USD's New Path of Least Resistance

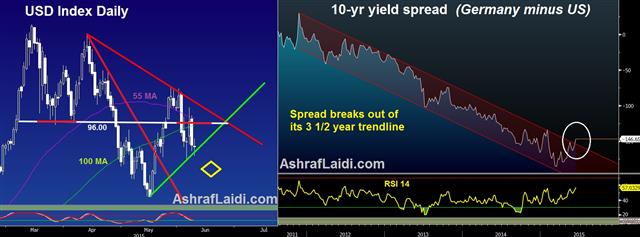

The plot thickens for USD bulls as the US currency falls victim to a deepening in the dynamics, which had previously capped its advances, namely faster gains in German yields relative to the US, prolonged erosion in Germany's DAX and the resulting close of euro hedges and lack of continuity in Fed tightening its planned rate lift-off (assuming one will take place this year). Last week we mentioned the German-US 10year yield spread broke hit 4-month highs. Today, the downchannel in the spread sustained a key breakdown, which could potentially extend towards the -133 bps resistance.

The implications of the recovering German-US spread on the USD index are important considering that EURUSD accounts for nearly 2/3 of the basket in the index. The series of lower-highs in USDX and the break below the 96 support spells further downside towards 93.00.

As German yields and Eurozone inflation pick back up, the effect of any expected Fed tightening no longer rewards the USD as was the case three or four months ago, when Eurozone inflation was below zero and the ECB was desperate to buy every asset in sight a la SNB.

Finally, unlike in previous Fed tightening cycles, the upcoming rate hike (if it ever materializes) is not at all expected to be succeeded by further subsequent moves, which will only make the first rate hike a classic sell-the-fact. That is why, the USD's path of least resistance has been aggressive selling of rallies.

Latest IMTs

-

Gold During Recessions & Bear Markets

by Ashraf Laidi | Dec 13, 2025 12:29

-

AAOI & the Fed

by Ashraf Laidi | Dec 11, 2025 19:22

-

3 Qstns for Today's Fed Meeting

by Ashraf Laidi | Dec 10, 2025 15:40

-

5 Stocks Worked for me Best in 2025

by Ashraf Laidi | Dec 5, 2025 14:42

-

Silver 150 Highly Plausible

by Ashraf Laidi | Dec 4, 2025 11:19