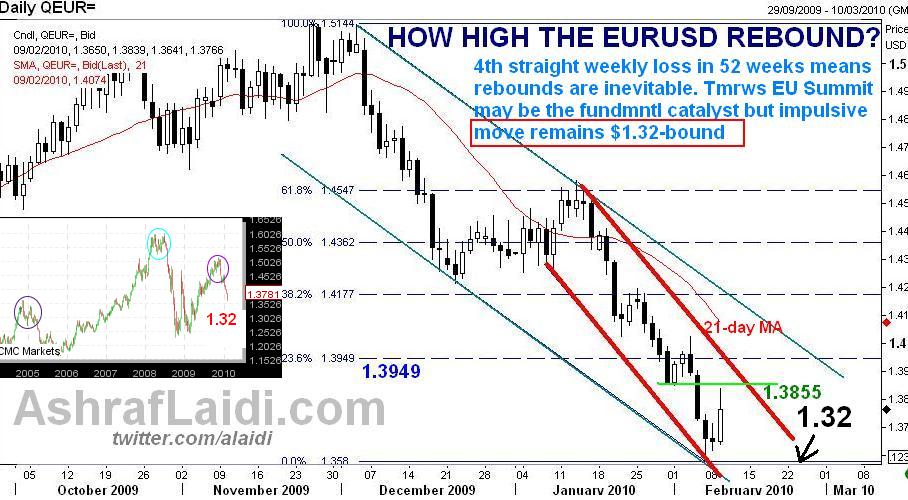

Capping Euro's Rebound

Finally, EURUSD shows signs of life (albeit short-lived) starting with a sell-off prompted by an overall market after Fitch said UK was the most vulnerable AAA sovereign, only for EUR to rally back upon reports by German govt sources about EU nations agreeing in principle in rescuing Greece. EUR then fell off its $1.3839 high when those remarks were dismissed as unfounded rumours. TRADERS MUST BE AWARE that EURUSD has fallen for 4 consecutive weeksLONGEST LOSING STREAK SINCE exactly a year ago and EURUSD remains well in midst of two major down channels (see chart). $1.3855 held up successfully against todays German-driven rumours but more upside MAY emerge when the EU Summit is due tomorrow. Any Greece rescue will prompt traders to ask What about Portugal, Spain ? Subsequent barrier stands at $1.3950. $1.32 target remains intact. EURUSD shorts stuck in any corrective bounce consider short-term longs in EURJPY as was the case today. Such a dynamic is backed by an intermediate (temporary) bottom in USDJPY.

More Hot-Charts

-

GoldBugs & Levels

Mar 3, 2026 16:14 | by Ashraf Laidiسأرسل رسالة صوتية و كتابية توضيحية لأعضاء مجموعة الواتساب الخاصة حول هذه المخططات - Will send detailed note on latest parameters to our WhatsApp Bdcst Group - -... -

Weekly & Monthly

Feb 27, 2026 13:54 | by Ashraf Laidiسأرسل رسالة صوتية و كتابية توضيحية لأعضاء مجموعة الواتساب الخاصة حول هذه المخططات - Will send detailed note on latest parameters to our WhatsApp Bdcst Group... -

Gold 5000?

Feb 24, 2026 14:19 | by Ashraf LaidiCan gold drop back to $5000 per ounce. Here are 2 possible technical scenarios. China's return to the market could also bring back selling pressure during Asian session..