If you're taking time off

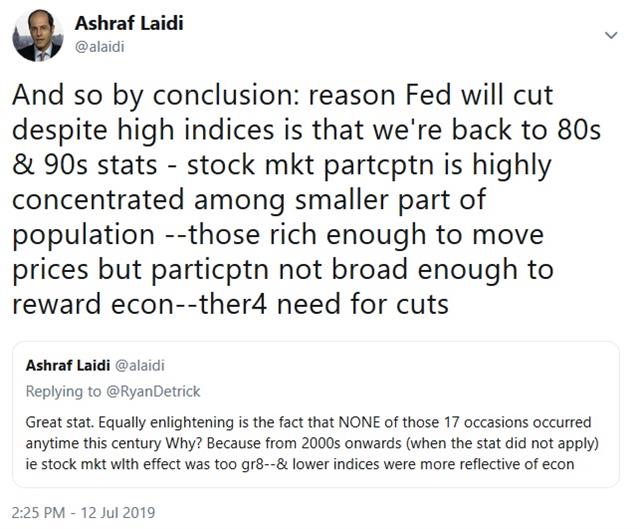

If you're planning to take a short holiday and return just in time for the Jul 31st FOMC decision, make sure to keep an eye on next week's release of US June retail sales, industrial production and a few Fed speakers. But there are some crucial items FX traders need to be aware of next week and the one that follows (excluding a very busy US earnings week). And here is a tweet on Fed cuts and indices.

Since you're aware that the new UK PM will be announced on July 23rd, next week should witness some volatility in GBP pairs as articles, reports and breaking stories unfold about candidates Hunt and Johnson. UK and inflation data will also be key. So far, cable has managed to hold the January lows.

Next week is the final week we hear from Fed speakers before the 2-week silent period begins. Speeches from Williams, Bowman, Evans and Powell will be most relevant to USD and gold traders. USD remains held at 1.1240 and 109.00 vs EUR and JPY, while gold must secure the 1382/3 support.

And we close from my April 12th IMT piece titled “Could we see DAX 12700?” when DAX was at 12000. This is a piece from which we can learn a lot. I was very bullish indices from January into April, but changed my stance midway through the May decline. It was a poorly taken decision. Take a look at the index over the last 4 months. Since then, we focused our Premium trades on FX and metals, where action should remain for the rest of the summer.

Latest IMTs

-

Mystery Chart & Coordinated Silver Attack

by Ashraf Laidi | Feb 6, 2026 10:52

-

From 4920 to 5090 and back

by Ashraf Laidi | Feb 5, 2026 9:41

-

How I Nailed $5090oz

by Ashraf Laidi | Feb 4, 2026 11:44

-

2x our Gains in 8 Weeks

by Ashraf Laidi | Feb 3, 2026 10:28

-

4500 and 72 Hit, now what?

by Ashraf Laidi | Feb 2, 2026 2:22