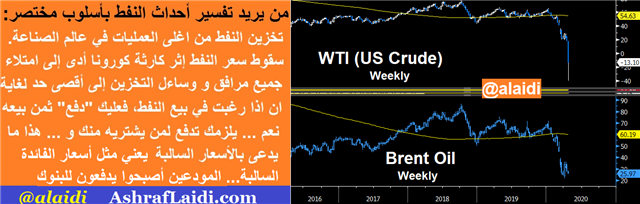

Oil Hit -37 as Oil Tourists Targeted

And it finally happened. US oil prices crashed below zero for the first time in history as plummeting demand alongside insufficient supply cuts sent storage costs soaring. The result: Oil sellers had to pay buyers to unload US fuel, sending WTI to -$37.63, from $18.30 on Friday. A new trade for the Premium Insights was issued earlier today.

One of the side-effects of the virus shutdowns are the number of people who are trading. Volumes are skyrocketing and they're also being concentrated in a small number of assets, often hyped on online message boards. Much of the new money is chasing volatility and in the past few weeks they've discovered it in oil.

A week ago -- after the OPEC+ agreement, we warned here and here that the market was still far too oversupplied. WTI futures opened 8% higher in a move that lasted mere minutes as real money swamped it and crude finished down 25% on the week. The reality is that supply continues to far exceed demand.

Yet retail traders have for some reason convinced themselves that crude will rise, probably because of a sharply higher forward curve. The front month is at $20 but it's at $35 six months out; perhaps they think that's an easy trade. The reality is that the negative roll in oil ETFs is devastating.

Whatever the reason, investors are piling into oil ETFs unlike ever before. The open interest in USO is up to nearly 900 million shares compared to around 120 million normally. The ETF owns a full 27% of the open interest in June WTI futures. The fund has realized it now has a problem and changed its mandate on Friday invest 20% of funds in second-month futures.

Moreover, we fear the same money sloshing around in hot tech stocks is skewing the market. That will be especially prevalent in a huge week of earnings that starts Monday with IBM but also includes Netflex (Tues), Tesla (Wed), Amazon (Thurs) and American Express (Friday) among many others.

Latest IMTs

-

3 Stocks Against Nasdaq

by Ashraf Laidi | Feb 13, 2026 17:46

-

Revisiting Gold Bugs Ratio

by Ashraf Laidi | Feb 13, 2026 11:10

-

Typical Trading Errors

by Ashraf Laidi | Feb 12, 2026 10:04

-

Trade Tips from Washington DC

by Ashraf Laidi | Feb 11, 2026 9:56

-

The Signal is Finally Here

by Ashraf Laidi | Feb 10, 2026 11:09