Enduring Disappointment, BoJ Next

A wild day in oil overshadowed a terrible durable goods orders report Thursday, but it shouldn't have. Volatility was high as the pound led the way while the yen lagged. The Bank of Japan decision is up next. An adjustment has been issued to the Premium EURJPY, justified by 3 charts and fund/flow note. Ashraf is warning that hey may issue a JPY trade before the BoJ decision. Subscribers are recommended to register their in the Alerts service to receive Premium alerts to their mobile/emai in here.

The past two days have delivered a different kind of market than the earlier part of January. Oil was a major driver then but the inability of risk trades to stage a meaningful rebound alongside crude is a worrisome sign.

Even more worrisome is the economic data. The durable goods orders report was one of the worst in years. Overall orders fell 5.1% compared to 0.6%. Core orders were at -4.3% compared to -0.3% exp. The bad news was compounded by downward revisions and weak shipments – something that will weigh on Friday's GDP report.

It's been a nightmare start to the for markets but now US economic data is beginning to turn. Earlier in the month December retail sales were soft as well.

Another concern is the continuing volatility. The market was bounced around on a series of OPEC headlines and sentiment-driven swings Thursday. That kind of instability is what sends long-term investors to the sidelines and causes bear markets.

The BOJ decision is a major event in the hours ahead. It has no scheduled time but is usually out between 0230 and 0330 GMT. The rule of thumb is that the longer it takes, the more likely the BOJ is to offer more stimulus. Kuroda hosts a press conference at 0630 GMT.

Four of 41 economists polled by Bloomberg expect the BOJ to raise the target for the rise in the monetary base to 100 trillion yen from 80 trillion. That may slightly understate market expectations. The tricky thing with Kuroda is that he likes to catch markets off guard. He spent the week in Davos playing down expectations but he did the same thing the last time he delivered QE.

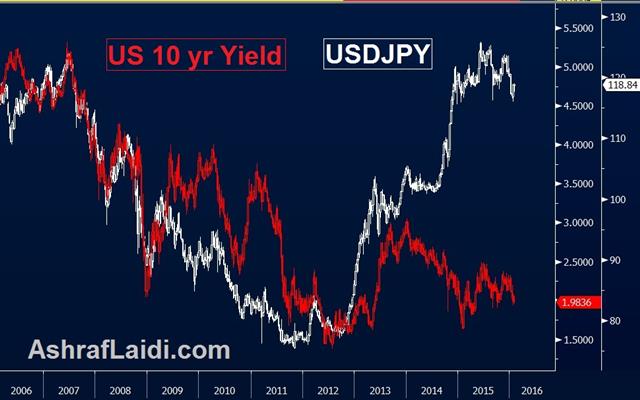

One reason the BoJ is unlikely to act is that the weak yen hasn't delivered the stimulus officials expected. Exports were down 8% y/y in this week's trade report and retail sales fell 1.1% y/y. Shortly before the BOJ decision, CPI numbers are due out and is expected to rise just 0.2%. Another reason for no action is what Ashraf has explained in detail for Premium subscribers, namely, the lack of sufficient JGB inventories to meet an increase in QE.

Press murmurs suggested the BOJ will push back its target for hitting 2% inflation but that doesn't mean more stimulus is coming. Kuroda will simply blame it on lower commodity prices. If he doesn't hike, don't expect dovish comments because he likely wants to maintain an element of surprise if the BOJ decides to cut again.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Core Durable Goods Orders (m/m) | |||

| -1.2% | -0.1% | 0.0% | Jan 28 13:30 |

| GDP Annualized (Q4) [P] | |||

| 0.8% | 2.0% | Jan 29 13:30 | |

| GDP Price Index (Q4) [P] | |||

| 0.8% | 1.3% | Jan 29 13:30 | |

| National CPI (DEC) (y/y) | |||

| 0.2% | 0.3% | Jan 28 23:30 | |

| National CPI Ex Food, Energy (DEC) (y/y) | |||

| 0.8% | 0.9% | Jan 28 23:30 | |

| National CPI Ex-Fresh Food (DEC) (y/y) | |||

| 0.1% | 0.1% | 0.1% | Jan 28 23:30 |

| Tokyo CPI (JAN) (y/y) | |||

| -0.3% | 0.0% | Jan 28 23:30 | |

| Tokyo CPI ex Food, Energy (JAN) (y/y) | |||

| 0.4% | 0.7% | Jan 28 23:30 | |

| Tokyo CPI ex Fresh Food (JAN) (y/y) | |||

| -0.1% | 0.6% | Jan 28 23:30 | |

Latest IMTs

-

Time Stamp تجزيء زمني للفيديو

by Ashraf Laidi | Jan 29, 2026 9:09

-

Trump Hits Dollar but Wait Bessent & Powell...

by Ashraf Laidi | Jan 28, 2026 11:47

-

Retail Traders' Hastiness

by Ashraf Laidi | Jan 27, 2026 9:40

-

From Silver to Yen

by Ashraf Laidi | Jan 26, 2026 11:55

-

Gold or Silver?

by Ashraf Laidi | Jan 23, 2026 17:42