The China Conundrum

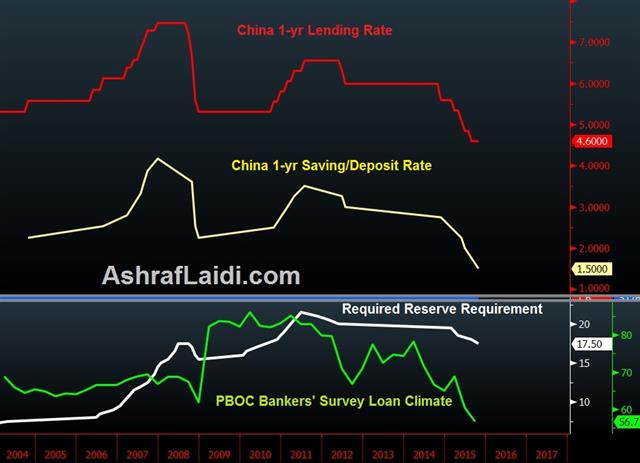

All signs point to a larger slowdown in China but is it wise to fight the central bank? Markets opened for the new week with the euro below 1.10 as the selling continues. The Asia-Pacific calendar is light to start the week but it will be the first opportunity for Chinese stocks to react to the rate cut.

The final two pieces of economic data before China cut rates were stronger-than-expected GDP and housing numbers. Yet in a departure from the usual practice of rate moves on the weekend; the PBOC cut rates on Friday, sending global stocks soaring.

The first conundrum is that if Chinese growth was as strong as touted, a rate cut wouldn't be necessary; especially as it comes less than two months after the previous cut.

Another worrisome sign we dug up on the weekend was the earnings report from Whirlpool. The appliance manufacturing giant is a good barometer of consumer health because it's rare for people to buy new fridges and stoves unless they're feeling good about their financial health.

The company's shares were hammered 11% on Friday as executives fretted about FX costs, flat US demand and weak emerging markets – especially Brazil. But they also noted that Chinese demand was down 4% y/y. That's another reason to believe the economy isn't growing near 7% with consumers picking up the slack.

So what's a trader to do? It's tough to fight any central bank. What contributed to the mini-panic in August wasn't that China cut rates and devalued. It's that it was read to be a signal of larger problems in the economy.

There are signs that growth is soft but unless markets begin to fret about China again; it's very tough to fight.

Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR -63K vs -81K prior

JPY -4K vs -14K prior

GBP +7.5K vs -8K prior

AUD -38K vs -34K prior

CAD -27K vs -34K prior

It looks like some euro shorts gave up just before the tide turned. The data is from before the ECB decision and it shows how low expectations were. There's a broader trend of USD selling early last week and that obviously reversed later in the week.

Latest IMTs

-

From Silver to Yen

by Ashraf Laidi | Jan 26, 2026 11:55

-

Gold or Silver?

by Ashraf Laidi | Jan 23, 2026 17:42

-

40 on the Mint Ratio

by Ashraf Laidi | Jan 23, 2026 11:27

-

Trump's Golden Hit

by Ashraf Laidi | Jan 22, 2026 10:58

-

4890 Hit, Now What?

by Ashraf Laidi | Jan 21, 2026 11:34