GBP Getting Best of Down Under

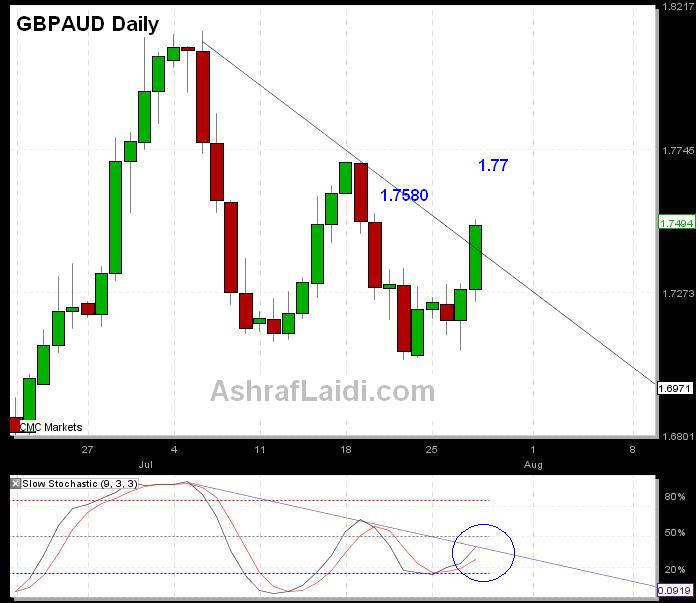

GBPAUD reflects contrasting expectations for the RBA and BoE, with the former expected to keep rates on hold due to softer than expected inflation and the latter seeing better reasons to listen to its hawkish members. Today marked the first time since July 2009 where GBP does NOT fall following Mervyn Kings testimony. With AUDUSD quickly FALLING back below its 200-day MA and GBPUSD RISING above its 200-day MA for the first time since Jan, the preferred play is favouring GBPAUD, especially that any GBPUSD longs from here may face resistance in the event of any sharp risk aversion. Since we know that AUD is the reliable victim of risk aversion, it is best to sell it vs. a currency whose fundamentals are neutral-to-positive. Having simultaneously broken above 200-day and 55-day MA today, GBPAUD eyes interim target at 1.7580s, followed by 1.77. While my bias remains firmly in favour of EURAUD, GBPAUD is an attractive alternative considering my negative positioning on EURGB. A a break below 1.72s merits scrutiny from the longs, while a close below 1.6980s is a red flag.

More Hot-Charts

-

Gold 5000?

Feb 24, 2026 14:19 | by Ashraf LaidiCan gold drop back to $5000 per ounce. Here are 2 possible technical scenarios. China's return to the market could also bring back selling pressure during Asian session.. -

Before and After the New Tariffs

Feb 23, 2026 12:49 | by Ashraf LaidiThe chart on the left is Nasdaq100 CFD (US100) which opened on Sunday night at 11 pm London Time after Trump announcement of 15% tariffs, and the other chart is the Nasdaq cash, ending on Friday... -

Mystery Charts

Feb 5, 2026 20:48 | by Ashraf Laidiسأرسل رسالة صوتية و كتابية توضيحية لأعضاء مجموعة الواتساب الخاصة حول هذه المخططات Will send detailed note on latest parameters to our WhatsApp Bdcst Group...