Intraday Market Thoughts

Peculiar Intermarket Moves

by

Oct 4, 2021 18:44

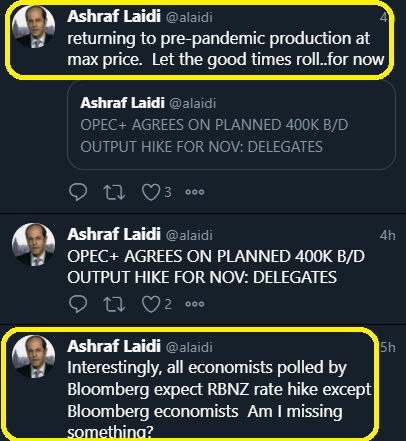

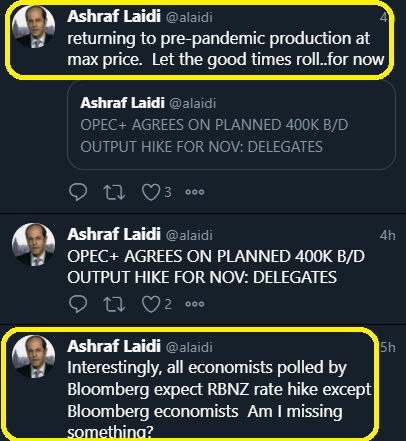

Another US tech-Selloff-Monday as yields bounce off the 1.45% support to regain 1.50%, dragging Nasdaq100 by 2.4%, Dow30 by 1.15% and SPX by 1.6%. Interestingly, Bitcoin oil and gold are both firmly higher and USD is down across the board. Ashraf tells me that such unusual intermarket moves often occur at points of key junctions in the market. Whether these moves signal the last throes of indices selloff and/or start of USD pulback remains to be seen. Market participants already had plenty to worry about, but the list grew on Monday with a report stating the US will outline how China hasn't lived up to Trump's Phase One trade deal. China is on holiday through Thursday.

In the trade deal, China had agreed to purchase an additional $200B of US exports but US Trade Representative Katherine Tai will announce Monday that China is not complying with purchases running at 62% of target with only three months remaining.

The report says the USTR will float tariffs as one possible response. No doubt China will point to the impacts of the pandemic as one reason for the shortfall.

The market was in a good mood on Friday and that carried over into early-week trade. US August PCE core inflation rose 3.6% y/y, matching the consensus. Within the report was a reminder that the US savings rate – at 9.4% -- remains remarkably high. Along with inventory rebuilding, that will be a lasting tailwind for growth.

Part of the reason for Friday's market optimism in markets was a drug from Merck that was tested on people who had mild-to-moderate covid symptoms for five days and other risk factors. The anti-viral pill lowered the chance of hospitalization by 50% and the results were so encouraging that US officials ended the trial early. The pill may ultimately go a long way toward one day getting back to 'normal' life. But the stagflationary confusion continues to weigh on sentiment.Latest IMTs

-

USDJPY Jumps on Dovish Picks

by Ashraf Laidi | Feb 25, 2026 11:40

-

Gold $5000?

by Ashraf Laidi | Feb 24, 2026 14:21

-

DXY Net Longs

by Ashraf Laidi | Feb 23, 2026 14:20

-

Iran Polymarket & Fed Odds

by Ashraf Laidi | Feb 20, 2026 11:27

-

Gold, Iran & Oil

by Ashraf Laidi | Feb 19, 2026 16:40