Intraday Market Thoughts

Gold Barely Passes so Far

by

Jan 7, 2022 20:25

Traders usually like the first trading week of the year because it wastes no time in getting back to action as ISM, NFP, ADP and other key data are released. The release of those FOMC minutes added a special flavor of extra volatility, in bolstering the possibility for a March rate hike (86% chance) and in making a June hike a slam dunk (so far).

Click To Enlarge

Click To Enlarge

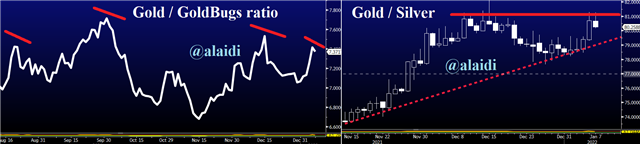

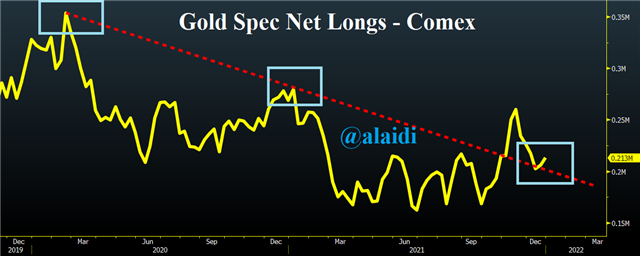

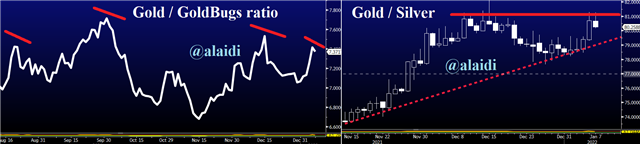

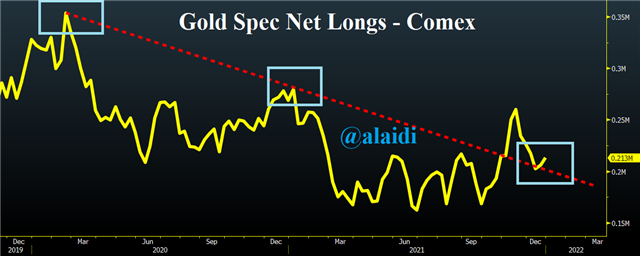

For gold bugs, XAUUSD survived another hard data test, by holding above the August trendline support, while the Goldbugs ratio remained capped as did Gold/Silver ratio—both positive end-of-week developments for XAUUSD and XAGUSD. Finally, the positioning among gold net longs remains above the previous trendline resistance, now turning into support.

10-yr yields posted their biggest percentage weekly gain since the 1st week of 2021...yes, exactly 52 weeks ago.

Next week, members of our WhatsApp Broadcast Group get ready to pull the trigger on a particular index. As for USDJPY, I make the case for 120 and 123 in this video.

Latest IMTs

-

USDJPY Jumps on Dovish Picks

by Ashraf Laidi | Feb 25, 2026 11:40

-

Gold $5000?

by Ashraf Laidi | Feb 24, 2026 14:21

-

DXY Net Longs

by Ashraf Laidi | Feb 23, 2026 14:20

-

Iran Polymarket & Fed Odds

by Ashraf Laidi | Feb 20, 2026 11:27

-

Gold, Iran & Oil

by Ashraf Laidi | Feb 19, 2026 16:40