Game Changers & Setters

Bonds & Indices

We continue to watch 1.00% in the US 10-year yield and how market behaves if/when it breaks. Will a breakout be a reflection of outright risk-on surge and optimism to the extent of boosting the reflation trade (USD-negative), or would it pose a threat to the increasingly low-rates dependent players and the borrowing-addicted US govt until it whispsaws lower?Outside of that, the mode in markets continues to be selling the US dollar even with Treasury yields rising. There is a mountain of money parked in the US bond market that's waiting for the right time to dip into foreign investments, particularly emerging markets. News of a vaccine that could potentially eradicate the virus may be that trigger but it's competing with rising cases in the interim.

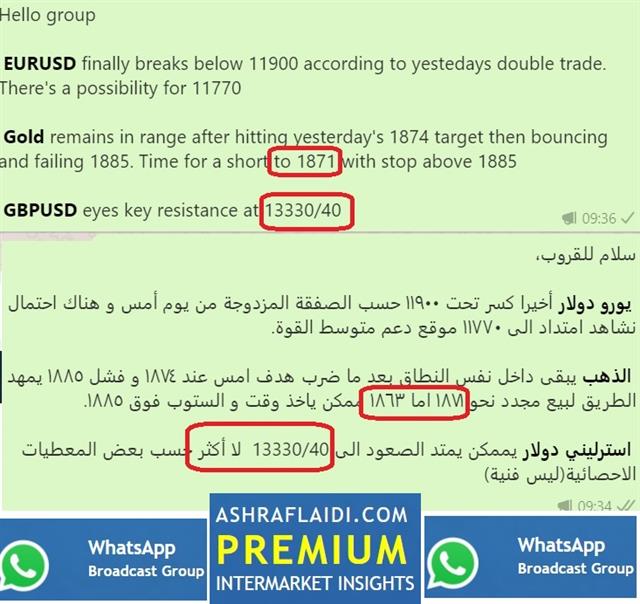

At present, the contours of the new deal don't appear to be onerous and combined with Sunak's willingness to spend, leave the UK in a solid position once Brexit and the pandemic are sorted. See in the above WhatsApp snapshots how Ashraf called cable's peak near 1.3330s for members of the WhatsApp Broadcast Group, minutes before 1.3312 was hit and held

Latest IMTs

-

Mystery Chart & Coordinated Silver Attack

by Ashraf Laidi | Feb 6, 2026 10:52

-

From 4920 to 5090 and back

by Ashraf Laidi | Feb 5, 2026 9:41

-

How I Nailed $5090oz

by Ashraf Laidi | Feb 4, 2026 11:44

-

2x our Gains in 8 Weeks

by Ashraf Laidi | Feb 3, 2026 10:28

-

4500 and 72 Hit, now what?

by Ashraf Laidi | Feb 2, 2026 2:22