Cable Jumps, Fischer Backtracks, RBA Next

The Fed has suddenly rediscovered its data dependency as part of a slow walk-down from a March hike. The pound leaped higher on Monday while the US dollar lagged. The Australian dollar now moves into focus with the RBA up next. The Premium Insights issued a new trade in gold, with 8 technical and fundamental reasons supported by 3 charts.

The Fed won't hike in March so officials are now working to re-establish credibility. Officials have suddenly rediscovered data dependency, which was something that didn't seem to matter when inflation was low and commodities falling in the weeks leading up to the December FOMC.

Less than a month ago the Fed's Fischer was talking about 'something in the ballpark' of four hikes this year. On Monday he said hiking four times was just one number that has been bandied about. He said inflation might be lower and that the Fed is data dependent.

It wasn't overtly dovish but the market senses the shift in rhetoric that will continue at next week's Humphrey Hawkins. The result was a broad slump in the US dollar.

Cable took advantage in a rally as high as 1.4448. That's nearly 300 pips from the low late on Friday and breaks above a recent series of highs to the best level in two weeks.

Most surprising was the Canadian dollar as it gained a half cent despite a 6% drop in oil prices. Flows may have been a factor to start the month because that divergence can't continue.

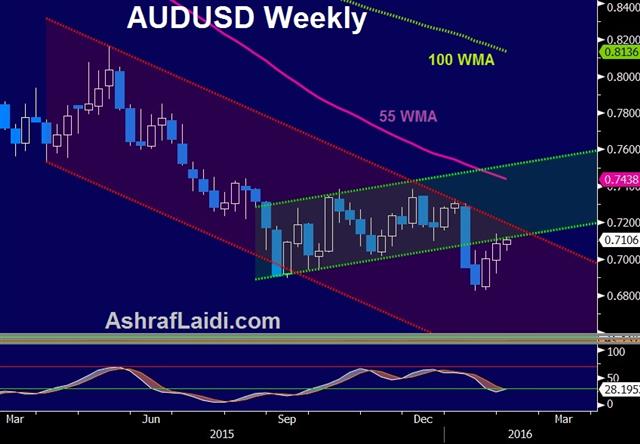

The commodity currency in focus in the hours ahead is the Australian dollar with the RBA due at 0330 GMT. Expectations for a change in policy are very low so the focus will be on rhetoric. Jobs growth and business sentiment have been resilient, as has the domestic economy on the whole. Stevens likely wants to preserve a dovish outlook, so expect him to emphasize risks from abroad. That likely won't be enough to hurt the Australian dollar and if he takes a more constructive outlook, AUD could rally.

Latest IMTs

-

Warsh Odds Hit Metals

by Ashraf Laidi | Jan 30, 2026 10:56

-

Time Stamp تجزيء زمني للفيديو

by Ashraf Laidi | Jan 29, 2026 9:09

-

Trump Hits Dollar but Wait Bessent & Powell...

by Ashraf Laidi | Jan 28, 2026 11:47

-

Retail Traders' Hastiness

by Ashraf Laidi | Jan 27, 2026 9:40

-

From Silver to Yen

by Ashraf Laidi | Jan 26, 2026 11:55