Intraday Market Thoughts Archives

Displaying results for week of Feb 09, 2020Bazooka or Nuclear Stimulus

It's far too early to declare anything about the coronavirus epidemic but the market reaction has been instructive – fiscal and central bank policy is overwhelming fundamentals. The pound was the top performer Thursday while the kiwi lagged. Stocks retreated slightly lower after the Fed announcd it was reducing the daily operations of its repo agreements, but will hold the monthly amount of t-bill purchases unchanged at $60 bn per month. Silver and CAD are at the top of the day's performers. US retail sales are due up next.

4,823 additional coronavirus cases were reported in Hubei, suggesting that the 15,000 reported a day earlier was an aberration due to the new methodology in counting infections. Will be crucial to see if markets pullback late on Friday and Sunday night as they did in the last 3 weeks.

Risk trades dipped again Thursday and once again the dip was bought. Looking back at the past month, not once did US stocks finish a day on the lows and there were only two days where genuine risk aversion took hold.

It's remarkable how well equity markets have held up facing a near-complete shutdown in the world's second-largest economy and a genuine threat of a global pandemic. With another 5000 cases reported on Friday, perhaps that's the wrong reaction but if we take it at face value, it sends a discomforting message: That easy money has conquered economic anxiety. The trio of central banks promising to keep rates low indefinitely, quantitative easing and looser fiscal policy (excluding the eurozone) aren't just a bazooka, but a nuclear bomb. Greek bonds are now trading under 1%, need we say anymore?

Having said, take a look at what's going on market internals in Ashraf's piece yesterday.

Ultimately, inflation or currency debasement will spark a re-think but the structural forces of globalization, automation and demographics are keeping prices low. On Thursday, US CPI rose 2.5% y/y, up from 2.3% a month earlier but that will surely unwind in February with the cratering of energy prices.

In the short-term, we warn (as we did last week) that Fridays are a tough day for risk trades because of virus uncertainty. AUD/USD has fallen an average of 0.53% in the past three Fridays.

Also watch out for the January retail sales report at 1330 GMT. The consensus is for a 0.3% rise, matching the December number, which could also be revised.

Look Here Before Jumping in

Whether you follow indices or not, it's crucial to keep in mind of the intraday and day-to-day flows across equity sectors in the US. I warned in today's earlier IMT against shorting feverishly at the first sign of a 0.5% drop in indices and cited in today's video (below) my reluctance to short indices on Friday (despite the approaching Friday bell and usually negative virus implications for markets). Having said, it is peculiar that the usually aggressive technology sectors (Not NASDAQ) have yet to hit new records (SOX and XLK). Further, as US indices hit new highs for the day (as of 16:39 London/GMT), defensive sectors are in the lead (utilities and consumer staples). So keep an eye on SOX, XLK for that crucial component needed to maintain upward momentum and I'll keep an eye at their equivalent in the DAX. Below is the video for Premium members, where I note the 2 metrics Im watching before a possible short.

Bears Lack Follow Through

Stocks were dealt an initial jolt in early Asia trade after the number of Coronavirus cases in Hubei soared by nearly 14,840 following a change in the method for counting infections. The death toll jumped by 242 for the day alone. More on the IEA warning below. GBP dropped briefly after UK Chancellor Javid (Finance Minister) resigned, but immediately spiked back to 1.3040s after the announced appointment of Rishi Sunak, a former Goldman Sachs analyst and rising young star in the Conservative party. Euro resumes its broad selloff, approaching key levels vs USD and GBP (more below). The English video for Premium susbcribers will follow momentarily.

متى بيع المؤشرات؟ فيديو للمشتركين

Weighing on oil and indices was the warning from the International Energy Agency that global oil demand could drop this quarter for the first time over a decade.

Some key levels

Beware in assuming that each 100-pt drop in the DAX or DOW will extend into a 400-pt plunge. Key levels seen on DOW30 are 29280 and 13600/20. As I will mention in the upcoming video, it is best to wait for more consolidation near current DAX30 levels (13750/13820) before our preferred metrics/components reach levels more suitable for shorts.Euro extends damage

EURUSD drops below 1.0860 as the single currency is dumped while being used as a funding vehicle to finance risk-on trades in indices. This is especially highlighted by its isolated performance vs USD at a time when the greenback is struggling vs GBP, CAD, the high yielders and even JPY. A break below 1.0820, risks breaking the gap from April 2017, potemtially reaching 1.0680s.ندوتي مع أكس تي بي يوم الإثنين

إنتهاز الضجيج الإخباري بين العملات و المؤشرات - كيف يمكن للمتداول الإستفادة من الضجيج الإخباري بين العملات و المؤشرات؟ بيع المؤشرات أو شراء الذهب؟ وما تغير داخل دور الفدرالي في دعم المؤشرات بدون تخفيض الفائدة؟ بإنتظاركم في ندوة مساء الإثنين. للتسجيل

Low Key Powell, High Gear Appetite

USD resumes pullback as yields recover and stocks rip higher after Fed Chair Powell stuck to the script: Monetary policy was appropriate and it's too early to estimate the impact of coronavirus. China reported the lowest number of Coronavirus cases in over 2 weeks. NZD leads the pack after the RBNZ surprisingly shut the door on 2020 rate cuts. Yesterday's Premium trade is 50 pips in the green, while the below is the "before-&-after" chart of our Premium long in Bitcoin from Jan 13.

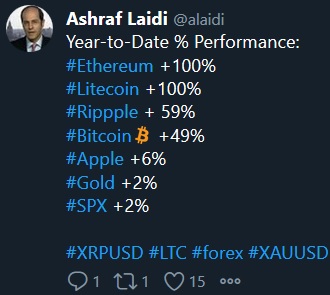

Fed Chair Powell said there will likely be some impacts on the US from the virus but said it's too early to judge if they will be persistent or material. Odds for a September rate cut have fallen to 64% from 87% 2 weeks ago. But Cryptos continue to rally across the board as the snapshot shows below.

The stock market continued to vote otherwise with the S&P 500 hitting a record before paring its gain to finish the day 6 points higher. Treasury yields rose 3 basis points across the curve and the modest strength in AUD also pointed to better sentiment.

The euro touched a new low for the year but support at the September low of 1.0879 has held for far. If the strength in the US dollar continues, that's a major pivot point to watch because there is little technical support below until the 2017 lows near 1.04.

Get these Intraday Market Thoughts in your mailbox Start now.

Risk Trades Escalate, Virus Cases Dip Pre Powell

The drift further higher in risk trades continues as China reported fewer new cases once again on Tuesday. USD is off across the board (w/ the exception against JPY) after Fed Chair Powell's prepared remarks hit the wires (see Ashraf's tweets below). More market action could ensue after Powell immerses himself in the Q&A of his testimomy to the House of Reps. GBP resumes gains after UK Q4 GDP came in at 1.1% y/y vs exp 0.8% y/y. One of EURUSD Premium trades was stopped out and a new trade has been posted, backed bu 4 charts

China reported 2,478 coronavirus cases compared to 3,062 a day earlier and that has so far kept risk trades bid. US equities finished with a flourish on Monday with the S&P 500 up 24 points. A red flat continues to be in bonds where Treasury yields fell 3 bps to start the week are now just 4 bps away from 1.50%.

One way to square the divergence is the expectation that the Fed will stay lower for longer and that all global central banks and governments will stimulate in the face of any kind of slowdown. It's the same one-way bet that has kept risk trades bid for months.

If the coronavirus fizzles it will be one of the great achievements in public health history. We're months away from the all-clear but AUD/USD presents significant value if there is a quick turnaround. It probed through 0.6700 last week to financial-crisis lows but has rebounded back above.

Here is what happened the last time Powell spoke 11 days ago.

Virus Inflection Point

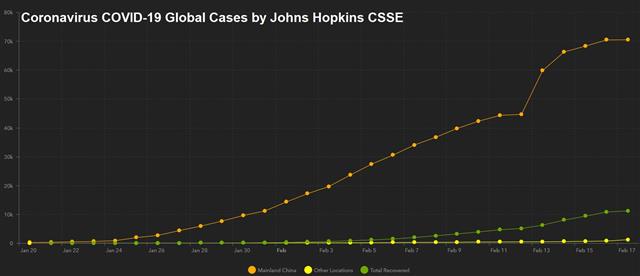

China has taken unprecedented steps to halt what surely would have been a global pandemic and in the next week or two, we will find out if they have worked. Markets are rallying on reports that FoxConn has received approval to re-open its plan in Schenzen and other versions of the story specified that iPhone production will resume in select regions. The chart below suggests that markets may also be starting to focus on the slowing pace of the virus than the aboslute numbers. Higher China CPI to start the week sparked some worries about PBOC ammunition. Fed chair Powell will testify to Congress on Wednesday and Thursday.

As coronavirus case hit 40,000 and deaths surpass SARS, the market remains on razor's edge. Incredible, if not draconian, measures by Chinese officials have slowed the pace of new cases, or at least reported cases. Yet as we learn more about the virus and some parts of China head back to work, there is plenty to worry about.

New daily cases have leveled off around 3000 in recent days and that's cause for optimism – so long as you believe the data. Skeptics might conclude that testing capability is strained and that would-be patients may be choosing to stay home rather than risk quarantine and isolation for family members. Rumors are rampant but the market has been trading on official news and hasn't worsened.

The week ahead will be a major test because parts of China's economy will look to restart and because we're now into the incubation window where secondary foreign cases are possible. One area to watch particularly closely is Indonesia. All its neighbours have cases and travel patterns show there should be some there yet there are still zero confirmed cases and traveler screening has been minimal.

Recovery and countermeasures

Nervousness re-emerged from the World Health Organization on concerns over the spread of the virus those with no travel history to China. But reports from the central govt announcing it will spend over $10 billion to contain the outbreak have helped stemmed an initial selloff in Chinese markets. The PBOC is also said to start injecting the first part of re-lending facilities to banks later this month, targeting nine major banks in 10 provinces and cities.CFTC Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR -75K vs -59K prior GBP +13K vs +18K prior JPY -21K vs -36K prior CHF +5K vs +3.5 prior CAD +19K vs +35K prior AUD -43K vs -27K prior NZD -2K vs +2K prior