US Claims Conspiracy, Remdisivir Awaited

US Indices paring their losses into the final hour of Monday's trade, while the USD recovers after a broadly negative week. Monday began deep in the red in Asia and throughout Europe after the US Secretary of State Pompeo asserted the coronavirus came from a Wuhan lab, while Warren Buffett revealed he dumped airlines stocks. May seasonals point to dollar strength and AUD weakness. Shutdowns relaxed in Italy and Spain. Trump raised the expected US death toll from Covid-19 to 100K and Russia reported over 10K new cases. Gilead's newly approved anti-virus drug remdesivir will be sent to hospitals this week.

A war of words is brewing between the US and China with the source of COVID-19 at the centre of it. On Saturday, Fox Business reported that “there is agreement among most” of the 17 US intelligence agencies that the virus originated in a Wuhan and was inadvertently released.

Secretary of State Pompeo took it a step further on Sunday and told ABC there is “enormous evidence” it came from a lab in the city. However the TV exchange was as confused as it was remarkable as he said “the best experts seem to think it was man-made”. Moments later the interviewer told him that the release from the Director of National Intelligence said it was not man-made, he then said he “has no reason to doubt that.”

To be clear, this is third-highest member of the US executive branch accusing China of a crime against humanity, yet he can't seem to get the story straight.

At best China will brush this off as an election tactic, but more likely it invites a strong rebut that will accelerate the decoupling of the world's two largest economies. A report on Thursday also suggested the US will pursue some kind of punishment or compensation from China for the virus.

Even without the coronavirus, the deterioration in US-China relations would justify the 15% decline in the S&P 500.

Worse still, the Oracle of Omaha was far-from inspiring at Berkshire Hathaway's annual meeting. While he extolled America's ability to overcome challenges and predicted a bright, long-term future, he also repeatedly warned about uncertainties around the virus. His actions spoke even louder as he dumped his entire position in US airlines and didn't invest any of his $137B cash horde.

May Seasonals & Payroll Tax Cuts

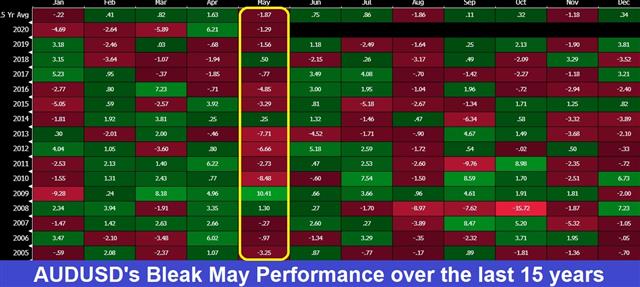

Risk assets are soft to start the week and the seasonal trend is for more along those lines. May is the strongest month for the US dollar index and even more so for the Swiss franc in the past 10 years. It's also the worst month for the Australian dollar and the euro over the past decade.Meanwhile, Trump insists he won't pass any further stimulus measures to combat the economic fallout of the virus, unless a payroll tax cut is passed. The measure would be seen as a complementary strimulus to helicopter money, but its impact on widening the deficit remains considerable.

Latest IMTs

-

USDJPY Jumps on Dovish Picks

by Ashraf Laidi | Feb 25, 2026 11:40

-

Gold $5000?

by Ashraf Laidi | Feb 24, 2026 14:21

-

DXY Net Longs

by Ashraf Laidi | Feb 23, 2026 14:20

-

Iran Polymarket & Fed Odds

by Ashraf Laidi | Feb 20, 2026 11:27

-

Gold, Iran & Oil

by Ashraf Laidi | Feb 19, 2026 16:40