USD Extends Weakness on China, Polls, Powell

USD weakness extended into Monday, while US indices paused from their record-breaking run after reports indicated pessimism prevailed in China regarding the US-China trade talks, while Trump revealed he had an unscheduled meeting with Fed chair Powell where he discussed the strong US dollar, and negative interest rates and manufacturing. GBP was the leading currency against USD, reaching $1.2985 after PM Johnson said each Conservative MP candidate for MP has signed a pledge to vote for his Brexit deal, further pushing opinion polls in favour of the Tories (see more below). on A new Premium trade was released in FX with 2 charts and 7 notes, while the DOW trade was stopped out.

The pessimism comments were reported by CNBC's Beijing bureau chief Eunice Yoon tweeting: "China troubled after Trump said no tariff rollback. (China thought both had agreed in principle.) Strategy now to talk but wait due to impeachment, US election. Also prioritize China economic support.

The new indications emerged after weekend chatter from China highlighted 'constructive discussions' and an agreement to maintain close communication. That hardly moves the needle in terms of news but fighting it on the market side has proven to be impossible. Yet for every step forward on optimism, there's a risk of a plunge backwards if talks fall apart. And for every 3 or 4 statements from the US side on the trade talks, Beijing makes 1 or none.

At the same time, there's a risk that trade news is overshadowing what's happening in the economy. There has been an undercurrent of stabilization in most of the world. On Friday, the US retail sales control group was up 0.3% to match estimates. Overall sales were also slightly stronger at +0.3% vs the +0.2% consensus.

Broad economic concern has shifted to a focus on struggling global manufacturing. Friday's industrial production data in the US showed a 0.8% fall compared to -0.4% expected. It's a similar story nearly everywhere but while manufacturing struggles, the consumer isn't worsening. Unless that changes, there's no reason to believe this paradigm can't extend through year-end.

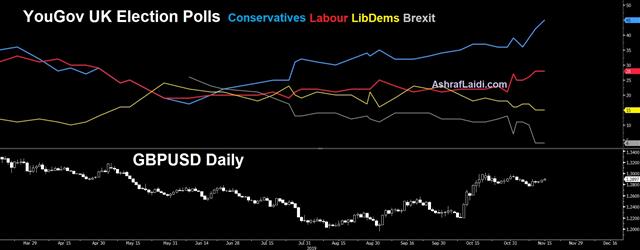

Latest UK Polls

The latest figures from the UK election polls according to ICM conducted for Reuters showed the Conservatives at 42% (up 3 points) from the previous ICM poll, Labour at 32% (up 1 point), LibDems at 13% (down 2) Brexit Party at 5%, down 3 pointsCFTC Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR -58K vs -61K prior GBP -28K vs -29K prior JPY -35K vs -27K prior CHF -15K vs -14K prior CAD +42K vs +52K prior AUD -41K vs -27K prior NZD -41K vs -27K prior

The Australian and New Zealand dollar have shown some signs of life following central bank decisions but the market is deeply sour on both. Watch the 100-day moving average in NZD/USD this week, currently about 35 pips above spot at 0.6440.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| FOMC's Williams Speaks | |||

| Nov 19 14:00 | |||

Latest IMTs

-

Of Gold Extensions مقياس إمتدادات الذهب

by Ashraf Laidi | Apr 15, 2024 16:38

-

Bitcoin performance & Miners Prehalving

by Ashraf Laidi | Apr 9, 2024 17:07

-

English Translation to Arabic Interview

by Ashraf Laidi | Apr 7, 2024 21:01

-

فشل الفدرالي في إقناع الأسواق

by Ashraf Laidi | Apr 6, 2024 14:17

-

Typical Errors on Gold, Silver, USD

by Ashraf Laidi | Apr 1, 2024 16:14