US Dollar Rides High, BoC Next

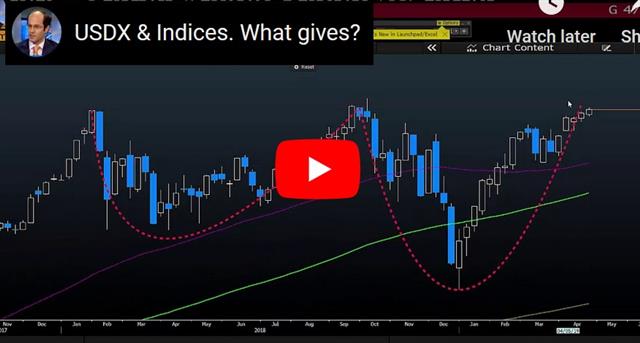

The US dollar continues to ride a tailwind from rallying stocks on upbeat earnings and forecasts. US indices are off after the S&P500 closed at a new high. DAX30 and US crude oil are at fresh 6-month highs and EURUSD drops back below 1.1200 after a disappointing IFO survey. The Bank of Canada decision is up next. Below is the Premium members' video, focusing on equity indices and gold.

The most frequent answer to why the US dollar is at the forefront of currencies remains related to equities. It's still early in earnings season but the numbers so far have been beating estimates and (more importantly) a number of large companies have raised forecasts for the year. Fears about a consumer slowdown appear to be overstated and international investors were buying up USD assets in responds.

The stock market opened slightly higher but climbed as the day went on and the S&P 500 rose 26 points to 2933 – a closing record and just 7 points from the intraday high from September.

The growing implication is that the Federal Reserve isn't going to need to cut rates. The market continues to price in a 56% chance of a cut before year end. As that falls, the US dollar may continue to strengthen unless growth fears elsewhere also fade.

One spot to watch next is the Bank of Canada. The central bank hinted that it will cut its growth forecasts, and some economists are looking for Poloz to also drop the mildly hawkish guidance. Nonetheless, Canadian macro data has held up relatively well all year and oil price are suddenly a CAD tailwind. Poloz has a long history of upbeat rhetoric so even if the statement takes a more-neutral turn, he could help the currency in the press conference by stressing that the H1 slowdown is temporary and that the outlook for US and Chinese growth is improved.

Latest IMTs

-

USDJPY Jumps on Dovish Picks

by Ashraf Laidi | Feb 25, 2026 11:40

-

Gold $5000?

by Ashraf Laidi | Feb 24, 2026 14:21

-

DXY Net Longs

by Ashraf Laidi | Feb 23, 2026 14:20

-

Iran Polymarket & Fed Odds

by Ashraf Laidi | Feb 20, 2026 11:27

-

Gold, Iran & Oil

by Ashraf Laidi | Feb 19, 2026 16:40