Oil Adds to Fed Intrigue

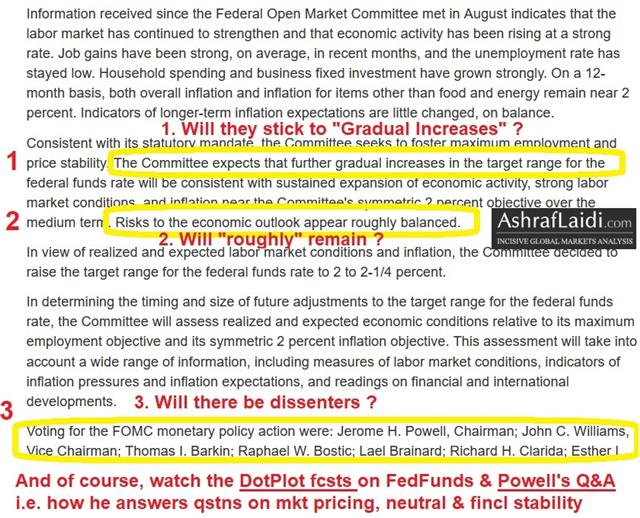

The collapse in oil prices resumed on Tuesday with prices now down 40% since October and 13% over the past three trading days. The New Zealand dollar was the top performer while the Canadian dollar lagged. The Fed decision looms. A new Premium trade ahead of the Fed decision was issued before the close of the NY session. The image below is the statement from the September rate hike, noting possible changes as a means of dovishness. A detailed video on pre & post-Fed trades has been posted for Premium subscribers on here.

We highlighted the fall below $50 in WTI as a key technical support breakdown, noting that it left little support until $42.05. It appears to be headed in that direction in a hurry with prices down $4 Tuesday to $45.91 as global growth fears mount. The market is voting that OPEC hasn't done enough and US inventories unexpectedly grew in the API report late Tuesday.

Risk trades in the currency market made some minor headway Tuesday but there was still plenty to be disappointed about. The S&P 500 had been comfortably higher but finished flat. After the close, FedEx cut its profit forecast on slower global growth and that rattled sentiment. They pointed to soft business outside of the US and weakness in Europe in particular.

The drop in oil is an added wrinkle for the Fed and may help to give them cover for an immediate pause or a dovish signal such as the reference to inflation mentioned in the image above. With Wednesday's decision looming the odds of a hike are down to just 64%, setting this up as one of the most uncertain meetings in two years. Through 2019, there's only a 35% chance of another hike.

What the vanilla pricing doesn't show is tail risk. The market is understandably jittery right now and the modest pricing for Fed hikes in 2019 doesn't capture the risk – however minor – that the Fed could stubbornly continue to forecast and signal hikes.

At the same time, the Fed is limited in exactly how it can send signals. There will be no line in the statement saying 'we're going to pause' and the Fed will want to retain some flexibility if markets rebound. The drop in oil is certainly deflationary and the Fed could argue that it also puts downward pressure on inflation expectations. This and trade worries could tilt the balance of risks to the negative side. A number of dissents in favor of no hike would also send a dovish message, as could the dot plot or something in Powell's press conference.

If the decides to immediately pause, it's not entirely clear that risk trades will jump. If the Fed isn't careful about the wording, the message could be interpreted as the Fed seeing a quicker slowdown in the economy.

Keep a close watch on gold. It's testing the December high and a surprise pause or dovish message would send it higher. There is also a strong seasonal tailwind early in the year.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| FOMC Press Conference | |||

| Dec 19 19:30 | |||

Latest IMTs

-

Winners & Losers

by Ashraf Laidi | Jan 15, 2026 16:22

-

Forecaster App التطبيق الذي كنت تنتظره

by Ashraf Laidi | Jan 15, 2026 13:55

-

Update on Gold & Silver after USSC

by Ashraf Laidi | Jan 14, 2026 19:54

-

Gold Channel Intact

by Ashraf Laidi | Jan 12, 2026 20:58

-

Why I Bought Gold & Silver

by Ashraf Laidi | Jan 9, 2026 16:53