Yen Sags, RBNZ Actions Point to Cut

Yen weakness was the dominant theme on Monday. The pound was the top performer in light, choppy trading. Japan returns from holiday but the calendar is focused on Australia and the July RBA meeting minutes. The kiwi fell in early trading after the RBNZ introduced loan restrictions. Ashraf warned Premium clients in Friday's London session against NZD by opening a AUDNZD long, followed by another NZD trade on Sunday night. Both NZD trades are currently in progress. Premium videos will be released later tonight ahead of Tuesday's UK CPI.

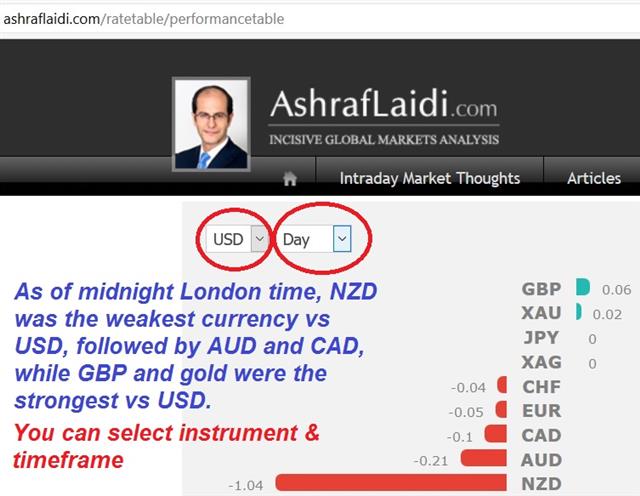

http://ashraflaidi.com/ratetable/performancetable

Yen weakness to start the week was generally ascribed to the failure of the coup in Turkey but BOJ speculation and positioning is a better bet. The July 29 BoJ meeting is critical for the near-term outlook in yen crosses and there is a growing sense that Abe wants to go all-in on another round of stimulus and easing.

Technically, USD/JPY is pushing up against Friday's high of 106.31 and then may challenge the pre-Brexit high of 106.81.

Economic data was light on the day. The lone notable release was the NAHB housing survey and it fell to 59 from 60 but US housing is not a market concern at the moment.

Turning to New Zealand, the chance of an RBNZ August cut jumped in the past week, now surpassing 80% and signals increasingly point to action. Last week, Wheeler revealed that an unusual economic forecast update will be published before the August meeting. Yesterday, Q2 CPI missed estimates. Today, the RBNZ said it plans to introduce tougher home-lending rules on Sept 1. The RBNZ's Spencer said two weeks ago those rules might not come until year-end so the latest action appears to be a rushed decision. Taken together, the 76% chance of a cut that's priced into the OIS market appears too low.

The only event on the economic calendar in Asia-Pacific trading is the release of the July RBA minutes. The market is pricing in a 53% chance of an August cut and this is a clear opportunity to signal what's coming next. The minutes are out at 0130 GMT.

The action will pick up later with the UK CPI and German ZEW reports.

Latest IMTs

-

Gold During Recessions & Bear Markets

by Ashraf Laidi | Dec 13, 2025 12:29

-

AAOI & the Fed

by Ashraf Laidi | Dec 11, 2025 19:22

-

3 Qstns for Today's Fed Meeting

by Ashraf Laidi | Dec 10, 2025 15:40

-

5 Stocks Worked for me Best in 2025

by Ashraf Laidi | Dec 5, 2025 14:42

-

Silver 150 Highly Plausible

by Ashraf Laidi | Dec 4, 2025 11:19