Intraday Market Thoughts Archives

Displaying results for week of Feb 02, 2020US Rides High into Non-Farm Payrolls

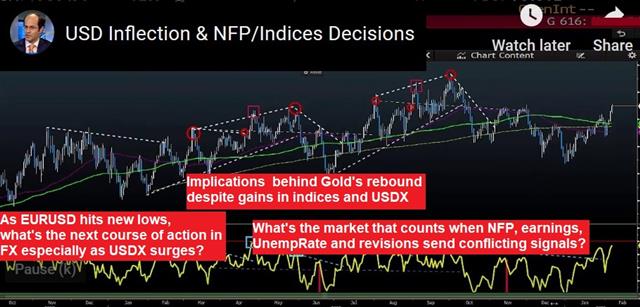

Markets were more settled Thursday and that's typical of the lull before non-farm payrolls. The US dollar was the top performer while the pound lagged. The Canadian jobs report is due along with the US report. Ashraf posted a Premium video ahead of NFP, addressing the 3 key points below.

The US dollar crosses some technical thresholds Thursday, but only tentatively. EUR/USD fell through 1.1000 and touched the lowest since October while USD/JPY rose above 110.00 for the first time since the coronavirus flare up on January 21. GBPUSD softened for the third time in four days this week and is now less than 30 pips from a fresh post-election low.

Even with the S&P 500 edging to a record, the commodity currencies remained tentative. The Australian dollar erased Wednesday's gain and USD/CAD briefly rose above 1.33 for the first time since Dec 3.

All the moves lacked genuine conviction and bonds were flat with no particularly market-moving news aside from OPEC chatter that ranged from a 600K BPD cut to simply extending the current quotas to year-end. Russia continues to be the reluctant partner.

The day ahead will be all about jobs with the US non-farm payrolls report forecast to show 165K new jobs. The market is probably priced 10-20K a bit higher after Wednesday's ADP beat. The dollar will need some measure of positive news to sustain its recent rally but it's tough to see this report as a game-changer no matter what the number is.

From a traders' point of view, USDX has pushed to news highs ahead of US jobs, while EURUSD is testing key support levels. By the same token, gold has recovered off its 1550s lows to climb along indices and stocks. Ashraf mentions some similarities with the current set-up and suggests possible inplications.

The Canadian jobs data released at the same time tends to be more volatile and it often results in a bigger kneejerk market move. The consensus is an unusually high +17.5K after a +27.3K reading in December.

Finally, the past two Friday's have featured a late-week selloff on coronavirus weekend worries. That's still a risk but with new cases now falling in China, it may not be a factor.

إحصل على 5 فيدوهات تعليمية للتداول الآن

لن أضيع وقتكم في التمييز بين التحليل الفني و الأساسي، بل سندخل في قلب النقاط الهامة في كلا من الفيديوهات الخمسة للكشف عن بعض الطرق الناجحة لتداول العملات و السلع و المؤشرات. إبدأ اليوم

A Nod to the Levels

Risk trades (buying equity indices, selling yen & treasuries) continue to make big swings, highlighting the importance of technical signals. We highlight some key levels to watch. +1000 DOW30 points over the last 2 days sums up the mood in indices. Although the Australian dollar was the top performer Wednesday (CHF was the laggard), the magnitude of the move was small. We would have expected better, especially if this was truly the market signaling China's containnment of the coronavirus. Ashraf will send a subscribers' video on Thursday to suggest the next course of action after having ridden the final leg down for a +500 pt gain. The Arabic version of the video is below.

فيديو للمشتركين متى الدخول في المؤشرات و الخروج من اليورو؟

On that front, fanciful rumors did the rounds about a 'cure' but scientists dashed that talk, while remaining optimistic that HIV drugs could help spare lives.

Early Wednesday, Hubei province reported 2,987 new cases; down from 3,156 a day earlier in the first daily decline since the outbreak. That may reflect a lack of test kits but on the surface it's genuinely good news, even with total cases approaching 30,000. What next? No one can predict a pandemic but some technical levels in market could indicate what's coming next.

Some key levels

AUD/USD is certainly one. It has climbed 75 pips above the major bottom near 0.6675 but it will need to get all the way back above the 200-day moving average at 0.6860 to generate a truly positive signal.With regards to USDJPY, have a look at this chart from the earlier IMT.

EURUSD A fight that will be settled much sooner is in EUR/USD, which continues to move inverse to the risk trade. It came within 2 pips of the 2020 low of 1.0992 on Wednesday and the November low of 1.0981 is just below that. If those levels in the euro break, it may come at the same time as a further rally in the S&P 500. It rose to within a point of a fresh all-time high on Wednesday and a decisive breakout would also send a positive signal for yen crosses.

US Crude Oil - WTI Crude oil rejected a decisive break of $50 so far, largely seen as the low of a triple top target. The OPEC+ technical committee is meeting for a third day on Thursday and if they recommend a 200k bpd cut or take a wait-and-see approach; the selling pressure could mount again. Upside seen cappped at 53.8/54.00 for now. The charts below are from the Premium Insights' Jan 8th trade to short oil at 59.65, which was closed at 52.55.

Treatment Rumours & Iowa Dems Damage

US indices resume their rally on a combination of surging tech shares partly powered by Tesla, reports of a possible treatment for the Corona virus and renewed signs from central banks that they will act where needed to stem the economic impact of the deadly virus. When the US election will begin to effect markets is an open question but the rally in risk assets after the Democratic fiasco in Iowa is some evidence that markets are tuned in. The Australian dollar was the top performer while the yen lagged. US ADP employment surged to a higher than expected 291K from 199K. All eyes turn to the Jan ISM non-manufacturing.

The main factor driving the big rebound in risk assets Tuesday was undoubtedly fading coronavirus fears and the massive liquidity injection from the PBOC but politics likely played a part as well.

Almost everything that could have gone wrong for Democrats on Monday night did, as the party failed to release the results. On Tuesday officials belatedly released partial results showing Buttigieg narrowly ahead of Sanders, followed by Warren and Biden.

A common refrain was along the lines of 'this is the party that wants the government to run healthcare, but they can't run a vote.' The failure hurt the party's brand and is a stumble right out of the gate for a party that can't afford one.

Importantly, no candidate generated any real momentum and enthusiasm from the race. In particular, Joe Biden performed badly, hurtingchances of a centrist winning the nomination. Even more damaging was the poor turnout. The numbers mirrored the prior election cycle and where nowhere near what Obama achieved in 2008 and that's means a return to Trump's market-friendly policies, and perhaps a re-take of the House is more likely.

Looking ahead, January ISM non-manufacturing index is forecast to post a slight improvement to 55.1 from 54.9.

To get these Intraday Market Thoughts in your mailbox: Start here

A Look at February Seasonals

Global indices resume their rally after a bounce in Asian markets following PBOC's biggest injection in over a year. But the news on the Corona virus front remain worrisome as cases exceed 20,600 and fatalities hit 425. USD is stronger across the board and GBP rebounds back above 1.30 on stronger than expected construction. Oil tested key support levels before bouncing on talk of a possible OPEC cut. Will take a look at some February seasonalities later below.

Clashing statements from the UK and EU were a reminder that nothing is easy in Europe and that Boris Johnson's promise of a deal by the end of the year is a longshot. The pound sank to 1.2990 from 1.3175 as it wiped out the gains of the prior two days and closed at the lowest since January 12.

It's clear that both sides are going to be playing games, starting with the EU's Michel Barnier who said he offered a deal but only if the UK agrees to its rules. Boris Johnson rejected the offer only minutes later. It was a reminder that it will be a bumpy road toward a deal, if one ever comes. Political headlines will be a constant headwind. But pay a close watch on GBPUSD and the chart Ashraf posted yesterday, which continues to hold. US factory orders are next.

Elsewhere, sentiment was positive outside of oil. A risk-on bounce couldn't halt a drop that's now extended to 24% from the peak of the US-Iran flareup. Worse still, WTI crude fell below a triple bottom at $51 and broke $50 for the first time in 12 months. OPEC+ continues to make noise about a production cut but the market is already signaling that it won't be enough. Meanwhile, US 10-year yields bottomed at 1.50%

A quick look at the February seasonals:

The February, March and April are the three best months for WTI crudeBitcoin has climbed in five straight years in February.

US natural gas is at a four-year low but Feb is the worst month.

US Crude oil (WTI) rose in February in each of the last 15 years, with the exception of 2018, 2013 and 2006.

Would you like to get these Intraday Market Thoughts in your mailbox? Start now.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Factory Orders (m/m) | |||

| -0.7% | Feb 04 15:00 | ||

Western Markets Absorb China's Plunge

Chinese markets did their part in returning from a long holiday with a broad sell-off as part of a price discovery catch-down exercise in light of the virus fallout. But markets in Europe and the US resumed their rally, after SPX held up above 200-DMA mentioned in Friday's note. China's decisiom to cit rates on 14-Day and 7 day reverse repos did help sentiment, as well as insistence from the PBOC to offer extra liquidity where needed. Sterling lost all of its post-BoE gains on prolonged conflicting statements from UK and EU officials regarding a future trade deal.

Coronavirus cases in China have increased to 17,205 and the first death outside of China was reported in the Philippines Saturday. The city of Wenzhou (pop: 9m) became the first outside of Hubei to be locked down. It's an important port city in the Zhejiang province that's south of Shanghai. Only one resident per household will be allowed to leave the residence every two days to buy household necessities.

Economically, oil market watchers are estimating that Chinese demand is down 20% below normal levels and WTI fell as low as $50.42 at the open.

The bigger spotlight was on Chinese equities, which fell 8% despite Beijing's efforts to curb short sales and boost liquidity. The rates on 7 and 14-day reverse repos were also cut by 10 basis points along with a series of smaller banking measures. Here's Ashraf's warning below to the shorts late Friday after the short DOW30 trade hit its final target for 520-pt gain.

China has many levers to pull to stimulate demand but no amount of stimulus will reverse the fortunes of the country while the virus is still intensifying, with millions of people cut off from commerce.

Early-week sentiment outside of China is modestly positive, perhaps on signs that there has been no sustained transmission outside of China. Further curbs and quarantines could help it from turning into a pandemic. What's worrisome is that, there are more reports of low-intensity cases. On the surface that sounds like good news but researchers highlight that it means there is a higher likelihood that there are dozens of people outside of China with only cold-like symptoms who are unwittingly seeding the virus internationally.

Expect coronavirus news to dominate the week ahead with more of the kinds of swings we saw late last week.

CFTC Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR -59K vs -47K prior GBP +18K vs +25K prior JPY -36K vs -45K prior CHF +3.5K vs +1.5 prior CAD +35K vs +38K prior AUD -27K vs -19K prior NZD +2.0K vs +1.8K prior

Expect a continued unwind in yen shorts if the coronavirus threat remains high.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Eurozone PPI (m/m) | |||

| 0.2% | Feb 04 10:00 | ||

هل ترغب في تعلم التداول في الأسواق المالية؟

بلإشتراك مع خبير الأسواق العالمية أشرف العايدي نقدم لكم سلسلة تعليمية مجانية لمساعدتكم في تعلم أساسيات التداول سيكولوجية التداول و إدارة المخاطر أقوى نماذج التحليل الفني و تطبيقات محققة دمج مؤشر القوة النسبية مع تحليل الأسواق البيني استغلال الأخبار و البيانات عبر دمج التحليل الفني و الأساسي خمس صفقات سابقة ناجحة وفاشلة

تتألف السلسلة التعليمية من 5 مقاطع مصورة نغطي خلالها المواضيع الأساسية و المواضيع الأكثر تعقيداً كذلك من أجل مساعدتكم في بدء مشوارك في عالم التداول اضغط على الصورة أدناه لمشاهدة كافة المقاطع في قسم التعليم

هل ممكن أن ينهار الدولار؟

هل ممكن أن ينهار الدولار؟ وماذا سيحصل بالاقتصاد العالمي في حال حدوث ذلك؟ هل يمكن أن يحل اليورو أو اليوان الصيني محل الدولار الأمريكي في غضون 10 سنوات أو 20 عامًا. المقابلة الكاملة