSD, traders must be aware that despite Brexit-related event have tended to trigger +100 pip intraday swings, the closing value is proving more crucial.

Looking ahead, an event to watch will be a speech from Powell at 1745 GMT Tuesday. The topic is rural poverty so it may shy away from monetary policy but it's also the kind of topic that lends itself to dovish undertones so watch out for US dollar selling. The RBNZ decision is also due early Wednesday.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Fed Chair Powell Speaks | |||

| Feb 12 17:45 | |||

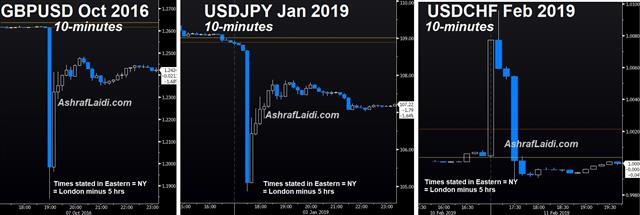

USD Firms ahead of Big Week

Most currencies are down against the US dollar since the start of Asia's Monday open with the exception of NZD and CAD as the latter holds on to gains after Friday's Canadian employment figures showed the best gain in 16 years. A big week of economic news and events awaits, with a statement from PM Theresa May tomorrow and US-China trade talks in focus later in the week. We took 230-pt profit in the DAX30 Premium Insights trade with a detailed note for subscribers citing the reason for exiting early. The franc was the latest victim of thin-liquidiy flash crash around midnight London, falling nearly 1%. A closed Tokyo session due to Japan Holiday helped propagate the move, but the charts below (GBP flash crash, JPY spike & CHF plunge) highlight the common denominator. US CPI is due next.

Canada's jobs market continues to defy signs of a slowing economy as it added 66,800 jobs in January compared to 5,000 expected. The economy averaged more than 47,000 jobs added for the past five months, in what's been the best five month period since 2002.

The numbers simply defy belief as the oil sector struggles and other economic data points point to trouble. At some point there will be a reversion to the mean but it wasn't on Friday. USD/CAD fell to 1.3230 from 1.3300 on the headlines but that was the low of the day and it bounced a half-cent. The rebound afterwards reflected skepticism of the report, including details that showed nearly all of the jobs were created in the service sector among those aged 15-24.

The overarching themes at the moment are global growth, central banks and US-China trade. In the week ahead they will all be in the spotlight. The main event will be meetings between Mnuchin, Lighthizer and top China officials on Thurs-Fri in Beijing. Recent signals have been mixed and a deal before month-end is increasingly unlikely but at the same time there have been signals about an extension of the March 1 tariff deadline.

This week's data calendar heats up as statisticians sort out the numbers after the US shutdown. Late in the week we get UK and US retail sales and CPI as well as China trade balance and Japanese GDP.

The UK data is likely to be overshadowed by Brexit politics once again as May brings her latest Brexit deal to parliament for a vote on Friday. But a Tuesday speech from here will be key. She will need to secure clear concessions from the EU by Thursday otherwise votes on Plan B become inevitable. Her best hope appears to be a deal with Corbyn for Labour support but that risks a Conservative civil war. At risk is the 1.2850 support on GBPUSD, which appears increasingly endangered amid the latest buying wave in USD.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| GDP (m/m) | |||

| -0.4% | 0.0% | 0.2% | Feb 11 9:30 |

| FOMC's Bowman Speaks | |||

| Feb 11 16:15 | |||