Rethinking Tapering-is-no-Tightening

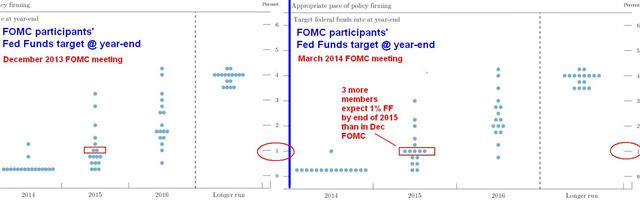

Markets usually react to novelty and the single new development in yesterday's FOMC statement was the forecast for earlier than anticipated rate hikes in the Fed projections. The hawkish projections are a challenge to the Bernanke-Yellen notion that tapering does not imply tightening, especially as bond yields showed their biggest daily rise in 4 months. The real challenge will occur after the April taper, when further tightening of US credit markets (rising yields in anticipation of earlier rate hikes) – combines with a slowing China and worries from US earnings ahead of higher rates. Expectations of higher rates are not necessarily bearish as long as post-winter macro-economic momentum extends into Q3. Failure to do so, will force the Fed to highlight the vagueness of its guidance and keep rates low beyond 2015. Full chart & analysis.

Latest IMTs

-

USDJPY Jumps on Dovish Picks

by Ashraf Laidi | Feb 25, 2026 11:40

-

Gold $5000?

by Ashraf Laidi | Feb 24, 2026 14:21

-

DXY Net Longs

by Ashraf Laidi | Feb 23, 2026 14:20

-

Iran Polymarket & Fed Odds

by Ashraf Laidi | Feb 20, 2026 11:27

-

Gold, Iran & Oil

by Ashraf Laidi | Feb 19, 2026 16:40