Retail Traders Forcing the Issue

3% +(-) days in indices are becoming rarer by the day as authorities do their utmost to keep some sort of normalcy...in the markets. If reopening the economy is considered to be a near equivalent to monetary easing, then what would it be if the $2.2 trillion stimulus package voted on by the House of Representatives is passed by the Senate? US Treasury Secretary Mnuchin appears confident it will pass, saying “there is a strong likelihood we will need another bill”. The Fed certainly agrees. Meanwhile, Monday's announcement by Germany and France to announce a €500bn EU recovery fund, coincided with the EURUSD's jump on the same day. As much as these developments are considered to be positive for the markets, given the macro realities of 20%-bound unemployment rates, the US and EU stimulus policies are just enough to prevent indices from breaking key support levels (2740s SPX and 23000 DOW30) and US 10-year yield resistance of 0.76%. That is not stopping traders from forcing the issue (more below).

اذا كانت هناك صفقة واحدة، ماذا سأختار؟ (فيديو المشتركين)

Don't Force the Market

A common mistake from retail traders (and a recurring error of mine during 2009), especially those who feel they missed this year's selloff (or the 30% rally) is to continuously expect the next 5% down-day at each and every minor pullback. Yet, it's crucial to not become too complacent. The last sentence implies a serious balancing act in the face of stark negative macro data and active sector rotation among sectors, keeping the major indices afloat. So far, we have had winning trades in DOW30 on the long and short. But it's not getting any easier.During the 30 mins starting today (Thursday) at 14:20 Eastern Time (New York) or 19:20 London, indices took a turn to the worse, but avoided touching the session lows of late Thursday morning Eastern time. The selloff was mainly driven by energy and technology. As we enter the final hour of trading, I expect SPX and DOW30 to retest the lows, if not then, at the futures session pre-Asia open. The key for Forex traders is to figure out, which pairs to trade and how to manage them. Currently, 5 of our 6 open our Premium Insights trades are in the green, with NASDAQ100 trade 40 pts in the red. There are 2 in FX, 2 in commodities, 1 index and 1 crypto.

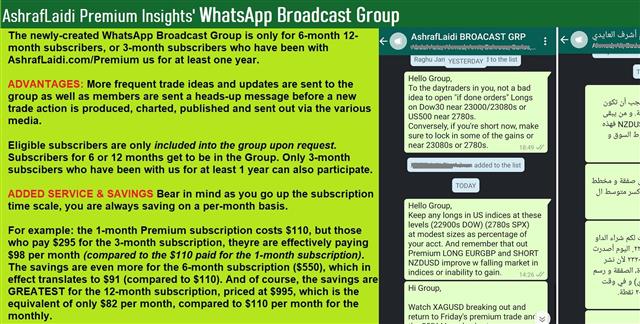

Join our VIP WhatsApp Broadcast Group

Latest IMTs

-

Mystery Chart & Coordinated Silver Attack

by Ashraf Laidi | Feb 6, 2026 10:52

-

From 4920 to 5090 and back

by Ashraf Laidi | Feb 5, 2026 9:41

-

How I Nailed $5090oz

by Ashraf Laidi | Feb 4, 2026 11:44

-

2x our Gains in 8 Weeks

by Ashraf Laidi | Feb 3, 2026 10:28

-

4500 and 72 Hit, now what?

by Ashraf Laidi | Feb 2, 2026 2:22