Real News, Fake Breakouts

An apparent de-escalation in the US-Iran conflict led to massive reversals in gold, oil and risk trades on Wednesday but that's unlikely to be the final chapter in this story. The kiwi was the top performer and yen lagged in a volatile day of trading. Expect geopolitics to continue to dominate in the days ahead. Tuesday's Premium short in the DOW30 hit it its final target of 28150 for a 470-pip gain. A new trade was issued on Wednesday evening (neither in FX nor indices).

حان وقت صفقة أنتظرناها اكثر من 3 أشهر (فيديو للمشتركين)

On Tuesday, gold rose to the highest since 2013 and WTI oil spiked to $65 but both later reversed to finish much lower. The high-to-low swing in oil was nearly 10%. Equity markets also swung towards solid gains from deep loses.

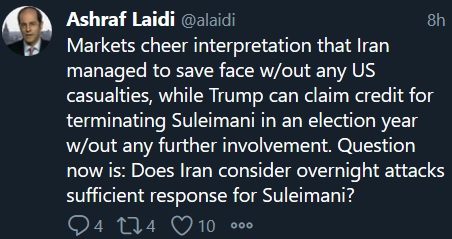

The market thinking now is that both sides have flexed their muscles, while seeking to avoid war. However that true that maybe at the highest levels, there are hawks on both sides pushing for further action. On the US side that impulse can be restrained by Trump but he's notoriously moody and impulsive so risks remain high. On Iran's side, leadership has less control over militias and proxies who could act independently.

Along those lines, late on Wednesday a pair of rockets were fired towards the US embassy in Baghdad. So while top leadership in Iran may want to avoid war, there are some who pine for it. Even if a group unaffiliated with Iran strikes the US, the blame (and retaliation) may fall on Tehran.

In terms of trading around geopolitics; it remains a minefield. Unlike the worst of Trump's tweets on the US-China trade war, where selloffs were pronounced in indices, yields and gold, a real war in the Middle East has significant weight on each of those markets in addition to oil mand the yen. The fog of war has descended on news surrounding Iran. There have been multiple rumors and fake reports of attacks in the past week including one shortly before the real attack. So when the real news began to trickle in, markets were initially skeptical.

A continual risk will be rumors and fake reports about further attacks. That backdrop will make it challenging to stay in risk trades and that strongly argues for stops, managing risk and staying nimble.

Latest IMTs

-

Mystery Chart & Coordinated Silver Attack

by Ashraf Laidi | Feb 6, 2026 10:52

-

From 4920 to 5090 and back

by Ashraf Laidi | Feb 5, 2026 9:41

-

How I Nailed $5090oz

by Ashraf Laidi | Feb 4, 2026 11:44

-

2x our Gains in 8 Weeks

by Ashraf Laidi | Feb 3, 2026 10:28

-

4500 and 72 Hit, now what?

by Ashraf Laidi | Feb 2, 2026 2:22