Intraday Market Thoughts Archives

Displaying results for week of Oct 29, 2023Pre NFP Video فيديو سريع قبل الوظائف

We sent this quick video to our WhatsApp Broadcast Group members focusing on key resistance levels in SPX (US500) and Nasdaq100 (US100) . أرسلنا هذا الفيديو السريع إلى أعضاء مجموعة لاعضاء مجموعة الواتساب التركيز على مستويات المقاومة الرئيسية

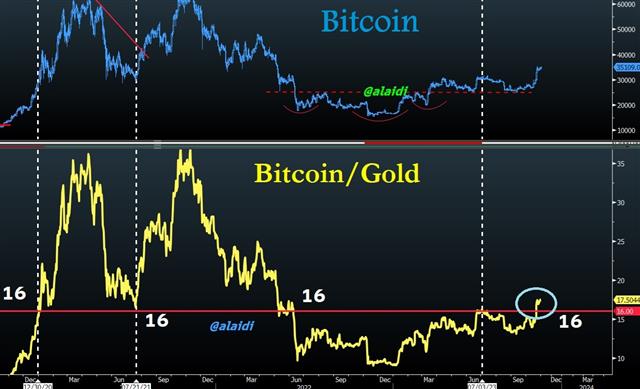

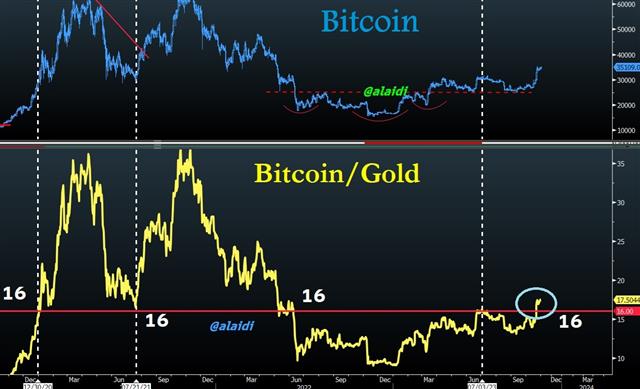

Bitcoin Leaves 16oz Gold Behind

As Powell's press conference drove down bond yields on his statement about upcoming tightening of conditions (reducing the need for further hikes), bitcoin rallied higher alongside equities. Now that Bitcoin/Gold ratio is well above 16 (17.9) the highest since May 2022, the implications for further run-up are enormous. If you take a closer look at last week's video about the importance of the 16.0 Ratio, you will appreciate its historical effectivenes regarding Bitcoin's inflection points (upside and downside). Here's the video again illustrating the turning poins since autumn 2020. And if you ask "Ashraf why compare Bitcoin vs Gold instead of something else?" here is the answer

Non USD Risk in the Money

Here is a trade I issued yesterday to our WhatsApp Broadcast Group ahead of today's Fed decision/Powell press conference, which does NOT involve the US dollar. You may think it is EURGBP, but it's not. The trade is already in the money since Tuesday afternoon. The 3 different charts below represent 3 different time frames, each supporting and bolstering the other with distinct approaches to technical analysis. Can you guess the trade? Pleas feel free to @ me via Twitter at twitter.com/alaidi or post a comment on my latest Youtuve video and we'll take it from there. Best of luck with the Powell press conference and keep in mind the meaning of Bear Steepening into the rest of the week.

Gold RSI & Indices' Price & Time Analysis

There is no hyperlink in these timestamps so you will have to manually go to these time sections in the video

9:05: +70% RSI Patterns in Gold

14:28: VIX Facing 24

15:00: What's after the 200-DMA in Nasdaq100, SPX500 & DOW30

16:15: Combining 350-DMA with 200-DMA for SPX

19:55: Example of Reward-Risk Ratio vs Size Management

PreFOMC Video with EightCap

I'm happy to announce the start of a new video series for November with EightCap and Trade Zone. I hope you enjoy this video ahead of Wednesday's FOMC with analysis on XAUUSD, SPX, Nasdaq100, USDJPY and EURUSD. Full video.

Why I Chose Gold vs Bitcoin

More on BTC vs gold:

You've already heard that bitcoin is a form of monetary gold. They both serve as store of value but far from the best medium of exchange. The market value of gold that's above ground is around $9 trillion, whereas for Bitcoin it is $680 billion. As Bitcoin disruption picks up partly with the help of democratisation by one of the safest investment instruments (ETFs) from the world's biggest asset manager (Blackrock manages $9.4 trillion), it has potential to gain 13x (9trillion/670 bln) to catch up with gold's captalisation. If you think that's way off, see what happened in in 2020-2022 when "things happened fast".BITCOIN remains the strongest computer network (confirming and validating transactions) in the world, and MONEY ... is the most powerful social network. It combines these two elements, alongside speed of exchange as powerful as email. Bitcoin is not controlled or backed by a sovereign state, while its supply shall remain capped at $21 million. As sovereign states resort to fiscal acrobats, living month-to-month by issuing debt to meet existing obligations, the fixed supply nature of Bitcoin combined with its technical invincibility makes it hard to miss. The Bitcoin/Gold ratio has been well above 16/oz for over a week. Take another look at the video to assess for yourself what happened to BTC when the ratio held or broke over the past 7 years.