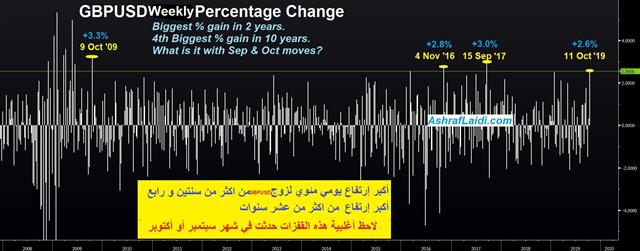

Biggest GBP Jump in 2 years

Sterling made its biggest weekly percentage gain vs USD in over 2 years and its 4th fastest rise in 10 years amid successive positive news on the Brexit negotiations front (more below). The Premium long trade in GBPUSD hit its final target for 260-pip gain. A solid Canadian jobs report dragged USDCAD lower by nearly 80 pips to 1.32. Markets now await comments from Trump on his meeting with China's vice premier as the US-China talks enter their 13th round. The other story is that of USDX selloff as the index broke its 55-DMA.

GBP extended its rally this morning when UK Brexit minister Stephen Barclay told ambassadors from the 27 EU member states earlier on Friday that sufficient progress had been made with his EU counterpart Michel Barnier in order for discussions to intensify. More developments are awaited ahead of next week's EU summit as well as the reaction from the DUP. GBP bulls are now reasoning that Boris Johnson had little choice (either to ask for a delay, or accept a deal) instead of being ready to leave without a deal.

GBP is now the best G10 currency performer since the start of Q3 (beginning of H2) and is the 3rd best performer year-to-date (behind CAD & JPY)

Onto US-China Talks

The market is pricing in a US-China trade deal that includes no new tariffs in exchange for agricultural purchases and a hollow FX pledge. That's nothing like the comprehensive deal many were hoping for but there is a reason the market liked it anyway. The Canadian jobs report is due on Friday but trade headlines will continue to dominate.A 'trade deal' is the wrong term to describe what appears to be shaping up between the US and China. This is more of a ceasefire that includes the bare minimum for both sides to save face at home and mitigate economic damage.

This wasn't what anyone was hoping for but markets are signaling it's good enough for now. Why? Mainly because it appears the US is backing down. If the truce comes together (and that's still far from certain at this point), it's because the US has backed down. They have been the aggressor in this fight and if Trump has had enough for now then he's not likely to escalate it until after the election.

In addition, this type of deal leaves enough uncertainty intact to keep the Fed easing cycle going. Or at least the market thinks it does. We will be watching for any signals to the contrary ahead of the Oct 19 blackout.

Looking further out, the deterioration in the US-China relationship is dire. The 'uncertainty' that the Fed has been lamenting on trade is now a permanent feature. It's entirely clear that a decoupling is underway and the only variable is the pace.

There are also important questions outside of the two countries. Those who can continue to trade openly with both sides stand to benefit, even if the overall picture means slower global growth.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| FOMC's Rosengren Speaks | |||

| Oct 11 17:15 | |||

Latest IMTs

-

NFP & CPI Credibility

by Ashraf Laidi | Aug 11, 2025 16:35

-

Forecaster App التطبيق الذي كنت تنتظره

by Ashraf Laidi | Jun 18, 2025 10:55

-

Updating GoldBugs تحديث مناجم الذهب

by Ashraf Laidi | Jun 16, 2025 13:58

-

Breaking Debt Ceiling & Forex Brokers

by Ashraf Laidi | Jun 6, 2025 17:33

-

Recession Metric & Tariff Marsh

by Ashraf Laidi | May 26, 2025 13:47