From Draghi's ECB to Trump's GDP

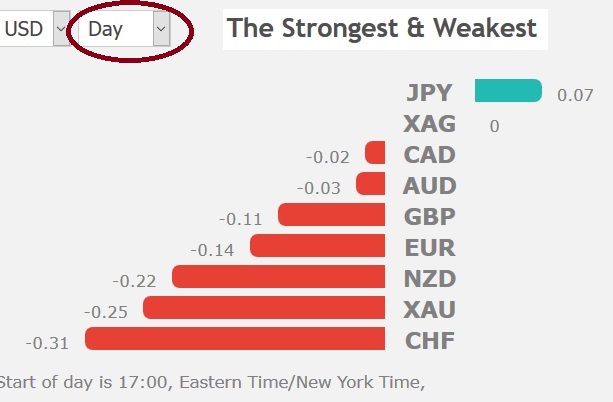

A subtle change in Draghi's messaging sent the euro lower on Thursday. The US dollar was the top performer while the Australian dollar lagged, reversing Wednesday's move. An intriguing US Q2 GDP number is due up next (more on this below). A new Premium trade has been issued alongside 4 technical reasons.

The ECB had a chance to tweak its forward guidance in order to clear up confusion about the meaning of 'through the summer' but instead chose to reiterate the line, leaving the option of hiking anywhere from June 2019 and beyond.

However later in the press conference, he said that officials were comfortable with market pricing, which currently shows a 57% chance of a September 2019 hike. That endorsement diminished that chance of an earlier hike an contributed to the euro's slide to 1.1622 from 1.1715.

Looking ahead, Friday's first look at US Q2 GDP is especially interesting. The consensus is 4.2% but a report earlier in the week from Charlie Gasparino, who is a reliable business reporter at Fox Business, said Trump had told at least one associate it was 4.8%. On Thursday, Trump also said that GDP would be 'terrific'.

If we ignore the President's talk, however, the final indicators were mixed. Wholesale inventories and trade balance for June were a touch soft while the shipments component in the durable goods report was strong. On net that roughly balances out and estimates range from 3.0%-5.0%.

In terms of positioning, it's likely that some specs bought the rumor of a strong number so all else equal, there should be some USD selling on the release. Equally important is the composition of GDP. Inventory building and trade will add about 2 percentage points to GDP in this quarter, but that won't last while if the consumer is particularly strong, that would be a tailwind.

Inventories & Soybeans

Ashraf reminds us that in order to assess the true strength of US GDP figures, we must watch for inventories i.e. how much of the GDP growth was driven by inventory surplus, which is not necessarily a result of true rise in the P in "GDP". For this, we must watch the "final sales" figure. Yet, even if final sales are high enough (close to GDP), traders are being cautious in interpreting the figures because of the possibility that US agricultural exports shot up temporarily ahead of tariffs.FInally, all eyes will be on the 3% barrier in US 10 year yields.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Advance GDP (q/q) [P] | |||

| 4.1% | 2.0% | Jul 27 12:30 | |

Latest IMTs

-

Mystery Chart & Coordinated Silver Attack

by Ashraf Laidi | Feb 6, 2026 10:52

-

From 4920 to 5090 and back

by Ashraf Laidi | Feb 5, 2026 9:41

-

How I Nailed $5090oz

by Ashraf Laidi | Feb 4, 2026 11:44

-

2x our Gains in 8 Weeks

by Ashraf Laidi | Feb 3, 2026 10:28

-

4500 and 72 Hit, now what?

by Ashraf Laidi | Feb 2, 2026 2:22