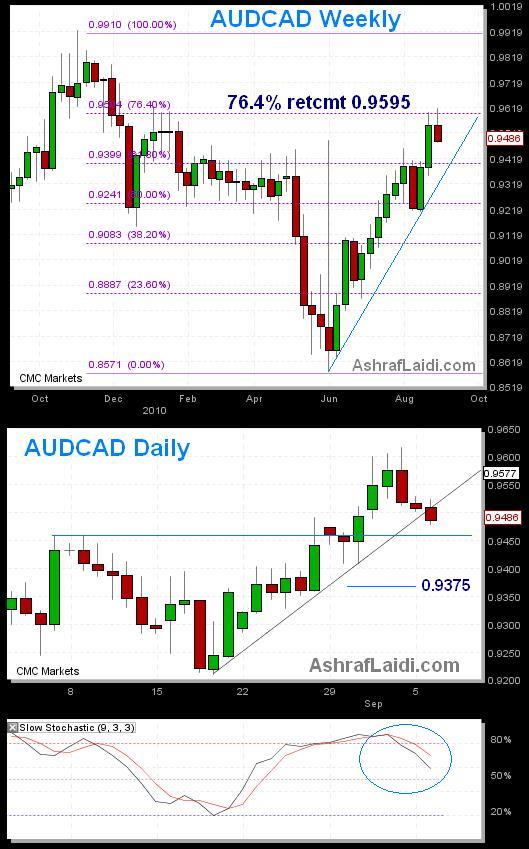

AUDCAD Where to from here?

AUDCAD has rallied 12% from its June lows as CAD descended in broad selling from an onslaught of weak US data. So will the tide start to turn? Tuesdays RBA decision is widely expected to keep rates unchanged at 4.50% while Wednesdays BoC decision is expected to produce a 25-bp rate hike to 1.00%. the RBA could well issue a cautiously positive assessment, that may give reason to anticipate 25-50-bps in tightening later this year. Nonetheless, I see more CAD upside ahead of the an actual rate hike from the BoC, in which case would drag the pair down to the prelim target of 0.9420, which is followed by 0.9370s. In the event that the BoC does NOT raise rates, we could see a run-up back above 0.9520s but capped at 0.9570s. Keep in mind, that both AUD and CAD gain significantly from improved risk appetite, with the former specifically driven by Chinese and Nth East Asian data and the latter (CAD) largely driven by US data. Also watch Canada AUUGUST JOBS DATA, expected to show a return to positive territory at 17.8K after -9.3%.

More Hot-Charts

-

Mystery Charts

Feb 5, 2026 20:48 | by Ashraf Laidiسأرسل رسالة صوتية و كتابية توضيحية لأعضاء مجموعة الواتساب الخاصة حول هذه المخططات Will send detailed note on latest parameters to our WhatsApp Bdcst Group... -

2hr Gold Chart

Feb 3, 2026 13:09 | by Ashraf Laidiسأرسل رسالة صوتية و كتابية توضيحية لأعضاء مجموعة الواتساب الخاصة حول هذه المخططات Will send detailed note on latest parameters to our WhatsApp Bdcst Group... -

Gold Net Longs

Feb 2, 2026 17:16 | by Ashraf LaidiI really dislike after-the-fact analysis, but looking at this chart of Gold speculative net longs at the Comex, it shows speculators began lightening their longs on Jan 23.