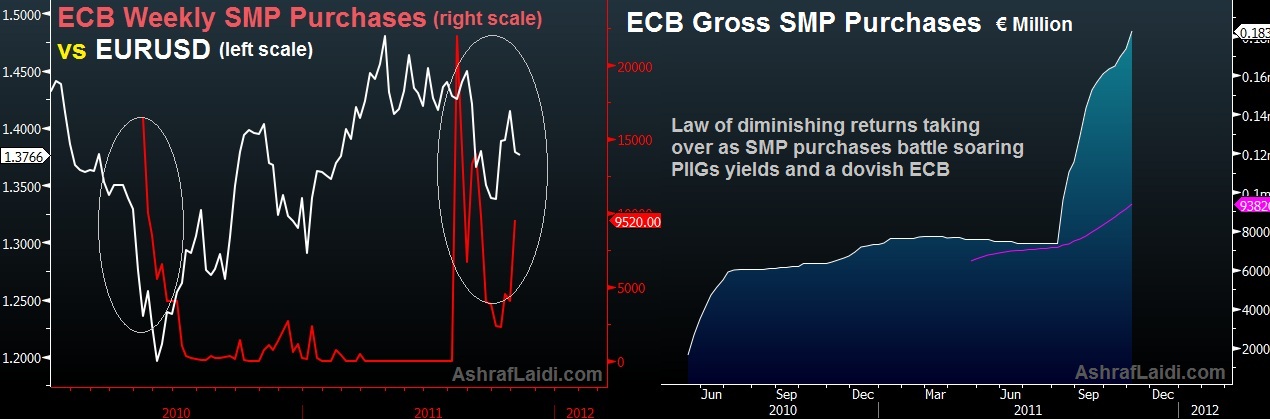

ECB Bond Purchases vs EURUSD

The ECBs Securities Markets Programme (SMP) has accumulated EUR 183 billion since starting in May 2010. The left chart shows weekly purchases to have reached EUR 9.5 billion as of early November, but these are well below the EUR 22 billion attained in mid-August. With the latest rush in ECB purchases of Italian bonds aiming at keeping 10 year yields below 7%, and possibly Spanish bond guying buying as the Spanish presidential campaign heats up, weekly purchases should be expected to regain their summer highs.

DESPITE THE CLEARLY positive correlation in the left chart between ECB weekly purchases and EURUSD, markets will likely reach a point of diminishing returns, whereby ECB purchases will cease from boosting EURUSD. Not only such purchases are a form of quantitative easing (usually negative for the currency), but the negative impact is likely to prevail as SMP purchases are now accompanied by a more dovish ECB (ECBs unusual admission of mild recession in the Eurozone). As Greek, Italian and Spanish bonds near 30%, 7% and 6% respectively despite these purchases, the ineffectiveness of the ECB will become an issue as long as no progress is seen in the austerity policies enacted and in the results aimed at (reducing debt/GDP & improving growth). Meanwhile, one favourite metric of ours (Eurozone-US 3 month LIBOR spread) finally falls below 1% for the first time since April. For a reminder of what this means, see the bottom right chart in this article http://ashraflaidi.com/articles/fed-twist-ecb-turn-euro-shouts.asp

For TRADABLE IDEAS on EURUSD, EURJPY and EURGBP, try our Premium Intermarket Insights here http:www.ashraflaidi.com/products/sub01/

More Hot-Charts

-

Gold 5000?

Feb 24, 2026 14:19 | by Ashraf LaidiCan gold drop back to $5000 per ounce. Here are 2 possible technical scenarios. China's return to the market could also bring back selling pressure during Asian session.. -

Before and After the New Tariffs

Feb 23, 2026 12:49 | by Ashraf LaidiThe chart on the left is Nasdaq100 CFD (US100) which opened on Sunday night at 11 pm London Time after Trump announcement of 15% tariffs, and the other chart is the Nasdaq cash, ending on Friday... -

Mystery Charts

Feb 5, 2026 20:48 | by Ashraf Laidiسأرسل رسالة صوتية و كتابية توضيحية لأعضاء مجموعة الواتساب الخاصة حول هذه المخططات Will send detailed note on latest parameters to our WhatsApp Bdcst Group...