Intraday Market Thoughts

Gold vs Oil Revisited

by

Nov 30, 2022 14:58

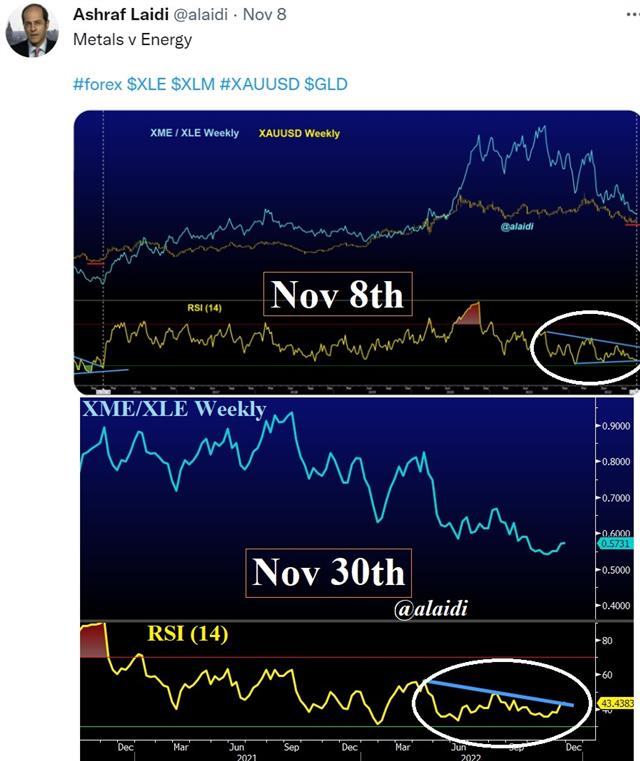

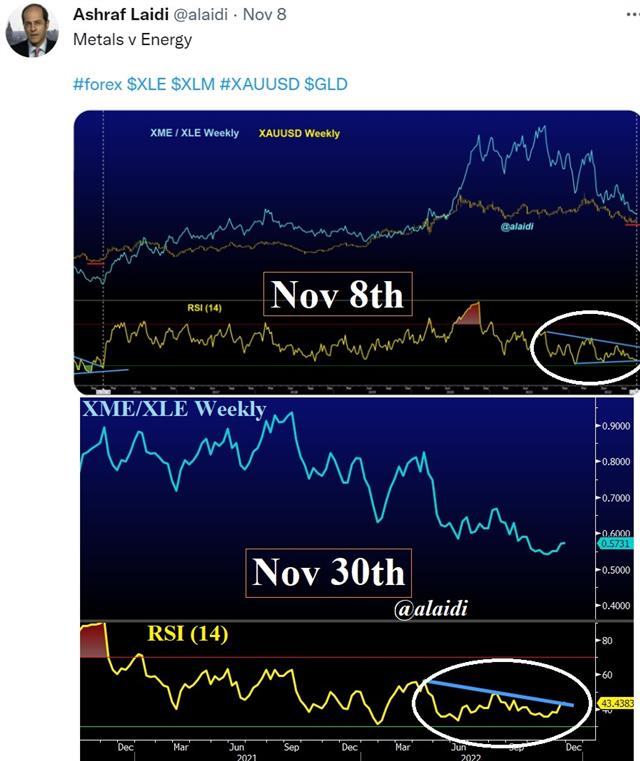

A lot has happened since I posted this XME/XLE chart from 3 weeks ago (click on this link and scroll down). Gold is a little stronger vs oil with XME/XLE ratio at 0.59 and the RSI is now testing the trendline resistance. As a reminder, XME is a major ETF for metals & mining stocks, while XLE is the biggest ETF for energy firms. Why am I mentioning this now? Metals (specifically gold) could further be boosted by the necessity for nations (especially oil-importers) to preserve the value of their monetary reserves against oil. Regardless of whether these nations are from the industrialized or less developed world, they must preserve their purchasing power of oil. See what Ghana agreed with the UAE about paying for their oil with gold in my tweet earlier this week. OPEC will be closely watching the ouctome of next week's EU discussions of the G7 price cap on Russian oil exports. Any prolonged decline in oil prices will see OPEC rushing to cut supplies, which would affirm the importance of stocking up on those few monetary/nonmonetary reserves that maintain their value relative to oil. And that would be no other than gold. Watch the RSI on XME/XLE.

Click To Enlarge

Latest IMTs

-

Gold Silver Next الذهب و الفضة

by Ashraf Laidi | Dec 26, 2025 17:15

-

Everyone's Talking about this Risk

by Ashraf Laidi | Dec 24, 2025 14:08

-

2026 Difficult but not Impossible

by Ashraf Laidi | Dec 22, 2025 20:06

-

Bank of Japan Massacre or Yawn?

by Ashraf Laidi | Dec 18, 2025 20:50

-

EURGBP Eyes 8920

by Ashraf Laidi | Dec 17, 2025 19:31