Risk on as No War on Two Fronts

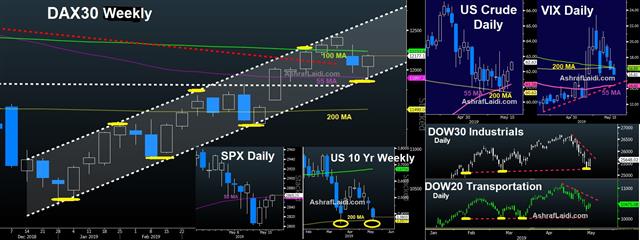

Multiple reports on Wednesday said Trump will delay a decision on auto tariffs, allowing for a major reprieve in indices throughout Europe and Asia. The move boosted risk assets and the Canadian dollar was (and is today) the top performer while the pound continues to lag. Watch out for comments from the Fed's Brainard on Thursday. US jobless claims, Philly Fed survey and hiusing starts are due next. The 7 charts below highlight the supporting technicals across the intermarket landscape, justifying why we went long indices during the selloff. The index trades are netting +500 pt in the green.

Risk assets reversed positively on reports that Trump won't use national security powers to put tariffs on auto imports. He had been scheduled to deliver a decision by Friday but he has decided to delay it by as much as six months. We have noted previously that the plan was likely to settle with China and then pivot to Europe and Japan on autos. Yet, the reccent breakdown in China talks meant Trump had to reorganize and decided he didn't want to fight two battles at once.

In a sense, that's good news – especially for automakers, Germany and Japan – but it may also be a signal that he's braced for a longer battle with China. DAX30 has regained the 12200 level, bouncing off the 5-month channel and 55 WMA.

Along those same lines, the White House also appeared to make moves to end steel and aluminum tariffs against Mexico and Canada. Several reports indicated a deal is close after ministers from the NAFTA countries met Wednesday in Washington. That news helped to lift the loonie.

Looking ahead, comments from the Fed's Brainard at 1615 GMT (17:15 London) will be worth heeding. What we're trying to evaluate now is how stubborn and committed the Fed is to holding rates and remaining patient. Low inflation, tariffs and further disappointing data like Wednesday's retail sales report have made the Fed fund futures market increasingly confident about a rate cut late this year (odds are at 76%). So far policymakers haven't genuinely opened that door but Brainard has floated key signals in the past and is a risk to do that again.

Latest IMTs

-

2026 Difficult but not Impossible

by Ashraf Laidi | Dec 22, 2025 20:06

-

Bank of Japan Massacre or Yawn?

by Ashraf Laidi | Dec 18, 2025 20:50

-

EURGBP Eyes 8920

by Ashraf Laidi | Dec 17, 2025 19:31

-

Only One Stock سهم واحد فقط

by Ashraf Laidi | Dec 16, 2025 19:58

-

Gold During Recessions & Bear Markets

by Ashraf Laidi | Dec 13, 2025 12:29