Intraday Market Thoughts Archives

Displaying results for week of Mar 01, 2020العثور على النظام في فوضى الأسواق

مع التراجع الحاد في المؤشرات والدولارالأمريكي، والارتفاعات في أسعار الذهببسبب استمرار تفشي فيروس كورونا بشكلٍ شديد، كيف يمكننا العثور على الصفقات الصحيحة في ظل هذه الفوضى؟ التفاصيل في هذا الفيديو

Dollar Yield Differential Crumbles

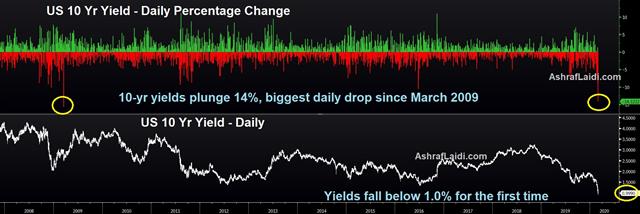

Equity indices fell by more than 3%, but it was the damage to the US dollar that gets our attention as the USD yield advantage crumbled further. The yen was the top performer while AUD and CAD narrowly underperformed USD. US non-farm payrolls is due up on Friday, but it will have little relevance as it captures no effect from the Corona virus. Meanwhile, the jump in the 10-2 spread is a typical occurence of an economy nearing recession after inversion. As the USD yield differential becomes fashionable, Premium members got an FX trade last Friday, based on 20-year cyclical time lags in FX-yield spreads, currently more than 200 pips in the green.

اليورو و الداو: الركوب او الانتظار؟ (فيديو المشتركين)

The virus reasserted itself as a dominant headwind for risk assets on Thursday and prompted a rush into safe-haven bonds and gold. US 10-year yields fell 13 basis points to 0.92%, just shy of the weekly low. The front end hit a new low with 2s touching 0.55% in the continued remarkable fall from 1.4% just two weeks ago.

That huge drop has deeply eroded the US dollar's yield advantage even as other central banks ponder easing. Given the high volatility in markets, carry trades are also more risk than market participants want to take. Those factors underpinned the continued rebound in EUR/USD and a fresh fall in USD/JPY to below 106.00.

With safe-haven yield now essentially extinct, gold is shining more brightly than ever. Last week's drop has been erased and the close on Thursday was a cycle high. There remains the risk of isolated liquidation as risk assets crumble but the extreme uncertainty around the virus makes gold particularly attractive.

Everyone is focus on the virus itself but the lasting impact is more likely to be the political and social faults it exposes. India's central bank took over its fourth-largest private bank on Thursday and Delhi shut down primary schools due to virus fears. The mix of political instability, extreme population density and a developing-world heathcare system is a massive risk in India and it was already grapping with slowdown before the virus. Whether it's there or somewhere else, a global pandemic is sure to topple some governments and gold-buying will be one response.

Looking ahead, the non-farm payrolls report along with Canadian jobs are due. All economic data does at the moment is set a baseline to measure how hard coronavirus hits when we get March numbers and beyond. Interestingly, BoC president Poloz hinted Thursday that they may have cut anyway even without the virus, so there may be a negative surprise in the Canadian number, and that could put some pressure on CAD.

Eroding the one-two punch

Markets erase 80% of Wednesday's gains 40 mins into the cash session amid news of more virus cases in NY and reports of testing for over a dozen cases in the US Pentagon. Also some US senators have announced the White House's goal of setting 1-million tests by end of week cannot be reached. If you were to sketch out an ideal scenario to counteract market sentiment related to coronavirus at the start of the week, it might have gone something like this: 1) Central bank rate cuts 2) Bernie Sanders faltering in the Democratic race. The one-two punch of central banks and politics is exactly what unfolded and it led to a big rebound in risk assets on Wednesday. Until things changed again.

Market developments will entirely hinge on the outlook for the virus. Signs of spread continue to percolate but many questions remain unanswered including how deadly it is, how many people get only mild symptoms and how easily it spreads. We don't have answers to those questions but the central bank and political moves are worth recapping.

The BoC cut 50 basis points (as we warned) on Wednesday to follow the Fed and RBA a day earlier. An MNI sources story also said the ECB was pondering rate cuts next week while incoming BOE Governor Bailey hinted at action. All are forecast to continue to ease. Had there been no virus, that would have been an extremely powerful signal.

Combine that with the latest political developments. Just four days ago Bernie Sanders was a 70% favourite for the Democratic nomination but with all the moderates coalescing around Biden and the results of the Super Tuesday votes, he's now at about 25%. A Trump vs Biden election is a significantly more market-friendly contest and that was clearly reflected in +10% rallies in US health insurers Wednesday.

Wednesday's one-two punch of central banks and politics is the market's best shot for a reversal. When the virus does turn for the better, it sets risk assets up for a remarkable rebound. For now however it's competing against a virus that threatens to devastate economies everywhere. Just 12 days ago there were 5 confirmed cases in Italy and today the government announced the shutdown of schools, cinemas, and public events nationwide. The European Commission is already warning about a recession in Italy and France.

The aforementioned one-two punch appears to be the market's best chance at a turn, as well as the best chance for to sell rallies, because it will be impossible to sustain upbeat economic sentiment until there is a clear picture of the impact of the virus, along with answers to the virus questions we posed above.

Staying above 10%

Indices are pushing higher (SPX and DOW +1.6% and 2.0% respectively) on a combination of Joe Biden's winning performance in Super Tuesday's presidential Democratic contest allaying fears of a win by the less market-friendly Bernie Sanders, and a 50-bp rate cut from the Bank of Canada. The latter cut rates to 1.5% to remain in par level with the US Fed funds rate. Chatter of a rate cut from the BoE and easing steps from the ECB are also emboldening sentiment from Friday's lows. The following key levels continue to act as key resistance; 3045/55 on SPX and 26430/50 on DOW30 acting as the level of 10% decline from the highs, DAX struggles to hold the 12180/90 trendline support from the Dec 2018 low and Apple capped below 304/5 (neckline & 55-DMA). USDJPY has yet to regain the 108.30s (200DMA). A new video for Premium susbcribers focuses on Wednesday's trades.

Fed Emergency Cut Falls Flat, BoC Next

The Federal Reserved has delivered its first intermeeting rate cut since Oct 2008, one week after stocks posted its biggest weekly decline since ...Oct 2008. The Global central banks failed to deliver a coordinated cut after a bland G7 statement but the Federal Reserve did with a 50 bps move. Yields on the US 10-year govt bond fell below 1.0% for the 1st time. Oil and US stocks initially spiked higher on the news but the reaction lasted only minutes as a 'sell the fact' trade hit hard. A consistent reaction throughout the day was weakness in USD/JPY and jumps in bonds and gold. Also keep an eye on the US Democratic presidential primaries in 14 US states and Bernie Sanders' road expandinhg his lead over Joe Biden. Friday's Premium short in EURUSD is currently in a 220-pip gain. Two new Premium trades were issued today.

The problem with the Fed surprise cut is that it was framed – unfairly or not – as an 'emergency' measure and to companies and Main Street all that does is underscore that coronavirus is an emergency. The S&P 500 jumped 80 points in seconds on the initial headlines but quickly gave it all back and closed down 86 points, or 2.8%.

Here are the levels Ashraf pointed out to as needing to clear for the bulls, before the rate cut. They were never celared.

As we warned yesterday, “Even if cuts are delivered the effect could be fleeting as investors continue to grapple with an seemingly endless stream of headlines about the virus.”

This isn't a financial crisis and it won't be solved by financial measures. Undoubtedly, lower rates will help in a rebound but that won't come until there is some visibility towards an end to the pandemic. Once again on Tuesday there was an endless stream of bad news about infections and deaths. The WHO revised its estimate of fatality rates higher to 3.4%, which is certainly a scary number to ponder with little chance now that the virus can be contained.

The Bank of Canada is the next central bank on deck with a decision coming Wednesday at 1500 GMT. A 25 bps cut is fully priced in and 50 bps is a 65% probability in the OIS market. The BOC has said recently that it doesn't want to fall behind the Fed so 50 bps is far more likely and 75 bps is a real possibility because Poloz may want to get ahead of a further March 18 Fed cut.

In any case, the bond market is way ahead of both of them. US 2-year yields hit 0.62% at the lows Tuesday and 10-year yields hit at record low of 0.90%. In a world where the Fed's mandate is to get inflation to 2% that looks like an overreaction but it also seems reasonable in a world where the Fed will seemingly do whatever it can to keep equity valuations high.

Central Bank Rescue?

The 1000-pt rally in Dow30 futures earlier in Asia was cut in half as markets await central banks to deliver on their statements to act appropriately in light of the global market and macro damage of the Corona virus. Fed Chair Powell's stmt on Friday was followed by similar remarks from the BoE and the BoJ, but not the ECB (that's partly why euro is the best performer since Sunday night). CFTC positioning data showed just how vulnerable euro positioning is to an unwind. Surprised by Goldman's Fed call below? Friday's Premium trade exceeds 100 pts in the green and Ashraf tweeted, urging partial profit-taking ahead of the US manuf ISM due at 10:00 Eastern (15:00 GMT/London).

A death and evident outbreak in the US pushed coronavirus onto front pages in America on the weekend as fears ramp up. The west coast of the US appears to be dealing with several outbreaks but it's the same story globally with cases continue to rise at a rapid pace in Italy and South Korea.

Goldman Sachs now expects the Fed to cut rates by a total of 100 bps by end of June (not by end of year).

The dramatic measures taken by Chinese authorities appear to have some positive effect on the spread with the number of new cases falling quickly. The types of mass, mandatory quarantines they have put in place will be tough to mimic elsewhere but the economic effects of the drastic moves came into focus on the weekend with the official manufacturing PMI falling to 35.7 from 50.0. That's an all time low that's far below the financial crisis bottom and much worse than 45.0 expected.

The non-manufacturing survey was even worse at 29.6 compared to 51.0 expected and 54.1 previously. The question is no longer whether Q1 GDP in China will be positive or negative, it's how deep of a contraction will it be.

That first piece of soft economic data may be enough to give cover to central banks to move fast. The BOC is scheduled for Wednesday and there is chatter of a global coordinated move then, or sooner. The market is already pricing in a March 18 Fed cut as a sure thing with a 70% chance of a 50 bps move.

Expect some kind of relief rally on central bank expectations or moves but how long it lasts depends on the next round of virus headlines. The central bank toolkit is much more powerful in a financial crisis than a biological one.

CFTC Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR -114K vs -92K prior GBP +30K vs +29K prior JPY -56K vs -27K prior CHF +1K vs +2 prior CAD +15K vs +8K prior AUD -44K vs -38K prior NZD -15K vs -12K prior

The theme in markets late last week was to head to the sidelines and that is likely to continue. That helps to explain the strength in the euro and yen.

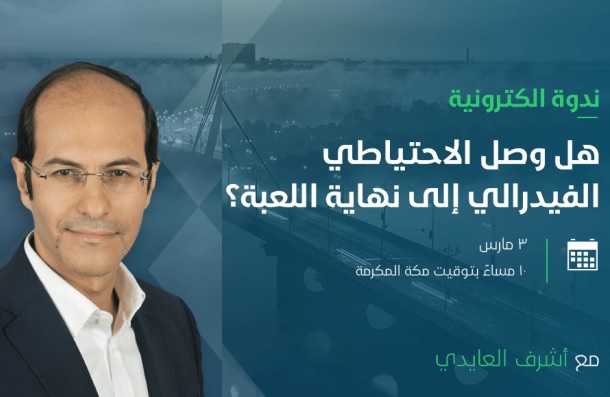

ندوة أشرف العايدي مع أوربكس مساء الثلاثاء

إلى أي مدى يمكن للاحتياطي الفيدرالي أن يدعم الأسواق بعد عودته إلى ضخ السيولة وعدم تمكن المؤشرات من تحمل التقلبات الاقتصادية بدون تدخل الفيدرالي؟ وماذا يعني ذلك لحالة الأسواق والاقتصاد؟ انضموا لهذه الندوة الالكترونية المجانية يوم الثلاثاء الموافق 3 مارس في تمام الساعة العاشرة مساءً بتوقيت مكة للتسجيل من السعودية للتسجيل من باقي البلدان