Sterling Disturbing Correlation

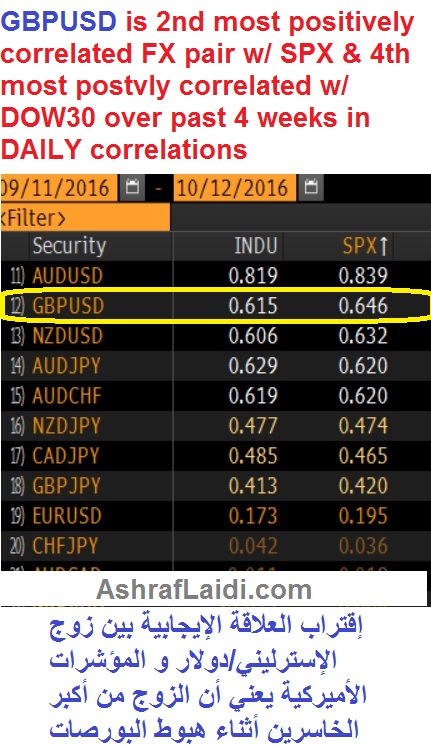

Most traders are aware of the positive correlation between equity indices and high yielding currencies such as the AUD and NZD. But something else has come up as of late. GBPUSD has grown positively correlated with equities, especially US indices (DOW30 and SP500). I have already mentioned this in several tweets earlier this month, asking followers why GBPUSD outperforms EURUSD and USDJPY during rallying stocks and why it is among the big losers during risk-off. Said differently, EURGBP tends to rally as stocks decline and vice versa. Why has GBP become a risk-on trade? 1) The UK's swelling current account deficit of 5.7% of GDP and 2) the structural downside risks of Brexit imply it will be more challenging for the UK to draw necessary funds to finance the deficit, especially at a time when the currency has fallen to the mercy of soundbites by bankers mulling departing London, politicians discussing Hard Exit. The situation with high CA deficit currencies becomes worse when the central bank is easing (or not hiking), as was seen in the case of the USD in 2006-7.

More Hot-Charts

-

Gold Net Longs

Feb 2, 2026 17:16 | by Ashraf LaidiI really dislike after-the-fact analysis, but looking at this chart of Gold speculative net longs at the Comex, it shows speculators began lightening their longs on Jan 23. -

EURGBP Channel Test

Jan 22, 2026 13:20 | by Ashraf LaidiEURGBP is on the cusp of a channel breakout. One of the least well known secrets is how this pair correlates with major equity indices. -

Gold Channel ABC and D

Jan 8, 2026 16:27 | by Ashraf Laidiسأرسل رسالة صوتية و كتابية توضيحية لأعضاء مجموعة الواتساب الخاصة حول هذه المخططات - Will send detailed note on latest parameters to our WhatsApp Bdcst Group - -...