Intraday Market Thoughts Archives

Displaying results for week of Aug 04, 2019Trump Threatens, UK Shrinks, CAD Jobs Slump, Germany Turns Taps

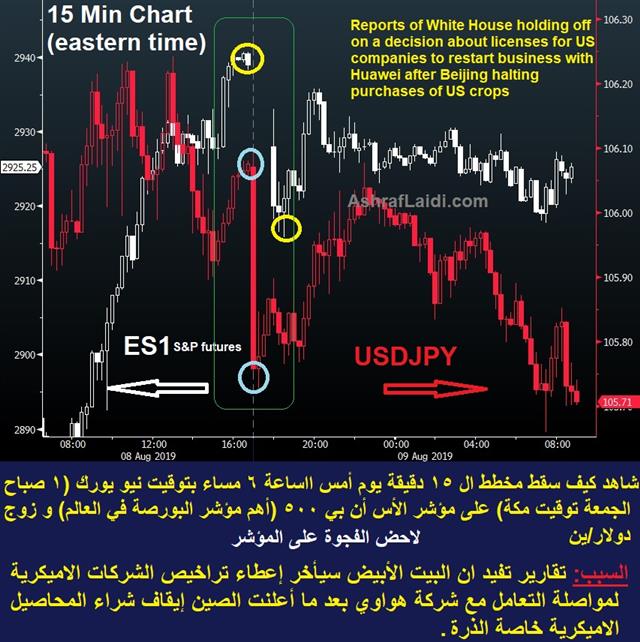

JPY is back on top and indices falling on fresh Trump comments threatening to cancel the September meeting with China. from GBP slumped below 1.21 on UK Q2 GDP falling to -0.2%, showing the first contraction in nearly 7 years (more on this below). Germany may finally relent to pressure to stimulate the economy as a report suggested new spending may be coming. Canadian July jobs fell by a net -24K vs exp -15K and the unemp rate rose to 5.7% from 5.5%, but wages rose 4.% from 3.6% complicating matters for the BoC. Indices peaked out at 6pm Eastern on Thursday on White House reports (see how it unfolded in the charts below). Premium subscribers look out for a potentially new trade later today if the parameters mentioned in this week's video take hold.

Euro is parly stabilizing on soaring EURGBP and on reports that that suggested Merkel's cabinet may be open to fresh spending. The IMF, ECB and others have been badgering the government to spend and the market is offering debt at sub-zero levels so there's a compelling case, especially with growth showing increasing signs of a slump. The report said new debt would 'strictly' go towards climate change measures but that's a potentially-broad category and could help to open the floodgates.

Elsewhere in Eurozone politics, the euro briefly stumbled with an Italian election now appearing inevitable. The League is in a dominant position in the polls and with a small further bump could form a far-right coalition. Risks are lower than they were in prior elections with an exit from the eurozone now clearly off the table, but we will have to wait and see where the talking points in the election lead. Watch EURCHF for a better appreciation of these risks.

Ominous UK GDP Report

Aside from the obvious warning signs the UK GDP contraction calls for supporters of a no-deal Brexit, note that the UK imports plunged 13% after having jumped in Q1 as British firms hoarded foreign-made components. The 1.6% y/y decline in business investment was countered by 0.7% rise in government spending focused on healthcare. The usually functioning services sector, showed no growth for the 4th straight month, while construction, industrial output and manufacturing all contracted.Back to the Bank of Canada. It's been weeks since Poloz and company weighed in and there is nothing on the schedule until the Sept 4 BOC decision. A cut would be premature and certainly isn't justified by recent economic data but given the global backdrop, it's not out of the question. However, if it's coming, there will need to be some kind of BOC signal – probably via a press interview – in the next week or two.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| GDP (m/m) | |||

| 0.0% | 0.1% | 0.2% | Aug 09 8:30 |

What's after Markets' Obligatory Bounce

The challenge is not to predict bottom picking in the markets, but how long and how high it will go. We'll look into that a bit later. Fresh cycle lows in Treasury yields and a sharp drop in equities turned around in wild trading on Wednesday. Markets bounced in the last 1 hour of NY traer and resumed into Thursday Asia & Europe when the PBOC fixed the yuan slightly stronger than was expected --despite having set the fixing below 7.00 for the 1st time since 2008. Here's Ashraf's take on CNY detailing this somewhat confusing subject. Gold also hit a six-year high above $1500.

داو جونز: بيع الإرتداد أو شراء الهبوط؟ (فيديو للمشتركين )

The market whimpered then roared Wednesday on a sharp turnaround in Treasury yields. Early in North American trade, US 10-year yields hit a cycle low of 1.59% and 30-year yields hit 2.21%, only a few basis points from an all-time low (that was established with Fed funds at a much lower rate). That fear spilled into equity markets and the S&P 500 fell by as much as 56 points.

In addition to the PBOC fixing, comments from Evans also helped sentiment, which was a departure from Bullard's comments earlier in the week. Also helping sentiment is a US report indicating that US-China trade talks are still planned for September. A Chinese report cast some doubt on that but sentiment reversed and stocks and bonds recovered to finish the day largely unchanged.

The FX market moves played out on the same plane, but to a much smaller scale. USD/JPY fell 60 pips to 105.50 only to recoup the entire move. The Australian dollar was more impressive as it fell a full cent on the RBNZ cut but recovered virtually all the losses by the end of the day.

One asset that didn't turn around was gold. It hit a six-year high of $1510 from an open of $1475 and held most of the gains to finish above $1500. That strength in risk-positive and risk-negative environments is telling. Ashraf focused on the most likely path for gold and JPY in yesterday's Premium video below.

Markets will likely revert to watching the CNY fixing at the start of every Asian session to get a read on Beijing's intentions and markets' reactions.

Beware of Mixed Intermarket Signals

Markets are getting a lift on a combination of technical buying off key MA lows and comments from Chicago Fed's Evans (see below). Risk trades are bouncing as we speak after a shaky start earlier in Asia following a larger than expected 50-bps rate cut from the RBNZ and prolonged declines in global bond yields, firing up gold and silver to 1510 and 17.12 respectively. The Premium long gold trade hit its final target of 1480 earlier today, after having been opened on Jul 25th at 1412. Ashraf tweeted he will lock gains & close one of the 2 existing remaining trades instead of waiting for it to hit the final target. His rationale is laid out in the video for Premium subscribers posted below momemnts ago.

Dovish Comments from Evans

Comments from Chicago Fed's Evans stating markets headwinds are a result of market events (Trump's tariffs and CNY's sub 7.0 fall), and that Fed may be called into more accommodation, are strengthening the case for rate cut in September, while some are speculating on an intermeeting cut (highly unlikely).BEWARE momentum traders wanting to chase the prevailing moves

Recapping from Monday night (early Tuesday Asia): China posted a tighter yuan fixing on Monday and reported told foreign firms that it wouldn't let the currency depreciate further. That short-circuiting escalating trade and economic actions and sparked a relief rally. In the S&P 500, that meant a 1.3% bounce that ended near the highs of the day but other markets were less impressed.

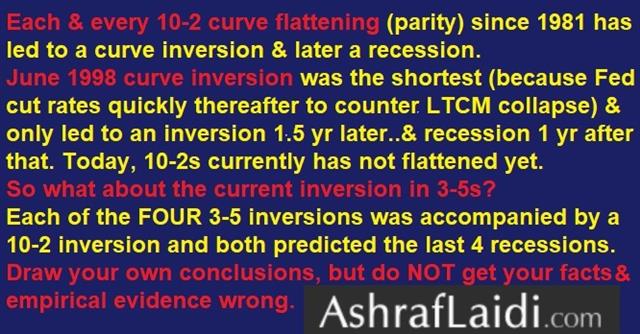

Broadening Inversions

The inversion of the yield curve earlier in the year has led to constant head-scratching because US data has been fine, but the resurfacing of the inversions is raising serious questions. Not only the 3-month/10-year curve has inverted to a -35 bps (the most inverted since sping 2007), but also has the 3-year/5-year curve down to -0.01 bps) leaving only the 2-year/10-year in positive territory. Here is a tweet from Ashraf earlier in the year, which is still releveant.

Gold sent a similar signal as it rose to fresh six-year highs at 1510 amid broadening declines in global bond yields and rate cuts from 3 central banks. There is nothing magical or particularly important on the chart about $1500 but that's the kind of number that could spark a rebirth of the gold-bug fanaticism from a decade ago. Ashraf spent 8 mins on gold in today's Premium video, calling for the next game plan in JPY and gold.

European equities will be a spot to watch closely in the day ahead. The DAX chart is particularly compelling as it once again finished Wednesday right at the 200-dma and just below the June low. Any follow through in the day ahead would be ominous.

Perhaps most-ominous development has been in the Australian dollar. It eeked out a tiny gain Tuesday against the US dollar but has been essentially flat or lower for 12 straight days and is flirting with a 10-year low. It's suddenly at the intersection of a slowdown in China, trade concerns and commodity weakness.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| RBA Assist Gov Bullock Speaks | |||

| Aug 07 21:30 | |||

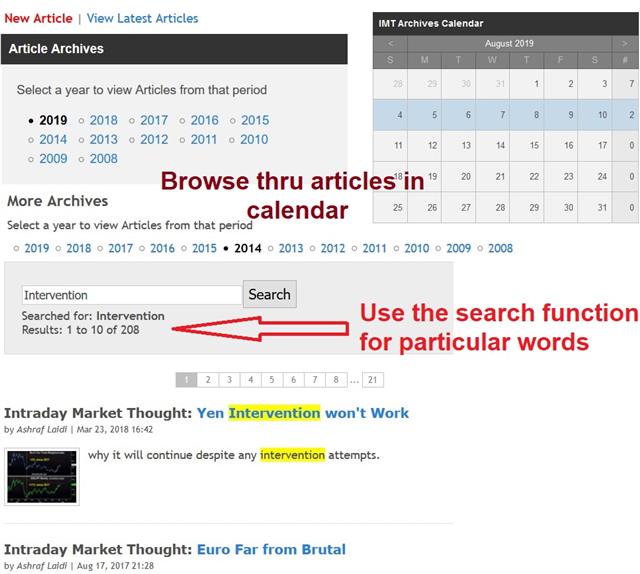

9 Years' Worth of Analysis

Do you realize there is 9 years' worth of archived charts & information, intermarket analysis & previews/reviews on this website? (This is a website not a blog). Do you want to know how markets moved during the 2008 crises? How did EUR and JPY do during the Spain, Irish or Greek debt crisis in 2010/2011? How did sterling act ahead and after the Scottish Independence referendum, Brexit referendum? Or, What the USD did on that China devaluation of August 2015? No other website gives access to sizable amount of info/analysis in such organised manner from one year to another. You can use the calendar function in the archives section here or here and learn via practical & empirical evidence.

China Wakes, Markets Wilt

China hit back on US tariffs Monday in a sign of a change in tactics in the trade war that has deep consequences. The Swiss franc is the top performer to start the week while the NZ lags. Kiwi underperformance puts the Premium Insights' long EURNZD trade in +570 pts in the green. The are three Premium trades currently open (all in the green) and new trades will be issued in the next 24 hours. CFTC positioning shows that risk-off trades could have some room to run. Here is a summary of the situation from Ashraf's tweets:

Until now, China had been angling towards a strategy of appeasement and slow-rolling the US on the trade war. That may have changed after Trump shocked the world last week by announcing a fresh round of tariffs to take effect Sept 1.

China allowed the yuan to weaken below the key 7.00 mark on Monday in the onshore and offshore market. Reports of cancelled agricultural purchases also roiled markets.

The result was dramatic. USDX posted its biggest decline since June 4th, US 10-year yields fell 10 basis points to 1.75% and the German bund fell to -0.52%. The S&P 500 fell 2.98%, the biggest daily drop since December 4th and the German DAX broke the 200-day moving average. Gold has exploded to a fresh cycle high, hitting $1469.

The shift in Chinese strategy to confrontation is a game-changer and it brings to mind the August 2015 drop in the yuan that sparked a wave of risk aversion. We're now in a situation where both sides are trying to hurt one another and it won't turn around until one side hits a breaking point.

CFTC Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR -53K vs -39K prior GBP -90K vs -79K prior JPY -4K vs -9K prior CHF -14K vs -13K prior CAD +21K vs +31K prior AUD -53K vs -48K prior NZD -12K vs -12K prior

The net short in the pound climbed to the most-extreme since 2017 on Brexit worries. The ones that jump out with a trade war looming are the relatively neutral positioning in the yen and franc.

انتقام الصين بكسر حاجز 7 يوان مقابل الدولار

ترامب يغرّد والصين ترد! تابع آخر تقلبات الأسواق في هذا الفيديو الحصري