Commodity Crunch-Time, China Trade Data Next

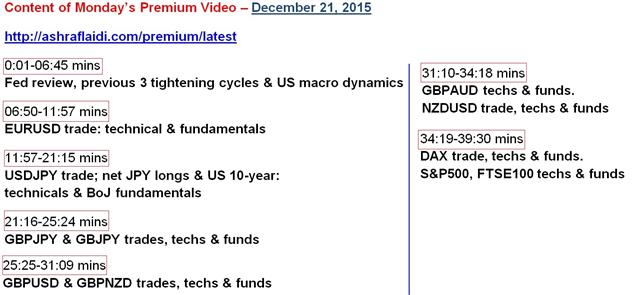

USD/CAD rose to an 11-year high as oil prices broke down. Routs on other commodity prices also hit the Australian and New Zealand dollars while USD was the top performer. Japanese Q4 GDP revisions are due late with Australian business conditions. China's Nov Trade figures is set for a possible release tonight. The Video for Premium subscribers has been posted. Full table of contents is found below.

The oil production war will be a major theme of 2016 and it's the worst possible news for the Canadian dollar. USD/CAD broke above the Sept high of 1.3457 and then cruised through 1.3500 on Monday to the highest levels since 2004.

We've repeatedly made the case for why the oil market is oversupplied. The US continues to produce near record levels, OPEC reaffirmed there are no limits to its production and Iran is weeks away from ramping up exports. Global demand is edging higher but week-after-week, oil is going into storage and soon (maybe now) it will be dumped on the market.

The commodity super-cycle ran further than almost anyone believed it would but it's busting now and the main risk is that there is a symmetrical response on the downside. In many raw materials the heavy investment in commodity projects is just beginning to produce. With all the start-up costs already absorbed, there is ample reason for indebted producers to continue mining at extremely low prices.

Iron ore is another example. AUD/USD has been remarkably resilient in the face of falling commodity prices over the past month but surely there is a limit. Iron ore fell below $40 on Monday and exposed some cracks in AUD as it fell 1%.

The broader market themes were limited. EUR/USD retraced back to 1.08 but held there and bounced. The US dollar was strong across the board despite a soft day for stocks and falling Treasury yields.

In the hours ahead, Japan will release its final Q3 GDP print. It currently stands at -0.8% q/q (annualized) but it's expected to be revised to +0.2% after some improved economic numbers late in the quarter. That would mean that Japan had avoided recession – something that will help remove pressure on the BOJ to act. The data is at 2350 GMT.

Another spot to watch is the Australian NAB business conditions survey. It's a lower tier indicator due at 0030 GMT but it may offer some insight into how the broad Australian economy is responding to soft commodities and a weak AUD.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| GDP Annualized (Q3) | |||

| 0.1% | -0.8% | Dec 07 23:50 | |

| GDP (Q3) (q/q) | |||

| 0.0% | -0.2% | Dec 07 23:50 | |

| GDP Deflator (Q3) (y/y) | |||

| 2% | Dec 07 23:50 | ||

| Exports (NOV) (y/y) | |||

| -5.0% | -6.9% | Dec 08 2:00 | |

| NAB's Business Conditions (NOV) | |||

| 9 | Dec 08 0:30 | ||

Latest IMTs

-

USDJPY Jumps on Dovish Picks

by Ashraf Laidi | Feb 25, 2026 11:40

-

Gold $5000?

by Ashraf Laidi | Feb 24, 2026 14:21

-

DXY Net Longs

by Ashraf Laidi | Feb 23, 2026 14:20

-

Iran Polymarket & Fed Odds

by Ashraf Laidi | Feb 20, 2026 11:27

-

Gold, Iran & Oil

by Ashraf Laidi | Feb 19, 2026 16:40