Dollar Undone as Fed Fears Market

The Federal Reserve pointed to international concerns as it lowered inflation forecasts and avoided hawkish rhetoric. The US dollar was beaten up on after the decision and the commodity currencies were the best performers. Japanese trade and Australian employment are due later. 2 new trades were issued ahead of the Fed decision, bringing the number of existing trades to 6. Our long NZDUSD trade was stopped out by 4 pips (low at 0.6576 & stop at 0.6580).

Most market watchers were anticipating a hint at rate hikes but instead the Fed sounded extra-cautious. The crowded USD-long trade was battered with the dollar falling 1-2 cents across the board.

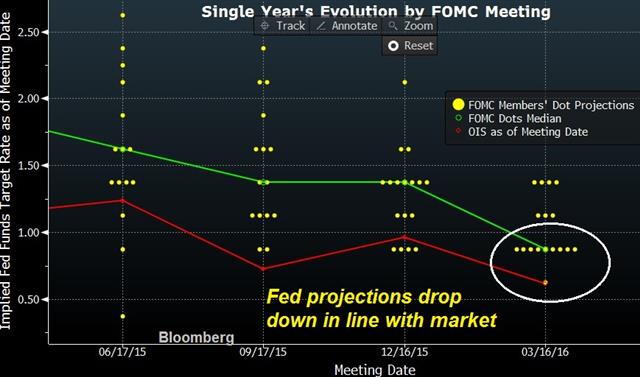

Yellen pointed to a deteriorating growth outlook abroad and said it was largely balanced by easier financial conditions because markets were pricing in fewer hikes. The Fed gave a full endorsement to that view by lowering the dot plot to indicate just two hikes this year, down from four.

Historically, it has been the Fed that's attempted to guide and bend markets but now it's the opposite. The Fed blinked in January because of market turmoil and let the market dictate where rates are headed today. The old mantra from the Fed was data dependency but that is difficult to reconcile with a more-dovish Fed despite great jobs growth in February.

To underscore the point, the Feb CPI report was released a few hours before the FOMC decision. It showed core inflation at 2.3% y/y compared to 2.2% expected. Yellen brushed off higher inflation, saying it was transitory.

The most dovish part of the press conference was a question on the balance of risks. Yellen indicated that there were two camps, those who thought they were neutral and those who thought they were negative. Aside from the dissent of George, it appears as though no convincing case was made for higher inflation. That bore out in the forecasts with PCE downgraded to 1.2% this year from 1.6% and no forecasts rising above 2.0% out to 2018.

Overall, this is the kind of statement that leads to a major rethink of the path of interest rates. The Fed spent much of last year cultivating hawkish bias but has abruptly abandoned it. The good news for the dollar is that other major central banks are more dovish.

So who are the winners? Gold was one on Wednesday, along with commodities and commodity FX.

Kuroda was surely hoping the Fed would spare the BOJ the difficulty of boosting USD/JPY but it was the opposite as it flopped to 112.75 from a cent higher. We get the first look at Japanese trade for Feb at 2350 GMT. Exports are expected down 3.0% y/y with imports forecast down 15.8%.

The major event of the Asia session comes at 0030 GMT when Australia releases Feb employment. After a 7.9K contraction in Jan, the consensus calls for a 13.5K rise. Earlier this week, AUD/USD touched the highest since July and a strong – or even a solid – number could take out the 0.7594 recent high.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Exports (FEB) (y/y) | |||

| -12.9% | Mar 16 23:50 | ||

| Imports (FEB) (y/y) | |||

| -18% | Mar 16 23:50 | ||

| Employment Change s.a. (FEB) | |||

| -7.9K | Mar 17 0:30 | ||

| Fulltime employment (FEB) | |||

| -40.6K | Mar 17 0:30 | ||

| Part-time employment (FEB) | |||

| 32.7K | Mar 17 0:30 | ||

| Unemployment Rate s.a. (FEB) | |||

| 6% | Mar 17 0:30 | ||

Latest IMTs

-

USDJPY Jumps on Dovish Picks

by Ashraf Laidi | Feb 25, 2026 11:40

-

Gold $5000?

by Ashraf Laidi | Feb 24, 2026 14:21

-

DXY Net Longs

by Ashraf Laidi | Feb 23, 2026 14:20

-

Iran Polymarket & Fed Odds

by Ashraf Laidi | Feb 20, 2026 11:27

-

Gold, Iran & Oil

by Ashraf Laidi | Feb 19, 2026 16:40