Intraday Market Thoughts

GDP: Gold’s Disinflation Plunge

by

May 29, 2014 16:15

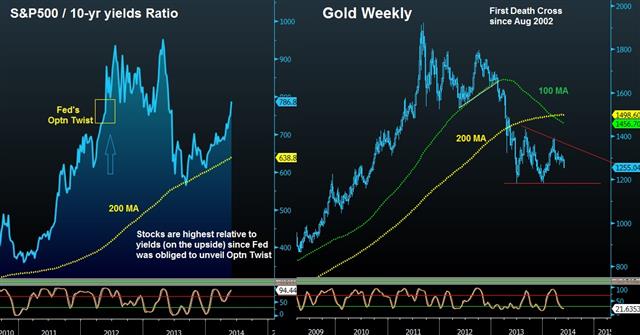

The bigger than expected downward revision in US Q2 GDP to -1.0% from an initial reading of +0.1% mainly resulted from an inventory drawdown of 1.62% (three times as original expected), lower private investments and more negative contribution from net trade. The good news is that personal consumption was revised to 3.1% from 3.0%. The absence of inflation combined with the onset of imported disinflation from the Eurozone and China's weakening currencies lends credence to the selloff in gold. The metal's shine is further eroded when new record highs in US & European stocks operate in a low-inflation environment. Full charts & analysis

Click To Enlarge

| Act | Exp | Prev | GMT |

|---|---|---|---|

| GDP Price Index (q/q) [P] | |||

| 1.3% | 1.3% | 1.3% | May 29 12:30 |

| PCE Prices (Q1) (q/q) | |||

| 1.4% | 1.4% | 1.4% | May 29 12:30 |

| Core PCE (Q1) (q/q) | |||

| 1.2% | 1.3% | 1.3% | May 29 12:30 |

| Core PCE - Price Index (APR) (m/m) | |||

| 0.2% | May 30 12:30 | ||

| PCE - Price Index (APR) (m/m) | |||

| 0.2% | May 30 12:30 | ||

| Core PCE - Price Index (APR) (y/y) | |||

| 1.2% | May 30 12:30 | ||

| PCE - Price Index (APR) (y/y) | |||

| 1.1% | May 30 12:30 | ||

Latest IMTs

-

USDJPY Jumps on Dovish Picks

by Ashraf Laidi | Feb 25, 2026 11:40

-

Gold $5000?

by Ashraf Laidi | Feb 24, 2026 14:21

-

DXY Net Longs

by Ashraf Laidi | Feb 23, 2026 14:20

-

Iran Polymarket & Fed Odds

by Ashraf Laidi | Feb 20, 2026 11:27

-

Gold, Iran & Oil

by Ashraf Laidi | Feb 19, 2026 16:40