Intraday Market Thoughts Archives

Displaying results for week of Dec 08, 2019400-pip Election & Unconfirmed Deals

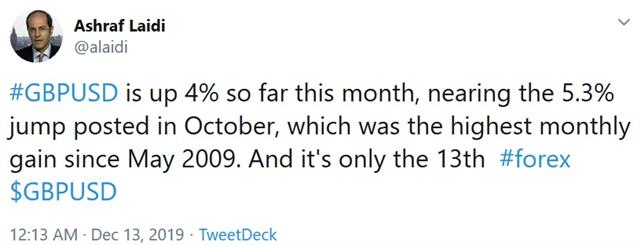

UK Conservatives won a resounding electoral majority to ensure a Brexit deal. Less than 20 hours after Trump lifted markets with his trademark tweet on reaching a tariffs deal with China doubts are resufacing ... again (more below). The pound soared by more than 4 cents to 1.3514--the highest in 19 months straight after exit polls showed Conservatives had the biggest parliamentary majority since 1987. US Nov retail sales disappointed with a 0.1% rise (control group) vs expectations of 0.3%. Days like Thursday remind us why we love the FX market. The news and market moves were non-stop in a sea of opportunity. The DAX Premium trade was stopped out and a new GBP trade issued ahead of the polls is +300 pips in the green.

What's a Friday without a Trump Trade Tweet

US indices are off 0.8% after Trump disputed a WSJ article stating that he agreed to roll back existing tariffs. The details are still murky but we have yet to hear from China's state council information office at its press conference due shortly. It will undoubtedly ratchet down tensions and promises a period of stability. Like the UK vote, traders were also reluctant to price in a deal because of Trump's unpredictability.The deal is good news for global growth in H12020 and underscores that the global easing cycle is over, at least for now. There are many breakouts but a standout is AUD/USD. We highlighted the break of the major downtrend yesterday. The was followed by breaks of the 200-day moving average and the October high on Thursday. A weekly close above those levels would be a further positive signal.

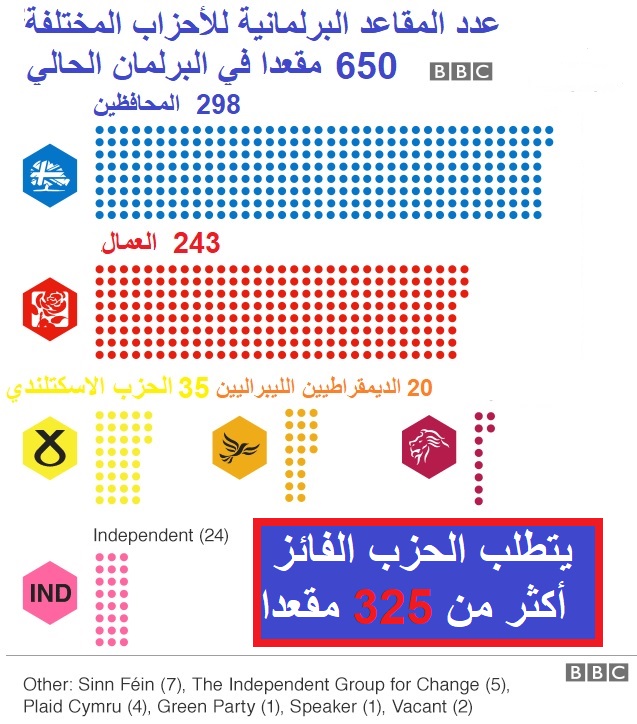

The UK election was the crescendo. The market has been leaning towards a solid Conservative majority since the vote was called but no one could forget the failure of pollsters in the Brexit and 2017 UK votes. So even though the result was 'expected', we had a massive market move. Part of that also speaks to the strength of the Conservative majority. It looks to be at the extreme limit of what polls were indicating.

UK Conservatives crushed expectations with 364 seat-victory, fuelling sterling's rally on the basis of a strong, stable, business-friendly government in the UK, something it hasn't had in a decade. Wit the rise above 1.35 the pound broke the March 2019 high. In the bigger picture it's only back to where it was on the night of the Brexit vote. In the days ahead real-money and structural shorts will be unwound and further upside could come from any less-austere hints from Johnson.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| FOMC's Williams Speaks | |||

| Dec 13 16:00 | |||

| Core Retail Sales (m/m) | |||

| 0.4% | 0.2% | Dec 13 13:30 | |

Powell, Lagarde, Elections & Trump

Powell kicked off another round of US dollar weakness ahead of what should be a wild finish to the week in the FX market. Risks include the ECB decision, UK election and US-China tariffs (more on each below). The Australian dollar broke a year-long trendline Wednesday, but keep an eye on AUDUSD's 200 DMA. After having closed GBP trades at a gain 2 days ago, a new round of Premium Insights trades will be released later this evening ahead of the UK elections.

فيديو المشتركين إدارة مخاطر الإسترليني حول الانتخابات

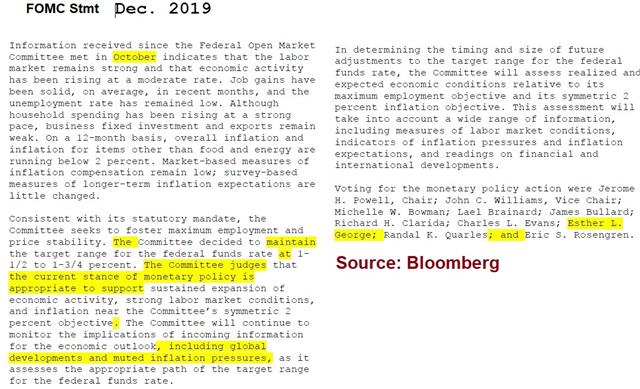

The most-notable change in the FOMC statement was the addition of a line saying “the current stance of monetary policy is appropriate” which is the Fed's way of saying they're in neutral mode. To emphasize the point, the Fed removed a dovish nod to 'uncertainties'.

But it was a comment from Powell in the press conference that sparked a slump in the US dollar along with a rally in bonds and gold. He repeated a line we highlighted after the October FOMC – that it would take a 'significant' and 'persistent' overshoot of 2% to trigger rate hikes. He emphasized that was his personal opinion and not the FOMC's but for the market that didn't matter.

The initial thinking in October was that it could have been a slip of the tongue but his choice of the exact same words means that it's a message and the implication is clear – that Powell doesn't plan to hike rates for a long time.

The commodity currencies made the largest moves on the comments in part because they're best positioned (along with EM) for global growth and reflation. Notably, AUD/USD rose above a downtrend that began almost exactly a year ago at 0.7400 and was previously tested (and held) four times. A break of the 200-dma at 0.6911 and the October high of 0.6933 would confirm the end of the long slide.

The first event of the day ahead is the ECB meeting. Changes in policy are almost out of the question but this is Lagarde's first press conference and it will be an opportunity to establish what kind of central banker she wants to be. Most analysts expect her to be a dove, but she may position herself as someone who will pressure governments to reform and stimulate and escaping negative rates could eventually be part of that toolkit. It could be argued Lagarde will not be in a hurry to ease as the Fed removes its foot off the accelerator.

The main event of the day comes late as UK exit polls and election results come in. The first exit polls are due at 2200 GMT and moves in the pound will be significant. Final polls show Conservatives with 5-12 point leads with the median closer to the high end. Whatever the result, expect the trend to have multi-day staying power at the very least.

Finally, there are reports that Trump plans to meet with top advisors regarding tariffs on Thursday. The decision may leak immediately, or he could announce it himself. A delay on the Dec 15 deadline is expected at the very least but nothing is ever fully priced in with Trump. If he announces that the tariffs will go into effect, it will crush risk assets.

إحصائيات ٣٢ سوق عبر ٢٥ سنة عملات، سلع و مؤشرات

الكل يعرف قياس أداة الأسواق (عملات، مؤشرات و سلع) عبر الترتيب الزمني، لكن ماذا عن الترتيب التصاعدي أو التنازلي من حيث الأداء بدل من الزمني؟ و لماذا يدعى الين الياباني بالعملة المتطرفة؟ و ما يعني اداة العملة الكلي؟ إستفيد من ٢٥ سنة من إحصائيات ٣٢ سوق عالمي في الفيديو المفصل

GBP Pares Poll Losses, Fed Next

The pound is paring its losses following a 100-pip drop caused by an update to a highly-influential election poll. US CPI is due next, followed by the FOMC decision later in the evening --widely expected to keep rates on hold. The Fed has succeeded in keeping itself out of the conversation (for now) as the countdown to US elections starts. Market emphasis shifts towards the Fed's rising purchases of repos and the onset for possible QE4 (more below).

The pound tumbled by more than a full cent after Tuesday's NY Close after a pair of polls showed slipping Conservative majority just ahead of Thursday's vote. The YouGov MRP model was a rare poll that showed a hung parliament ahead of the previous election so it carries extra weight. In late November it showed Conservatives with a 68-seat majority.

The polls, however, picked up on a renewed shift towards Labour in the final days and now see just a 28-seat majority. They also said a hung parliament was within the margin of error in what would be a nightmare scenario for the pound, especially with the DUP in danger of turning its back on Boris Johnson.

A separate model from Focaldata hours earlier showed a similar trend. They pegged the majority at just 24.

We are now certainly in the gut-check moment ahead of the vote. No trader has forgotten the surprises on the 2017 election night, or the Brexit referendum and these numbers are a stinging reminder of the risks. Cable fell more than 100 pips in the aftermath of the polls to 1.3108 but has rebounded to 1.3160 in Lodon trade.

Ultimately, that leaves more upside for the pound if Johnson prevails with a comfortable majority, but would-be buyers are more apt to wait until the fog clears at this point.

Compounding the uncertainty at the moment is the FOMC decision on Wednesday. Expectations for any meaningful change in policy are minimal but expect a small downgrade in commentary on consumer spending. A research report from Credit Suisse also got plenty of attention. It warned that the market is underestimating the probability of year-end liquidity stress and raises the possibility the Fed could be forced to buy bonds.

25 Yrs of Intermarket Stats

Updating our performance charts on 25 years of intermarket history --Currencies, commodities and global indices by chronological order, by instrument and even by ascending/descending order of performance (not by year). The last part may not be famililar but could be more valuable than what you're accustomed to. Full Video.

مصير الإسترليني بعد الإنتخابات البريطانية

ستعقد الانتخابات البريطانية التي طال انتظارها يوم الخميس. ونشاهد حاليا الإسترليني أفضل العملات أداءً حتى الآن هذا العام، حيث اكتسب احتمالات فوز حزب المحافظين بأغلبية. فما هو احتمال حدوث صدمة أو مفاجأة؟ أي ساعة سيتم إعلان النتائج؟ سيناريو 1: فوز المحافظين بأكثر من 325 مقعد سيناريو 2: فوز المحافظين ولكن بأقل من 325 مقعد سيناريو 3: حزب العمال مع أو بدون أكثرية و ثلاثة نقاط مهمة التحليل الكامل

EoY Competition مسابقة نهاية السنة

What's happening in currency markets that we have not seen since 1996. Pls read the box below carefully. A big hint is found here.

يمكن إستعمال الرابط للوصول على الإجابة الصحيحة

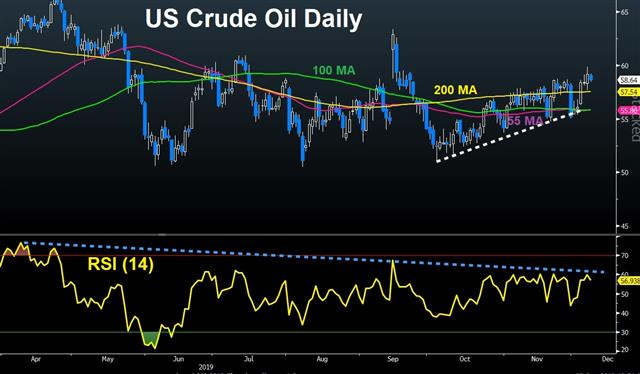

2020 Oil: Intrigue & Non-Direction

The latest decrease in OPEC+ quotas, combined with an extra cut from Saudi Arabia sent oil prices 7% higher last week. Despite the move, the market has grown far too complacent about the risks in the sector and the murky outlook for 2020. CFTC positioning data showed a shift into antipodeans and out of the low-yielders. Cable regains 1.3150s, making the GBP the year's highest performing currency. Earlier today, Ashraf closed the Premium long GBPUSD trade at 1.3170 for 250-pip gain, before the next move ahead of Thursday's elections.

Aside from a brief bout of volatility around the Saudi rocket attacks, the oil market has been unusually sleepy this year. If we exclude the first 9 days of the year, the $15 range this year is the narrowest since 2003. The market has become a proxy for global growth sentiment more recently, but far more is emerging under the surface.

OPEC showed up in a big way this week, pledging deeper cuts than anticipated along with Saudi Arabia adding an extra 400k bpd in voluntary cuts. After the surprise move, crude rose to the highest since the aftermath of the missile attack.

The intriguing spot to watch in 2020 is US shale. The pain in the shale sector is hardly drawing any attention, but it's real and -- could get much worse, especially as yields correct.

The two key forces to watch:

1) Shale wells aren't producing as well as promised and production isn't growing as fast as anticipated. Estimates for 2020 US production growth are down to 600k bpd and they're falling almost daily. There's underinvestment elsewhere so a shortfall is coming so long as global growth holds up.2) The debt market for small and medium oil companies is shut. There's a fiscal cliff – or a fracking cliff – in oil coming. All the cheap money raised in the 2010-2014 era and is coming due from 2020-2024. It's increasingly clear that they will not be able to roll over the debt. That's leading to a rush to deleverage and many producers are going on a starvation diet. At some point large producers will come in and pick off the small ones but there's no telling if they'll wait for bankruptcies or just lower stock prices.

The nightmare scenario remains that of a protracted bust, spreading through debt markets. It's tough to see that unfolding in a US election year but even a sharp shift towards cash flow and away from production growth threatens to tip the oil market into undersupply. That will reverberate through FX, central banking and virtually every other part of markets.

CFTC Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR -69K vs -61K prior GBP -30K vs -37K prior JPY -48K vs -40K prior CHF -22K vs -21K prior CAD +21K vs +20K prior AUD -36K vs -45K prior NZD -27K vs -36K prior

The crowded AUD and NZD-short trades are clearing out quickly. That's a classic shift as the rate-cutting cycle comes to an end – at least a temporary one. Friday's US jobs report added to the optimism about global growth in 2020 and helped to boost the pair. On the flipside, note how better sentiment is not narrowing the EUR position; it's another sign that its status as a funder is secure.

ندوة أشرف العايدي مع أوربكس مساء الثلاثاء

لا تفوتوا ندوة مساء الثلاثاء-- يوما قبل قرار الفدرالي و يومين قبل الانتخابات البريطانية. كيف سيؤثر قرار الفيدرالي على العملات والمؤشرات؟وما هي أفضل إستراتيجية لتداول الجنيه الإسترليني؟تابعوا خبير الأسواق العالمية في ندوته الالكترونية يوم الثلاثاء 10ديسمبر في الساعة 10 بتوقيت مكة للتسجيل من السعودية فقط الرجاء النقر هنا و للتسجيل من باقي دول العام الرجاء الدخول هنا