How To Use Premium Intermarket Insights

INTERMARKET INSIGHTS is the Premium service offering trading signals with fundamental & technical analysis-- to which you can subscribe in this link: http://www.ashraflaidi.com/products/sub01/ Are Premium Insights the same as IMTs ? How to make sure you do NOT miss new Premium trades?

PREMIUM INSIGHTS ARE NOT THE SAME AS INTRADAY MARKET THROUGHTS (IMTs)

Intraday Market Thoughts (IMTs) are FREE previews and reviews released 2-3 times per day, aimed at preparing and summarizing traders of the day's more important events in G10 currencies. They are primarily written by and . Reading these IMTs every day provides a basic but consistent awareness of the fast-moving events in currencies. You can subscribe to these FREE IMTs via the newsletter (upper right corner of the website by registering for a username/password).

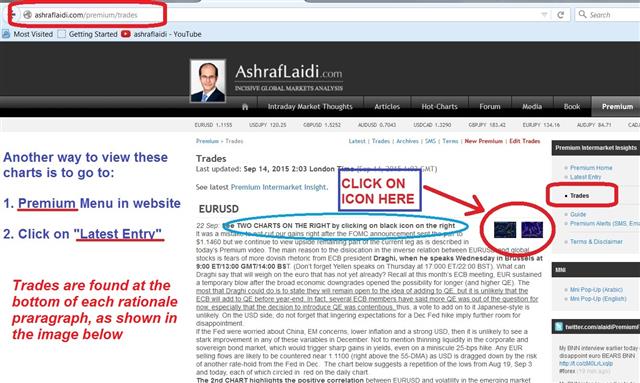

Explanatory Illustrations

Premium Videos

We recent added charting videos on FX, indices and commodities to the Premium service aimed at shedding more light on existing and non-existing trades. The videos are used to combine fundamental analysis with illustrative charts analysis, encompassing the major currecny pairs as well as the assessment for US and European indices. Video duration ranges 20-35 minutes

HOW TO KNOW WHEN PREMIUM INSIGHTS ARE UPDATED ?

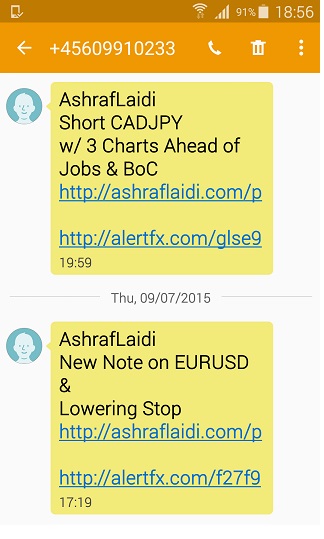

1. SMS PREMIUM SERVICE. The SMS Premium alerts are messages sent to your mobile phone consisting of an Internet link (url) to the latest post of the Intermarket Premium Insight, which contains Premium trades, charts and technical/fundamental commentary. As long as you have your mobile device with you, this is the BEST WAY to ensure that you do not miss the latest release of the Premium trades (such as being away from your laptop).

EXAMPLE of an SMS ALERT:

AshrafLaidi.com: Latest Premium Trades EURUSD, GBPUSD, Gold http://ashraflaidi.com/p

3. TWITTER: Once a new Premium has been added (trade, note or video), the url is immediately posted on the @alaidiPremiumFX stream. The addition is also announced on @alaidi but without the url.

2. INTRADAY MARKET THROUGHTS (IMTs) . The IMTs are occasionally used to let recipients know that a new set of Premium trades are ready. You can subscribe to the IMTs newsletter FREE at the upper right corner of AshrafLaidi.com and you check on "Intraday Market Thoughts". These IMTs are written by Ashraf and his staff ( and ) – they go out 2-3 times per day to those who subscribe to them. Each time Ashraf completes the premium trades/analysis in the Intermarket Insights, he writes a short IMT alerting subscribers that the new trades are up and ready, including the direct link to the analysis/trades.

PERFORMANCE, ACCURACY & LIMITS/STOPS

Since the start of the service in Q2 2011, about 52%-67% of our trades hit all targets. EURUSD has a 59% success rate; GBPUSD has 51%, USDJPY has 47%, CADJPY and GBPUSD have 68% and 54% success rates respectively.

THE USE OF RANGES, ENTRY, LIMIT & STOPS

In the real world, there is not one single price that is best for entry or exit. Accordingly, we give ranges for entries and exits in our Premium service, which we deem to be in line with our trading conclusions. Issuing a range also avoids the problem of obliging clients to commit to a single price. If we issue an alert to buy EURUSD at 1.3020 and the price exceeds that level right on the moment a client in Singapore or London receives the alert, then what is the client to do? Will he or she let the opportunity go by just because the price was missed by 3 or 8 pips? Employing ranges helps solve the problem. The use of ranges for targets (limits) aims at maintaining the same amount of targeted profit, regardless from which end of the range the entry was made.

Our methodology tends to be on the conservative side. Some of our trades may have hit 99% of our target range before being stopped out and therefore will be categorized as "stopped out", even though they may have hit all but the last 5 or 8 pips of the final limit in the range. Trades deemed not to have "hit all targets are" are those, which did not hit the full range of our limits. We use ranges for entry & limitss, but one single stop.

Example 1: A trade to go long (buy) USDCAD between 1.0250-1.0270, for limit between 1.0350-1.0370, stop at 1.0200. We will only deem the trade to have hit all targets if the price rose all the way to the final limit of 1.0370. If say, the market goes as high as 1.0366 before dropping back to 1.0200, then the trade will be deemed "stopped out" if 5 pips away from the stop, even though some clients may have chosen to take profit near our final limit of 1.0370. So in this case, we call the trade a "failed" trade and include it in the losing trades category.

Example 2: A trade to go short (sell) gold at 1350-1370 for targets at 1300-1320 with a stop at 1390. If the price were at 1347 at the moment of issuing the trade and gold drops all the way towards 1320 before rebounding and hitting our stop of 1390, then we consider the trade to have been stopped out although it hit more than half of the range in our limit/range but never filled the range of our 1350-1370 entry. Therefore, such trade would go to our losing trades, while many may have used this as a winning trade had they chosen to enter at 1347.

Due to the strict approach used, we judge some trades to have been stopped out when they may have in fact hit targets for several traders. The levels for entry, limit (target) and stops are employed in the service are used as for indicative purposes and we use the Premium Videos to detail the extent to which leeway can be given around these levels.

Since our approach aims for a 2-1 Reward-Ratio and the average number of pips targeted is about 170-250 pips, the maximum drawdown per trade ranges stands around 80-130 pips. For this reason, we recommend adopting a leverage of no more than 100-1. These trades are for Swing Traders, which means they could take as long as 3-5 weeks to hit their target.

With regards to recent performance, please verify through the previous editions in the Archives section of the service.