Boris Bails, Carney to Cut

The two-way showdown between Boris Johnson and Theresa May was over before it started with Johnson opting not to enter the race for UK PM. We take a closer look at May's gameplan. The main market mover Thursday was a strong hint at an impending BOE rate cut from Carney. A huge day of economic data awaits Asia-Pacific traders, including the Tankan survey. Silver outperformed all currencies and commodities by suging to fresh 3-year highs above 18.70s, helping Ashraf answer why he re-entered silver last Friday rather than gold, which lost $30 since. GBPUSD dropped 300 pips.

The Boris-exit from the Conservative race makes Theresa May an overwhelming favourite. Of course, anything can happen in UK politics but we take a close look at her comments and how she is likely to shape a Brexit.

The headline-grabber from her speech was that there can be no turning back on a Brexit but in subtler tones she left the door open. She focused almost entirely on the anti-immigrant and border control angle of the Brexit debate while repeatedly highlighting the importance of trade.

The easy solution would be for the EU to relent on immigration but that would open similar challenges from other countries. Given May's bias towards trade, the EU may offer very little and call her bluff. If that's the case, she will probably lose.

The outcome is unknowable but it's increasingly unlikely that whoever heads the Conservative party isn't willing to disrupt or even to risk full access to the EU.

The month ends with the yen as the top performer and GBP as a laggard. The pair made a 2300 pip swandive in the month with almost the entire move taking place after the Brexit vote.

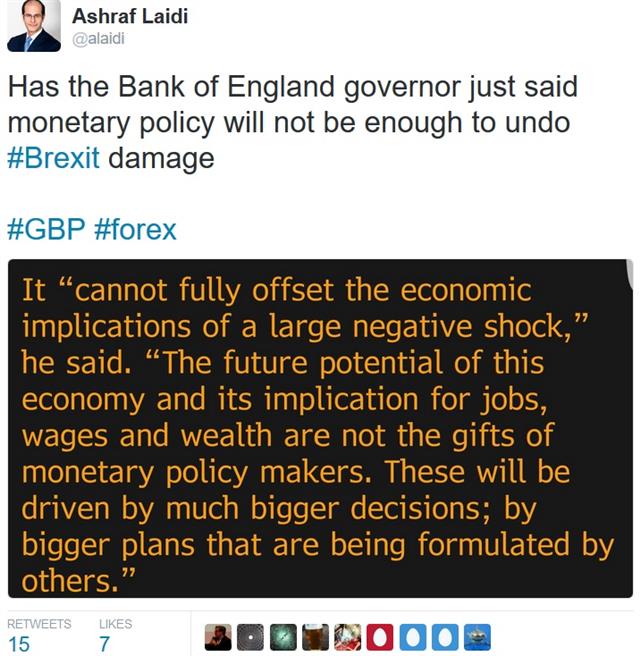

The final flurry of selling came after Carney said some monetary stimulus is likely to be needed over the Summer. He then doubled down and said easing is not just about the bank rate.

Cable tumbled to 1.3206 after the comments from 1.3420 beforehand. It later recovered to 1.3300, in part because he warned that cutting rates too low would wreck bank profitability.

In the hours ahead, we shift our attention to Asia for a huge day of economic data. Japanese figures include the employment report, CPI and the Q2 Tankan. For China, the official PMIs and report from Caixin are due. All the numbers are possible market movers but the Tankan large manufacturing index is the most important. It's expected at +4 from +6 and a miss. Or soft numbers throughout could push the BOJ towards easing in July.

Note that Friday is a holiday and Canada and trading will be shortened in some US markets because of the holiday on Monday.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Chicago PMI (JUN) | |||

| 56.8 | 50.8 | 49.3 | Jun 30 13:45 |

Latest IMTs

-

Time Stamp تجزيء زمني للفيديو

by Ashraf Laidi | Jan 29, 2026 9:09

-

Trump Hits Dollar but Wait Bessent & Powell...

by Ashraf Laidi | Jan 28, 2026 11:47

-

Retail Traders' Hastiness

by Ashraf Laidi | Jan 27, 2026 9:40

-

From Silver to Yen

by Ashraf Laidi | Jan 26, 2026 11:55

-

Gold or Silver?

by Ashraf Laidi | Jan 23, 2026 17:42