Import Tax Confusion

The surprise of the first working week of Trump's administration was how smooth it went, which was reflected in a record high in stocks, but a Thursday fumble could give the market second thoughts. The dollar played some catch up on the day to lead the way while the yen lagged. Japanese CPI is due up next. The Dow short was stopped out and 4 trades remain in progress (3 in FX and 1 in an index).

The bar for Trump's team was low coming into the week. The spat over inauguration crowd sizes was a poor start but after meetings with executives and market-friendly executive orders, it seemed as though Trump was on his way to fulfilling some of the hopes markets had placed in him since election night.

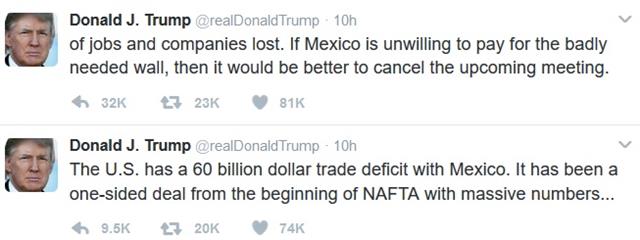

We wrote earlier in the week that the early part of his Presidency will be all about evaluating how well he can stay on message and how smoothly things can run. The early returns were good but it started to unravel on Thursday as the White House team floated an idea about a 20% tax on Mexican imports to pay for the border wall as part of comprehensive tax reform. It didn;t add up. With more than $300 billion in annual imports from Mexico a tariff would generate far more than the cost of a wall. It was compounded by the White House saying Trump favored a 20% import tax on every country in what would be an extreme protectionist policy.

Hours later, Republicans walked back the suggestion, saying it was one of just a buffet of ideas. The process of floating ideas then adjusting, backtracking or changing them was a hallmark of Trump's campaign but it's a reckless way to govern.

Ultimately, the market has shown it will give Trump plenty of rope but fumbles like this will erode market confidence, especially if they're on policies that would crush trade.

Otherwise US trading wasn't overly volatile. New home sales and initial jobless claims were weak but the Markit services PMI and wholesale inventories were high. The latter probably adds 0.2 pp to Friday's advance US GDP reading and some upside risk into Friday USD trading.

Before that comes the December Japanese CPI reading. The 0.2% y/y rise expected will be slower than 0.5% in November and will serve as a reminder that the BOJ remains far from its goals.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Tokyo Core CPI (y/y) | |||

| -0.3% | -0.4% | -0.6% | Jan 26 23:30 |

| BoJ Core CPI (y/y) | |||

| 0.1% | 0.2% | Jan 27 5:00 | |

| New Home Sales | |||

| 536K | 585K | 598K | Jan 26 15:00 |

| Flash Services PMI | |||

| 55.1 | 54.4 | 53.9 | Jan 26 14:45 |

| Advance GDP (q/q) [P] | |||

| 2.1% | 3.5% | Jan 27 13:30 | |

| Unemployment Claims | |||

| 259K | 247K | 237K | Jan 26 13:30 |

Latest IMTs

-

NFP & CPI Credibility

by Ashraf Laidi | Aug 11, 2025 16:35

-

Forecaster App التطبيق الذي كنت تنتظره

by Ashraf Laidi | Jun 18, 2025 10:55

-

Updating GoldBugs تحديث مناجم الذهب

by Ashraf Laidi | Jun 16, 2025 13:58

-

Breaking Debt Ceiling & Forex Brokers

by Ashraf Laidi | Jun 6, 2025 17:33

-

Recession Metric & Tariff Marsh

by Ashraf Laidi | May 26, 2025 13:47