The Slow Disintegration of Team Transitory

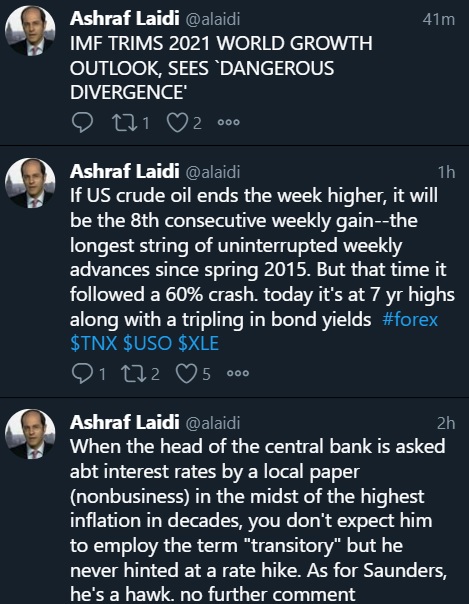

Central bank comments are increasingly littered with caveats. On Monday, ECB chief economist Lane tried to lay out how wages could rise in a one-off without leading to inflation. He called price rises 'mostly transitory' but warned they are in the early stages of an energy shock.

In the US on Sunday, the Fed's Daly – an ardent dove – warned that if bottlenecks continue and spending remains high, there will be more inflation. Given that economies continue to reopen and there's a glut of US savings, that's a fair bet.

The FX and rates market is increasingly signaling that team transitory is losing. The latest axis is the yen, which is the traditional low yielder. The implication of strength in yen crosses is that rates divergence is coming. Given the big breakouts, including USD/JPY hitting a seven-year high on Monday, the implications are clear.

It's been a slow transition for the Fed but the doves are now clearly on the backfoot and supply chain problems aren't easing.

A release that's sure to spark more chatter is the August JOLTS report, which could show a record 11 million job openings. There is good reason to be skeptical of this report. Companies have taken to spamming job ads and using algorithms to screen resumes. It's the proliferation of an 'always hiring' policy that's simply a search for low-wage workers. In any case, policymakers still believe in it and so does the market.

The other event to watch will be the 10-year Treasury sale. The cash market is at 1.62% with little standing in the way of a return to the 2021 high of 1.78%.Latest IMTs

-

Gold Bear or Correction

by Ashraf Laidi | Oct 23, 2025 9:51

-

Gold Wave 3 تحديث موجات الذهب

by Ashraf Laidi | Sep 18, 2025 16:19

-

Forecaster App التطبيق الذي كنت تنتظره

by Ashraf Laidi | Jun 18, 2025 10:55

-

Updating GoldBugs تحديث مناجم الذهب

by Ashraf Laidi | Jun 16, 2025 13:58

-

Breaking Debt Ceiling & Forex Brokers

by Ashraf Laidi | Jun 6, 2025 17:33