Beware of Mixed Intermarket Signals

Markets are getting a lift on a combination of technical buying off key MA lows and comments from Chicago Fed's Evans (see below). Risk trades are bouncing as we speak after a shaky start earlier in Asia following a larger than expected 50-bps rate cut from the RBNZ and prolonged declines in global bond yields, firing up gold and silver to 1510 and 17.12 respectively. The Premium long gold trade hit its final target of 1480 earlier today, after having been opened on Jul 25th at 1412. Ashraf tweeted he will lock gains & close one of the 2 existing remaining trades instead of waiting for it to hit the final target. His rationale is laid out in the video for Premium subscribers posted below momemnts ago.

Dovish Comments from Evans

Comments from Chicago Fed's Evans stating markets headwinds are a result of market events (Trump's tariffs and CNY's sub 7.0 fall), and that Fed may be called into more accommodation, are strengthening the case for rate cut in September, while some are speculating on an intermeeting cut (highly unlikely).BEWARE momentum traders wanting to chase the prevailing moves

Recapping from Monday night (early Tuesday Asia): China posted a tighter yuan fixing on Monday and reported told foreign firms that it wouldn't let the currency depreciate further. That short-circuiting escalating trade and economic actions and sparked a relief rally. In the S&P 500, that meant a 1.3% bounce that ended near the highs of the day but other markets were less impressed.

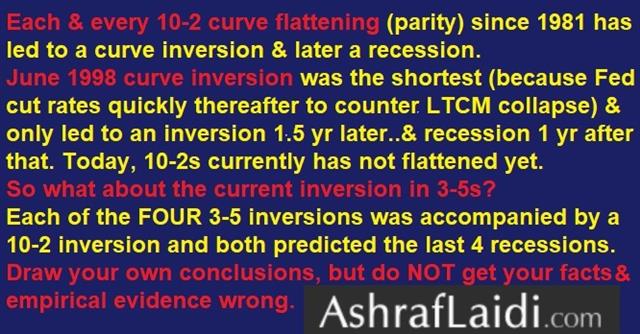

Broadening Inversions

The inversion of the yield curve earlier in the year has led to constant head-scratching because US data has been fine, but the resurfacing of the inversions is raising serious questions. Not only the 3-month/10-year curve has inverted to a -35 bps (the most inverted since sping 2007), but also has the 3-year/5-year curve down to -0.01 bps) leaving only the 2-year/10-year in positive territory. Here is a tweet from Ashraf earlier in the year, which is still releveant.

Gold sent a similar signal as it rose to fresh six-year highs at 1510 amid broadening declines in global bond yields and rate cuts from 3 central banks. There is nothing magical or particularly important on the chart about $1500 but that's the kind of number that could spark a rebirth of the gold-bug fanaticism from a decade ago. Ashraf spent 8 mins on gold in today's Premium video, calling for the next game plan in JPY and gold.

European equities will be a spot to watch closely in the day ahead. The DAX chart is particularly compelling as it once again finished Wednesday right at the 200-dma and just below the June low. Any follow through in the day ahead would be ominous.

Perhaps most-ominous development has been in the Australian dollar. It eeked out a tiny gain Tuesday against the US dollar but has been essentially flat or lower for 12 straight days and is flirting with a 10-year low. It's suddenly at the intersection of a slowdown in China, trade concerns and commodity weakness.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| RBA Assist Gov Bullock Speaks | |||

| Aug 07 21:30 | |||

Latest IMTs

-

USDJPY Jumps on Dovish Picks

by Ashraf Laidi | Feb 25, 2026 11:40

-

Gold $5000?

by Ashraf Laidi | Feb 24, 2026 14:21

-

DXY Net Longs

by Ashraf Laidi | Feb 23, 2026 14:20

-

Iran Polymarket & Fed Odds

by Ashraf Laidi | Feb 20, 2026 11:27

-

Gold, Iran & Oil

by Ashraf Laidi | Feb 19, 2026 16:40