Pandemic Declared, BoE Cut, Trump, ECB Next

The UK unveiled a double-barreled fiscal and monetary policy response Wednesday but it didn't help sterling or the FTSE 100. The yen was the top performer while the pound lagged. US indices joined the DAX in reaching the definition of a bear market by extending losses to 20% from their record highs. Trump is set to speak about coronavirus early in Asian trade. The gold Premium short opened at 1669, targetting 1639 was closed for a smaller than anticipated gain, leaving the long in progress. Minutes before the Wednesday close, profit, a new Premium trade was issued, supported by 3 charts 7 key notes.

The Bank of England delivered an unscheduled 50 basis point rate cut and eased the counter-cyclical buffer by 1 percentage point. The moves were generally expected but most expected them to wait until the scheduled March 26 meeting.

The timing makes sense in hindsight as they wanted to match the timing of the government budget and send a powerful signal. New chancellor Sunak delivered a set of measures that won near-universal praise. It included a GBP30 billion response to the virus including gov't paid sick leave for private businesses with less than 250 workers, gov't guarantees on loans to small businesses and abolishing business taxes for a year. They coupled that with a five-year plan to spending GBP175B on infrastructure.

That's the kind of budget that pound bulls were hoping for after the election before talk of more-austere measures took over. This time, the pound fell but that was likely due to the rate cut and general flows.

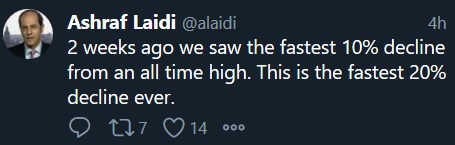

The broader market went back into a deep risk-averse mode after Trump failed to deliver his promised coronavirus stimulus. The S&P 500 fell 4.9% after briefly falling more than 6% on the day and 20% from the high.

Trump and US officials will get a second chance in the day ahead. The President will speak at 9 pm ET (0100 GMT) on the response to the virus and House Democrats say they will release a stimulus package Wednesday.

The UK package is a good blueprint for what governments need to do right now – especially measures like sick leave that can slow the spread. More importantly, the market may now respond positively to mass event shutdowns because the short-term pain is likely to outweigh the long-term risks of a severe pandemic.

All this to barely mention the ECB which will reveal its set of measures at 1245 GMT. Look for a package of rate cuts and watch for more euro selling. There are early signs that the reverse of funding flows may be drying up, or overwhelmed by safe haven flows into USD, CHF and JPY.

Latest IMTs

-

Warsh Odds Hit Metals

by Ashraf Laidi | Jan 30, 2026 10:56

-

Time Stamp تجزيء زمني للفيديو

by Ashraf Laidi | Jan 29, 2026 9:09

-

Trump Hits Dollar but Wait Bessent & Powell...

by Ashraf Laidi | Jan 28, 2026 11:47

-

Retail Traders' Hastiness

by Ashraf Laidi | Jan 27, 2026 9:40

-

From Silver to Yen

by Ashraf Laidi | Jan 26, 2026 11:55