Why the Dow30 Now?

Anyone who is/was a member of the WhatsApp Bdcast Group, would know I dislike trading the DowJones Industrials Index (DOW30) due to its higher margin requirement. I usually pick the Nasdaq100 or SPX500. But over the past 3 weeks, I'd been warning the Group to prepare for shorting the DOW30. We eventually pulled the trigger last week and we're still in the trade. So why the Dow30 this time? We cited 5 reasons, some of which are listed below:

1. The Dow Theory and the lack of confirmation in the Dow Transportation to hit a new high as did the Industrials. A video was published on this here.

3. The DOW30, however, does contain Apple, which makes up about 8% of the index, and is the 2nd worst performer of the Magnificent 7. Apple and Netflix are down 0.2% and 26% year-to-date respectively.

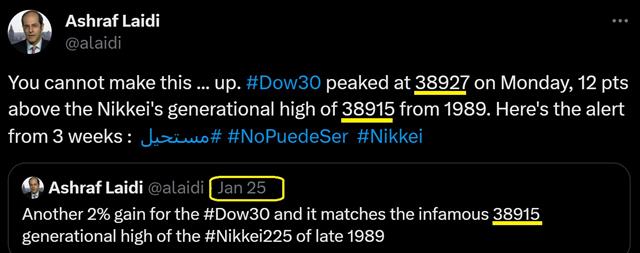

4. DOW30 likes big numbers and 38900s is equal to 20% rise from the October low. Monday's high of 38927 is nearly exactly equal to the 38915 generational top reached by the Nikkei225 in December 1989, before Japan descended into the Black Decade of the 1990s. Coincidences? The USA is far from descending into a dark decade or semi decade but the level/magnitude calls for at least a pause at the big figure.

With regards to the VIX, see the above chart how it's setting to break above the the 200-DMA for the 1st time since October after two failed attempts. A close above 15, would mean more trouble for stocks. There are other more advanced quantitative analysis requiring further scrutiny such as the VVIX and 10-yr yields.

And dont forget February is the 2nd worst month of the stock market over the last 20 years (after September).

Latest IMTs

-

Mystery Chart & Coordinated Silver Attack

by Ashraf Laidi | Feb 6, 2026 10:52

-

From 4920 to 5090 and back

by Ashraf Laidi | Feb 5, 2026 9:41

-

How I Nailed $5090oz

by Ashraf Laidi | Feb 4, 2026 11:44

-

2x our Gains in 8 Weeks

by Ashraf Laidi | Feb 3, 2026 10:28

-

4500 and 72 Hit, now what?

by Ashraf Laidi | Feb 2, 2026 2:22