No Fed Hike Signals, BoJ Next

The FOMC was in no mood to send hawkish signals after building up rate hikes hopes only to see them dashed by the non-farm payrolls report. The US dollar initially sold off on the FOMC statement but later battled back. The BOJ decision and Australian jobs report are due later. Due Thursday are UK retail sales and the BoE decision/MPC minutes. Ashraf's Premium Insights issued 2 trades today, one before the Fed and one after, both of which have been filled and in progress.

The FOMC statement downgraded the labor market assessment and fretted about soft business investment but retained some optimism. It was largely the same as the April text, reverting to a wait-and-see stance.

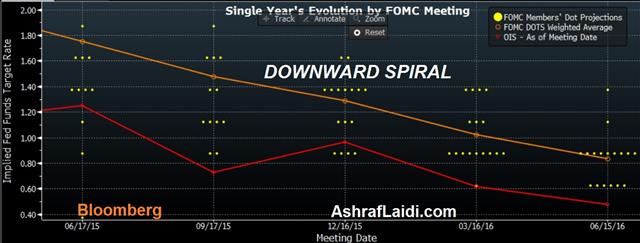

The dot plot showed a downshift in hike expectations and George dropped her dissent but the media still shows two hikes this year. GDP forecasts were lowered slightly this year and next, both to 2.0%.

The was some speculation the Fed may want to keep a July hike on the table but they let it go rather easily and the dollar initially dropped. On inflation, the Fed wasn't overly concerned about falling inflation expectations but Yellen said it may be 2-3 years before core inflation returns to 2%.

The dollar rebounded during Yellen's press conference but it's difficult to tie it to anything she said. She was clear that the Brexit vote was a concern but equally clear that it wasn't the only one.

Looking ahead, “once bitten, twice shy” is an apt expression. It's clear the coordinated effort to signal a rate hike 'in the coming months' has been abandoned and the cautious tone from Yellen suggests she doesn't want to make the same mistake again. The Fed will now wait for abundantly clear economic signs before making a move. Given the sluggish economic news, that probably means no hikes at all in 2016.

Other central banks with biases towards waiting and seeing are the BOJ and RBA but the pictures from both will grow clearer in the coming hours.

The Australian jobs report is due at 0130 GMT and expected to show 15.0K new jobs compared to 10.8K the prior month. The Aussie jobs numbers have been nearly impossible to bet against. The economy has done an admirable job adjusting to the commodity collapse, at least so far. Even a weak number likely wouldn't jar the RBA.

The BoJ, due to announce around 2-3 am GMT, hasn't sent any easing signals and we haven't picked up on secondary signs in the local press. However, we take nothing for granted from Kuroda, who loves to surprise. The timing would be advantageous to the government with Upper House elections coming and would help to underscore a floor near 105.55 in USD/JPY. That was the May low and although it was momentarily broken after the Fed, it's the critical level in the day ahead. If the BOJ delivers another wait-and-see statement, expect it to break.

Latest IMTs

-

5 Stocks Worked for me Best in 2025

by Ashraf Laidi | Dec 5, 2025 14:42

-

Silver 150 Highly Plausible

by Ashraf Laidi | Dec 4, 2025 11:19

-

4264 Gold

by Ashraf Laidi | Dec 2, 2025 13:56

-

Bitcoin & 35 Pct

by Ashraf Laidi | Dec 1, 2025 11:10

-

Forecaster App التطبيق الذي كنت تنتظره

by Ashraf Laidi | Nov 30, 2025 9:55